A short trade in SPDR Gold Trust ETF may not be consensus, yet Landon Whaley, Founder and CEO of Whaley Capital Group, tells why he likes the reward-to-risk in his weekly trade idea.

The SPDR Gold Trust ETF (GLD) declined over 3% in the week ending May 5. For folks who believe US growth is slowing, look no further than recent price action in gold to disprove your thesis. If US economic data was painting a “growth slowing” picture, gold wouldn’t decline three straight weeks and give back half of its 2017 gains in the process.

Based on the way I evaluate markets, it doesn’t get more attractive for a short trade than what I’m seeing in gold right now.

The Fundamental Gravity, driven by US growth accelerating, has been decidedly bearish all year. Despite this fact, gold managed to gain over 11% in the first three months of the year but that upside momentum has now stalled.

GLD’s recent price action, as well as other components of its Quantitative Gravity, are flashing bearish signals and aligning with gold’s Fundamental Gravity.

Coupled with a bearish shift in gold’s quantitative aspects is a change in its Behavioral Gravity. Investors who were leaning to the short side in gold futures during Q1 have been covering those positions steadily for the last month. This has left positioning ever so slightly short but benign, making a short trade no longer a consensus idea.

I love initiating trade ideas that aren’t consensus when my Gravitational Framework tells me the reward-to-risk is skewed heavily in my favor, as it is right now.

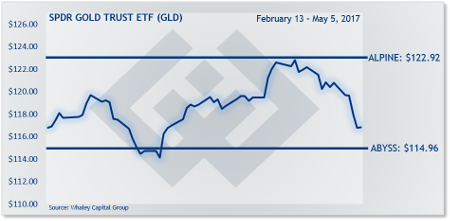

Today’s trade Idea: New short trade ideas can be initiated if GLD rallies to $120.60, or higher. Depending on how much room you want to give this trade to move around, use a risk price between $121.92 and $124.76. Your profit target price range for this trade idea is between $116.32 and $114.03.