It’s time to add another PowerShares QQQ Trust (QQQ) trade to the portfolio. We locked in a nice 15.6% gain in our QQQ trade yesterday and now we have another opportunity to sell more premium, explains Andy Crowder, editor and chief options strategist for Options Advantage.

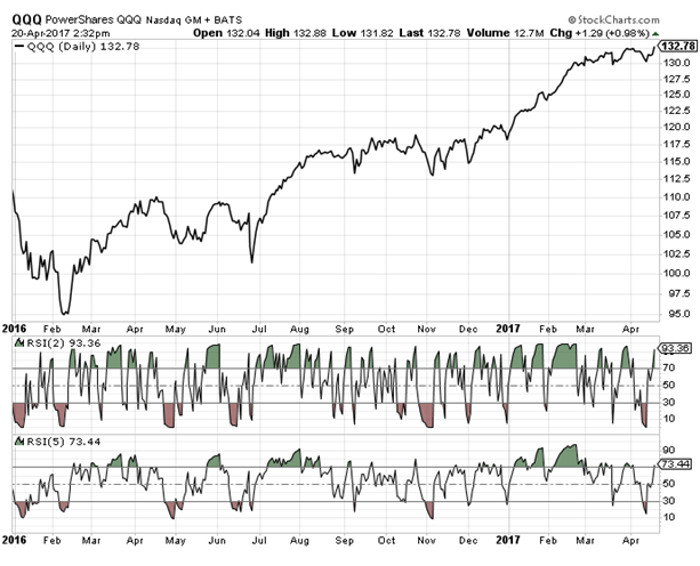

QQQ is once again in an overbought state. Thus, I want to add a bear call spread to the Weekly Options Portfolio. My intent is to close the trade for a small gain in the next few days, if the market allows.

Here is the next trade:

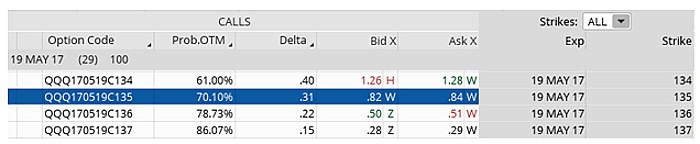

*The following are options with 29 days left until expiration and is due to expire during the third Friday of May (standard expiration).

Simultaneously:

Sell to open the QQQ May 2017 135 calls

Buy to open the QQQ May 2017 137 calls for roughly $0.54

Do not accept less than $0.50 credit to enter this trade. Enter this trade as a spread to avoid paying double commissions.

The goal of selling the QQQ bear call (credit) spread is to have the underlying ETF, in this case QQQ stay below the 135 strike through the May expiration in 29 days.

Here are the parameters for this trade:

- The Probability of Success – 70.17%

- The max return on the trade is the credit of $0.54 or 37.0% based on the required margin ($146) over the next 30 days.

- Break-even level -- $135.54

- The maximum loss on the trade is $1.46 (remember - that's really $146 per spread)