As with any trading methodology, there is always some room for improvement. But what can we do to enhance our trade signal performance? Ideas from John Person, a 36-year trading veteran who has written several books and is a featured speaker Nov. 2-4 at TradersExpo.

At the end of the day when we look for a choice setup, do we really know the outcome of each trade?

Do the markets always go where we expect them to go when we expect the move to occur?

If you answered yes, then you have psychic powers. We also refer to that phenomenon as hindsight or 20-20 trading.

Let me be the first to tell you no matter how often my analysis says a market can go up or down, somehow I have an expectation of a profit-taking price level or profit objective. Nevertheless, the outcome is not always what I am expecting. I may be right on the money or the trade price comes close to that level and reverses and it misses the mark completely or keeps going well beyond my expectations.

Advertisement

Therefore, how do I properly position myself for a move if my profit target is never guaranteed? Do I build a futures account up trading two lots and then double my position size when or if my account size doubles?

Should I calculate my position size on the risk to expected reward? Meaning if I am risking 4% per trade of my trading capital - let’s say that’s $100,000.00 - and I have a one to three ratio objective, then I may calculate my position size accordingly.

Just because I have a risk target that doesn’t mean that’s an accurate assumption either. Stop-loss orders never guarantee a loss due to market conditions and slippage. Since I can’t trust the reward objective being met, exceeded or have a complete trade failure, we tend to use the risk factor in helping to determine position sizing as a method of allocation.

Those traders with smaller size equity accounts simply have to use a stagnant position size order entry method as their financial resources are limited. That does not mean one can’t make money, it simply puts a trader at a disadvantage of seeing high rates of profit growth at a faster rate for compounded returns.

A good trading plan consists of an entry signal, a risk factor a profit target, a trailing stop mechanism, a back-up exit strategy based on a peak equity performance or a maximum holding period and lastly a money management or position sizing calculation.

This is a vital aspect of my trading methodology, which is why it is the subject of this article and what we programmed in the Persons Algo Optimizer. It is also a large portion of what I will be covering in my presentations at the Las Vegas Traders Expo and my three-day seminar here in Palm Beach this November. If you would like more information on my seminar click on this link for more details.

But what’s the best way to use money management? There’s been an enormous amount of work done in the field on calculating position size yet an area that continues to be overlooked by retail traders.

For a retail trader with a smaller sizer trading account is this information even worth looking at. Does one have the capital to trade a move more efficiently? For gosh sake who cares, all a trader wants to do is survive and make money right? To a degree, this is true but what we really need and want is to make sure our rewards significantly outweigh the risks in connection with both our efforts and time spent in the market.

As a trader becomes more of a seasoned veteran and looks to improve performance that turns their focus on capitalizing on position sizing tactics. Generally speaking, this is as a direct result from developing a solid trading style that gives consistent results that are more rule-based or built on a sound structure.

A sound structure system would include considerations like:

- Efficiency use of capital.

- How much time is spent in a trade or holding period in a trade.

- Position size of trade based on risk per trade compared to average rate of return.

Another topic in this discussion is what are “quants” and “algo” programmers doing in the field of Artificial Intelligence?

Does an artificial intelligence system allow maximizing positions in anticipating a big move? Does it allow more positions to be put on if the risk is lower than the average trade?

Can computers running an artificial intelligence program really foretell the future or just the likely outcome if all the “stars line up” based on data given?

I’m leaning towards the later as the popularity of data science and data mining is a function of gathering data to input to a computer for determining an expected outcome. But it’s really position sizing tactics that gives traders the leverage to exponentially enhance profits.

Let’s examine a swing trade model on Tesla (TSLA).

