Anyone buying gasoline likely has noticed that energy prices are climbing and that reality has helped to fuel record financial results and a recent rise in the unit price of midstream energy producer Enterprise Products Partners, L.P. (EPD), of Houston, notes Paul Dykewicz, editor of Stock Investor Insights.

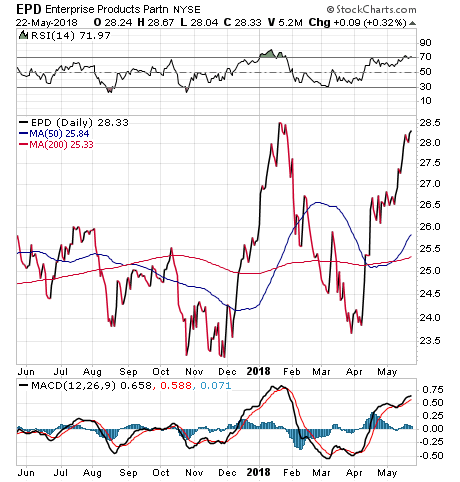

The natural gas and crude oil pipeline partnership beat analysts’ expectations when it recently released first-quarter 2018 financial results and led forecasters to boost their stock price targets for the company. EPD’s stock price has jumped 9.74 percent so far this year and it should go higher amid forecasts of increased economic growth of close to 3 percent in 2018 that likely will spur additional demand.

Enterprise Products, which offers a current yield of 6.45 percent, generated a 23 percent jump in distributable cash flow (DCF) to reach a record $1.4 billion for the first quarter of 2018, providing 1.5 times coverage of its $0.4275 per unit distribution. That distribution excluded proceeds from asset sales and marked a 3 percent hike from the first quarter of 2017.

Two key developments at Enterprise Products Partners emerged during its first-quarter results that were highlighted in an April 30 research report by Stifel, Nicolaus & Company’s Selman Akyol, an energy industry analyst.

First, Enterprise Products Partners’ strong quarterly results propelled it significantly toward reaching its goal of self-funding its operations. Second, the company reported that “tight” pipeline, rail and fracking capacity is not expected until the second half of 2019. Both are positive for Enterprise Products Partners, which retained $460 million in distributable cash flow during the first quarter.

For investors who want to profit from rising energy prices, Enterprise Products Partners and its pipelines offer a way to do so. When its current yield of 6.45 percent is factored into the decision, the appeal of receiving both capital appreciation and income is strong, indeed.