An emerging landscape of risk remains unrecognized or appreciated it seems, at least based on the efforts to sustain market upside regardless of the actual and factual backdrop as well as deteriorating technical action, writes Gene Inger over the weekend.

This has been sort of an emerging turf battle among sectors or rotation, contrasting views on the credit markets and shuffling geopolitics.

It was a dicey call for us to emphasize North Korean recrimination at their withdrawal from pre-summit talks last weekend. They caved-in and as we reported, crawled back to such an extent that the summit may be on.

Reuters: S&P and Dow Jones Industrials (DIA) on track Tuesday for biggest one-day drops in a month.

Recall my assessment about the down phases being like an elevator, and up phases more like climbing stairs. That’s what we’ve got and our view of June S&P 500 (SPX) 2720-40 as the resistance range continues valid. We would not shift that view unless we got a meaningful thrust above 2740 as I noted at least a few times last week.

In-sum: there’s no overall change in our perspective of this market being an accident waiting to happen.

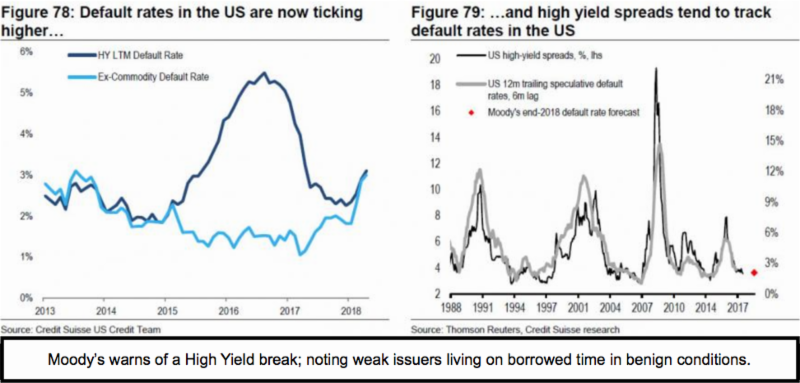

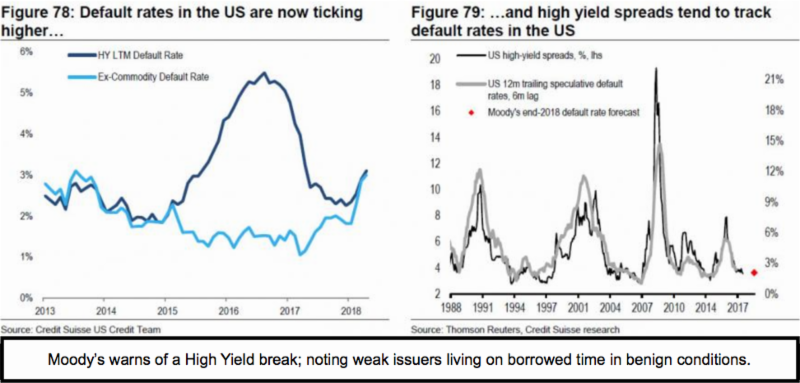

Whether it’s high yield, or just a sag from a decline in techs and oils (both have been warned of as being too pricey in the most recent stages), this remains a market on tenterhooks.

Basically, rotation won’t save it here, though it postpones reckoning.

Hard to say how it finishes month-end, especially with North Korea pending, but it’s not hard to say that meaningful upside progress is unlikely.