Over the past few weeks and months, a number of key economic data has continued to rally the US major indexes toward new highs, observes Chris Vermeulen, chief market strategist for The Technical Traders.

The interesting facet of this move higher is that it is happening while trading volume has diminished dramatically in the S&P 500 (SPY). The futures contracts continue to show relatively strong volume activity though.

Additionally, the overnight Repo markets have risen to the attention of many skilled analysts. The concern is that the continued US Fed support of the overnight Repo facility may be a band-aid attempt to support a gaping credit crisis that is brewing just outside of view.

We’ve been doing quite a bit of research over the past few weeks regarding this Repo market support by the US Fed and we believe there is more to it than many believe. We believe certain institutional banking firms may be at extreme risks related to derivative investments, shadow banking activities and/or global commodity/stock/currency/asset risk exposure.

The only answer we have for the extended Repo facility at increasing levels is that the institutional banking system is starting to “fray around the edges”. Thus, we believe some larger credit risk problems may be just around the corner.

Our longer-term analysis continues to suggest that “all is fine — until it is not”. Our belief that a capital shift that has been taking place over the past 5+ years where foreign capital continues to pour into the US markets is driving US stock market prices higher.

There is evidence that the capital shift into the US has slowed over the past 5+ months, yet one would not notice this by looking at these longer-term charts. The point we are trying to make today is that price peaks near current highs have, historically, been met with strong resistance and collapsed by 8 to 15% on average.

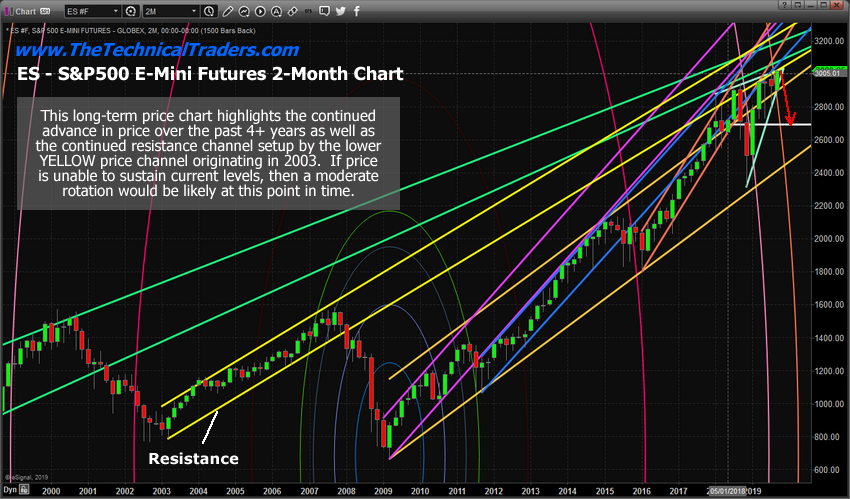

This chart below highlights the resistance channel initiated near the 2003 lows (the lower yellow price channel line) and how that level has continued to act as moderate price resistance throughout most of 2017, 2018 and 2019.

We believe that price, at current levels, must either rally above this level and be capable of sustaining higher price levels (which would be supported by stronger forward guidance, earnings, economic data and/or investments), or will attempt to rotate lower from these current highs because price is simply unable to support/sustain higher price levels given the current global economic data.

When we attempt to rationalize the potential for price given the Repo issues, the current global economic data/news, the uncertainty of a US Presidential election cycle only 12 months away, the BREXIT deal hanging out in the near future and recent currency rotations, we believe is transitional shift is taking place in the markets in preparation for some type of surge in volatility associated with a very strong potential for extended price rotation.

Skilled traders must understand that subtle risks are starting to show throughout the global markets. Foreign markets are starting to show signs of extended contraction — China and Asia in particular. The situation in Europe and with the Euro are open to interpretation. Our opinion is that risk levels have already exceeded a comfort level in this arena.

Should some event take place where the global banking system and/or Repo market continue to attempt to take up the slack — traders will become even more concerned that “something is broken” and could pull massive amounts of capital out of the markets fairly quickly.

If this happens when volume and volatility are very low, we have a situation where simple price exploration could present a real problem (think "flash crash").

Skilled traders need to stay very cautious near these new highs. We may see a surge in volatility over the next few weeks unless the markets are able to settle the concerns raised by analysts and others.

Headed into the end of 2019, into a contentious US presidential election cycle and with obvious signs that something may be breaking in the global banking system, now is the time to protect and prepare for the unknown. We can’t make this any clearer — consider this a warning alert.