Both the DJTA and RUT indexes have broken to new highs. The recent improvement in these secondary indexes raises the likelihood of additional stock market gains ahead, observes Jim Stack, money manager and editor of InvesTech Research.

Persistent divergences in secondary indexes have now resolved to the upside.

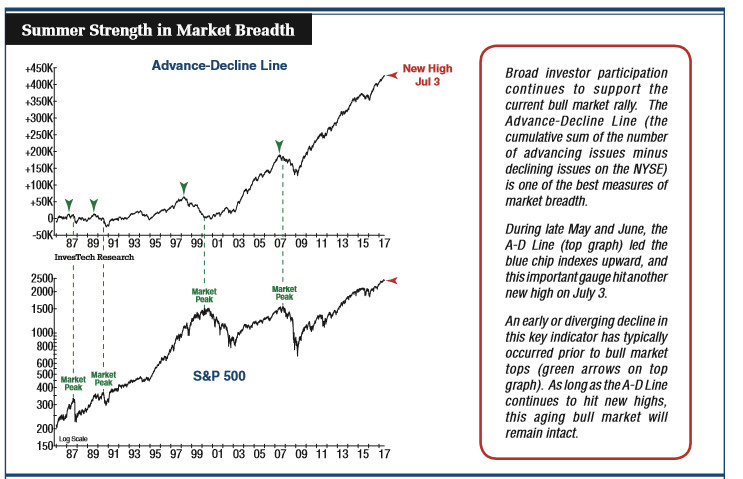

One of our most reliable leading technical indicators continues to hit new highs.

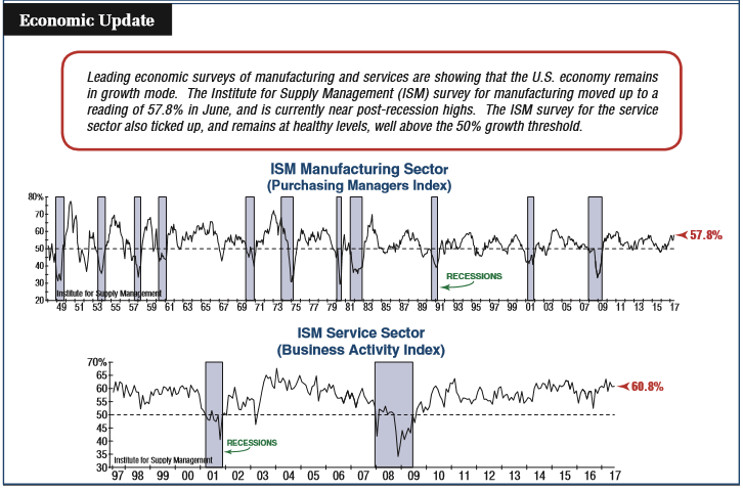

Recent data for the economy points to continued growth over the summer.

Both the Dow Jones Transportation Average (DJTA) and the small-cap Russell 2000 Index (RUT) hit new record levels on July 3. The blue chip indexes, including the Dow Jones Industrial Average (DJI) have been climbing steadily higher since the start of the year, yet the DJTA and Russell 2000 have essentially traded sideways since early March.

Now, with this latest rally, both these indexes have broken to new highs, resolving the negative divergence to the upside. The recent improvement in these secondary indexes raises the likelihood of additional stock market gains ahead.

Broad investor participation continues to support the current bull market rally. The Advance-Decline Line (the cumulative sum of the number of advancing issues minus declining issues on the NYSE) is one of the best measures of market breadth.

During late May and June, the A-D Line (top graph) led the blue chip indexes upward, and this important gauge hit another new high on July 3. An early or diverging decline in this key indicator has typically occurred prior to bull market tops (green arrows on top graph).

As long as the A-D Line continues to hit new highs, this aging bull market will remain intact.

Leading economic surveys of manufacturing and services are showing that the U.S. economy remains in growth mode.

The Institute for Supply Management (ISM) survey for manufacturing moved up to a reading of 57.8% in June and is currently near post-recession highs. The ISM survey for the service sector also ticked up, and remains at healthy levels, well above the 50% growth threshold.