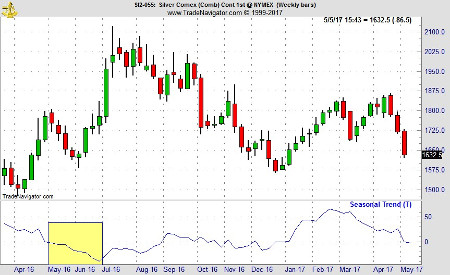

Silver has a strong tendency to peak or continue lower in May, bottoming in mid to late June, explains seasonal trading expert Jeffrey Hirsch, editor of Stock Trader's Almanac.

Traders can look to sell silver on or about May 12 and maintain a short position until on or about June 23. In the past 44 years this trade has seen declines 29 times for a success rate of 65.9%.

Prior to 2014, this trade had been successful for eight years in a row. Two years ago, this trade was successful while last year silver bottomed in early June resulting in a loss.

This trade has been successful in 9 of the last 11 years. In the chart below, the 44-year historic average seasonal price tendency of silver as well as the decline typically seen from mid-May until the low is posted in late June into early July is shown.

This May silver short trade captures the tail end of silver’s weak seasonal period (shaded yellow) that typically begins in late February or early March.

ProShares UltraShort Silver (ZSL) corresponds to two times the inverse of the daily performance of silver. However, ZSL is not tracking spot silver price, rather it is tracking the U.S. dollar price for delivery in London.

Nonetheless, ZSL has a solid history of rising when silver price declines. ZSL could be bought on dips below $35.40. If purchased, an initial stop loss of $32.21 is suggested.

If ZSL then rises and closes above $38.95 switch to a 5% trailing stop loss. Use ZSL’s daily close to update its stop loss.