While news may be catalyst for a market move, the substance of the news will not provide you a directional bias, and, many times, will even have you looking the wrong way, asserts Avi Gilburt, a widely-followed Elliott Wave technical analyst.

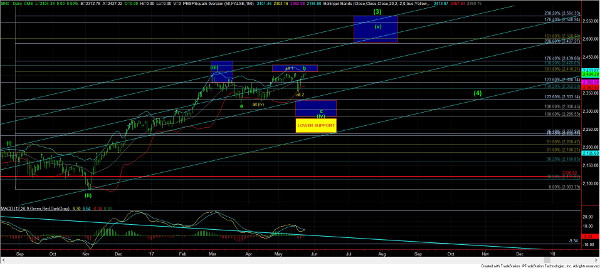

With the market remaining below our resistance of 2410SPX, we expected a drop towards 2330SPX. This past week saw a drop which bottomed within 20 points of our target region.

Anecdotal and other sentiment indications.

In my never-ending quest for outperformance in the stock market, I am still bewildered by those who follow news as their triggers to buy or sell.

Now, while I can point to specific events which have confounded those looking for a market “crash,” such as the French terrorist attacks, or Brexit, or the Trump election, it seems people simply do not learn their lessons that you cannot glean market direction from news.

While it may act as a catalyst for a market move, the substance of the news will not provide you a directional bias, and, many times, will even have you looking the wrong way.

Again, each of the examples I have presented above caused most market participants to be looking the wrong way, as the market continued its march higher towards our long-term bull market targets. You see, the market really does not care about the news. Only people who need a reason for what they want to do care about the news. But, markets are not reasonable. Markets are emotional.

Consider what Ben Franklin said hundreds of years ago: “So convenient a thing is it is to be a reasonable creature, since it enables one to find or to make a reason for everything one has a mind to do.”

So, when the market sees a sizeable move, people start searching the news events to explain why the market moved in such a way. Come on, admit it. We all do it. When you see a spike, you always ask yourself what just happened? Then you look to the news to see if something caused this spike. Yet, we are all too often fooled into believing that correlation is akin to causation.

But, before I go into how ridiculous this exercise really is, I want you to consider several other quotes:

“The causes of these cyclical changes seem clearly to have their origin in the immutable natural law that governs all things, including the various moods of human behavior. Causes, therefore, tend to become relatively unimportant in the long-term progress of the cycle. This fundamental law cannot be subverted or set aside by statutes or restrictions. Current news and political developments are of only incidental important, soon forgotten; their presumed influence on market trends is not as weighty as is commonly believed.” --Ralph Nelson Elliott

“At best, the news is the tardy recognition of forces that have already been at work for some time and is startling only to those unaware of the trend....kings have been assassinated, there have been wars, rumors of wars, booms, panics, bankruptcies, New Era, New Deal, trust busting, and all sorts of historic and emotional evelopments. Yet all bull markets acted in the same way, and likewise all bear markets evinced similar characteristics that controlled and measured the response of the market to any type of news as well as the extent and proportions of the component segments of the trend as a whole. These characteristics can be appraised and used to forecast future action of the market, regardless of the news....Those who regard news as the cause of market trends would probably have better luck gambling at race tracks than in relying on their ability to guess correctly the significance of outstanding news items....To sum up our view, then, the market essentially is the news.” --Ralph Nelson Elliott

Now, after you contemplate what Elliott said over 80 years ago, I want you to consider some of the studies done about how news events effect the stock market, and their conclusions will likely shock you.

In a 1988 study conducted by Cutler, Poterba, and Summers entitled “What Moves Stock Prices,” they reviewed stock market price action after major economic or other type of news (including major political events) in order to develop a model through which one would be able to predict market moves retrospectively. Yes, you heard me right. They were not even at the stage yet of developing a prospective prediction model.

However, the study concluded that “[m]acroeconomic news bearing on fundamental values explains only about one fifth of the movement in stock market prices.” In fact, they even noted that “many of the largest market movements in recent years have occurred on days when there were no major news events.” They also concluded that “[t]here is surprisingly small effect [from] big news [of] political developments . . . and international events.”

In August 1998, the Atlanta Journal-Constitution published an article by Tom Walker, who conducted his own study of 42 years of “surprise” news events and the stock market’s corresponding reactions. His conclusion, which will be surprising to most, was that it was exceptionally difficult to identify a connection between market trading and dramatic surprise news. Based upon Walker's study and conclusions, even if you had the news beforehand, you would still not be able to determine the direction of the market only based upon such news.

In 2008, another study was conducted, in which they reviewed more than 90,000 news items relevant to hundreds of stocks over a two-year period. They concluded that large movements in the stocks were not linked to any news items: “Most such jumps weren't directly associated with any news at all, and mostnews items didn’t cause any jumps.”

What happened this past week to make me think about all of this again? Well, back on May 8, as we were striking our recent highs, I was warning those in my Trading Room at Elliottwavetrader.net:

So, I want to prepare you emotionally for what may happen. You see, if our primary count continues to play out, the c-wave down we are expecting will likely be quite scary.

We have now seen the Chicago Board of Options Exchange Volatility Index (VIX) strike levels it has not seen in over a decade, which means complacency is now at an extreme. While the market got the good news it wanted to hear about the French elections, we are still relatively flat. In other words, it does not look like there is much juice left in the market to the upside, just as we are approaching our targets for this b-wave.

And, when the market is unable to go up, well…it usually then goes in

the opposite direction, especially as we are completing 5 waves up.

Moreover, to re-set the VIX to levels which can support a rally

to 2500+ in the SPX, I think something can hit the market which can truly

scare the market. In fact, I would not be shocked to see a 2% down day in

the c-wave to the downside that I am expecting. Remember, c-waves often

feel like crashes, as they set up the market for its next rally. So, for

this reason, I want you to at least prepare emotionally for a potentially

strong move down.

The reason you need to prepare is because it will be a buying opportunity for the run to 2500SPX, but the manner in which I would want to see the c-wave down may scare you from being able to pull the trigger.

And, this past week, we saw a day where we almost hit 2% to the downside in the Standard & Poor 500 Index (SPX). Yet, people say that such days are not foreseeable. Well, I will tell you that I was short coming into the day of the Flash Crash years ago. And, there was no news accompanying that event.

But, what truly astounded me about this almost 2% down day was the ridiculous reasons that people ascribed to the market drop.

Personally, I was expecting something bad centered around North Korea, or maybe in the Middle East, as I had mentioned in my Trading Room the prior week. But, no. The market blamed it on the issues surrounding Trump’s conversation with the FBI director. I mean, REALLY? This was the largest single day point drop we have seen in almost a year, and, I can certainly point to much worse news that has occurred during the year. Yet, the pundits and talking heads have convinced the masses that this ridiculous piece of news was the “cause” of the largest daily drop we experienced in almost a year. To me, this was laughable.

But we have been so well trained to believe that exogenous causation is what moves our market that when the market sees a sizeable “unexpected” move, we run to the news events of the day and attempt to find a reason, no matter how ridiculous. Do you not see the futility in such an exercise performed after the fact? Will this ever drive you to outperform the market? I think not.

Well, all I can say is that there was something that did give us advance warning of a potential 2% down day in the market, and it ain’t the news.

For my current analysis, please visit my "Is This a Big Fakeout?" commentary here.

At the end of the day (May 23), we came within 20 points of our downside target region. While I certainly would like to see our downside target struck, I don’t believe one should be aggressively shorting a bull market for that ideal downside target because in bull markets we often come up a bit short. See charts illustrating the wave counts on the S&P 500 here.