It’s not easy for cryptocurrency speculators now. it seems like everyone in a position of power is turning against them. Be careful with cryptos. Consider a bet on Accenture’s blockchain consulting, writes Jon Markman, editor of The Power Elite and Tech Trend Trader.

Officials at the International Monetary Fund and the U.S. House Financial Services Committee clamored for regulation. Earlier on March 14, Google announced it would ban cryptocurrency-related ads. And all this comes after regulators are lining up like the SEC and CFTC to start regulating cryptos.

I can’t say any of this is a surprise. Let’s face it, the regulators were always going to come after cryptocurrencies. I can say, ultimately, this is a good thing for investors.

One of the attractions to digital coins is decentralization. The underlying architecture, blockchain, was designed to that ensure no single entity could exert control.

There is a permanent, digital record of every verified transaction since inception. It cannot be edited. That is a very good thing. In theory, that makes the network trustless.

It is a peer-to-peer network. It is open source. However, anyone can use the open source code to create another digital coin. And therein lies the concern…

There are now approximately 1,500 of these alternative coins. Regulators fear that, because they are unregulated and mostly anonymous, promoters are making misleading claims or, worse, engaging in criminal activity.

In “Addressing the Dark Side of the Crypto World,” IMF officials argue that decentralization and anonymity help criminals use cryptocurrency for money laundering and other nefarious acts. The only remedy, according to the IMF, is regulatory and supervisory technology.

On March 14, Rep. Bill Huizenga (R-Mich.) sounded a similar note. Normally a deregulation hawk, Huizenga told the subcommittee that Congress should act to protect crypto investors.

Rep. Brad Sherman (D-Calif.) was even more aggressive. He told the panel “cryptocurrencies are a crock,” according to a report from NBC News.

I would not go that far. They are not a crock.

But investors should be able to see where all of this is going. The powers-that-be are going to regulate cryptocurrencies. They are going to treat them as speculative investments. That means issuers, and the mechanisms where they are exchanged, will come under government scrutiny.

They will have to be vetted. They will have to make disclosures. They will have to file conflicts of interest with regulators. And they may have to do all of this retroactively.

Crypto speculators don’t want to hear this; that probably means many will disappear.

There is good news, though …

Related story: Why Most Crypto Altcoins are Going to Zero

The good news is the bad ones should disappear. Their absence will emphasize what is good.

Cryptocurrency, as a concept, is legitimate. It was born as an alternative to fiat currency during the 2008-2009 Financial Crisis. It is everything paper money is not. By design, it cannot be modified or duplicated. It is decentralized, so it cannot be controlled by a single entity. And it is deliberately scarce.

These strengths mean it is never going to go away.

Regulation, accompanied by fair and transparent methods of exchange, arguably makes cryptocurrency more valuable. Crypto investors need to keep this in mind as near-term values crumble under the weight of regulatory scrutiny.

I have been telling my newsletter members to avoid cryptocurrencies during this shakeout. During the next several months, I expect that negative headlines and lower prices will prevail. By contrast, the near-term outlook for blockchain could not look better…

Blockchain is the distributed ledger technology that underlies every cryptocurrency. Due to its transparency and flexibility, it is being widely adopted outside of digital coins. And that means blockchain-related stocks generally don’t dip when cryptos do.

Consider a bet on Accenture’s new blockchain consulting business.

This week Accenture (ACN), the global consulting business, announced a partnership with the German logistics company DHL. Together, they will use blockchain to secure pharmaceutical supply chains.

The idea is to track drugs from the manufacturing facility to warehouses, hospitals, pharmacies and doctors using Radio-frequency Identification (RFID) tags and blockchain. DHL says the setup could handle 7 billion serial numbers, and 1,500 transactions per second.

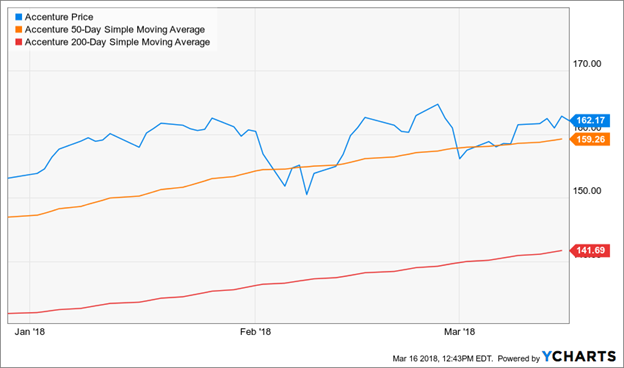

Accenture shares are up 6% in 2018 so far.

According to Interpol statistics cited by DHL, counterfeit medicine kills 1 million people annually.

Accenture is an attractive investment on its own merits. Growth has been solid, thanks to the company’s working relationships with 95 of the world’s largest 100 enterprises. In addition, managers have done a very good job increasing shareholder value. Its shares have advanced an average of 18.7% for the last five years.

Its early adoption of blockchain makes it even more attractive.

At a price of $163, the stock is ready for an upside breakout. Investors interested in crypto-related stocks should look to Accenture.

Best wishes,

Jon D. Markman

P.S. Weiss Ratings, the nation’s leading independent ratings agency of financial institutions, was the first to release letter grades on cryptocurrencies. These ratings are based on a groundbreaking model that analyzes thousands of data points on each coin’s technology, usage and trading patterns. To get the newest Weiss Cryptocurrency Ratings sent straight to your inbox every week, click here.

Subscribe to Jon Markman’s Power Elite newsletter here

Subscribe to Jon Markman’s Tech Trend Trader here

Subscribe to Jon Markman’s Strategic Advantage here

More recent cryptocurrency commentary on MoneyShow.com

The CFTC and virtual currencies

The risks and rewards of trading cryptocurrencies

Trading Lesson: Why the crypto market still lacks clarity

Trading Lesson: Decrypting the cryptic cryptos

Trading Lesson: Decrypting the cryptic cryptos: Many questions, few answers

As regulators come for crypto criminals, invest in what is real

Trading Lesson: The rise and fall of bitcoin, built on blockchain