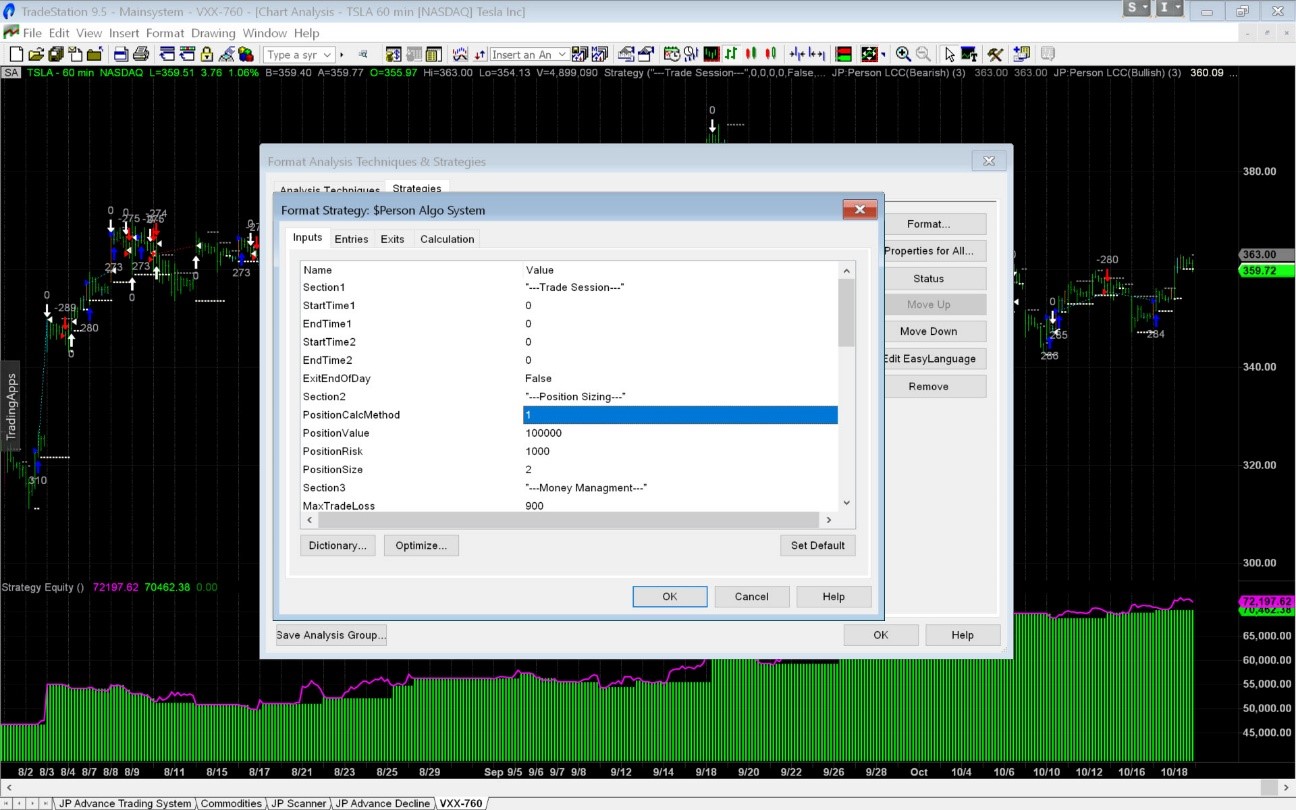

It’s been fairly active in this year but since June 2017 it has mainly been stuck in an active trading range between 320 and 380. The graph below shows the Position value selected is $100,000 under “position sizing” sections using the Person Algo Optimizer.

This is a short-term swing trading system that calculates the position size by using a maximum capital amount of $100,000 and divides that by the share price to allocate position size. This method does not require margin as it does not allow for trading more shares than the account can afford, but uses the entire capital allocated in the account.

Note the last trade was a long position at $352.11 with 284 shares (284 x $352.11 = $99,999.24). For the time period tested from June 1 through October 18, the system using a function of shares to capital function gives a nice return of $72, 197.62 which is posted in lower quadrant marked strategy equity. The magenta colored line gives open trade equity and the green vertical histograms gives the closed out trade performance.

Another method to calculate position sizing may require more capital or margin as it will use a bit of leverage in terms of calculating the position size in accordance to the risk per trade. Using a loss amount of four percent per trade against a base size account of $100,000 one can have a position size automatically calculated on a per trade basis which will adjust your position size to increase share size on smaller size stop loss trades and decrease the position size on higher loss calculations.

Using the same entry signals with this, we have now taken the equity position from a positive $72,197.00 up to $183,616.94. However, note that the position or share size changes on these trades. For example the same trade made on October 16th increased the position size from 284 shares up to 560 shares based on the risk factor. At the same time this increases the capital requirement up to $186,618.30 (560 x $352.11 = $186,618.3). At one point we need to put a cap on how much capital we want to use (or borrow) and define what our expected maximum loss per trade should be.

This is both an exciting and fascinating subject all traders should embrace which is why I wanted to heighten your awareness to the subject matter.

In addition, I want to follow up with another article covering more on the topic of position sizing using another calculation technique along with why, how and when it’s important to look at another position sizing tactic known as entry and exits.

I refer to the matter of partial entry and exits techniques, otherwise known as scale in and scaling out of trades. I do not believe one style is the right fit for all types of markets and trading various time periods and time frames. There is a proper time and marketplace that is best suited to “scale in and out” of trades or entering and exiting an entire position all at once.

This is where we will want to use the function of a backtesting optimizing feature to add a function of slippage and commission accountability to help solidify and represent a real trading market environment. With this type of data research, it will give the trader more information to make an educated trade decision based on the analysis if they want to take auto trade signals.

Until the next time, may the trend remain your friend until the backtest studies show otherwise!