Now we think it gets dicier despite some believing excess is worn off. That is partially so for some of the stocks that are softer. Financials, Telecom & Utilities for instance, writes Gene Inger.

And there’s little doubt that if interest rates were firm, not as soft as they are regardless of the Fed’s policy, stocks would have more trouble holding up.

<

<

Now, just because Financials are low does not at all mean they can’t drop more. In fact, they likely will. Then there’s AT&T (T), which for unique reasons (the arbitrage-related decline) and analysts who disdain value and love excess.

It’s like those who preferred buying a potential loose cannon like Netflix (NFLX) and selling AT&T, while I stated the opposite made more sense (so far it has).

The next iPhone is more or less interim sometimes called S. But because Apple (AAPL) is making all the mainline iPhones FaceID, they may go to an iPhone 9 for that, and then a revised iPhone X Plus, which will have dual SIM capability I hear, and will be popular due to the larger 6.5-inch OLED screen. And ironically Apple has gone to some length to anodize the case in a new gold color again.

Next: some moan about AT&T’s (T) slight service, price increase and DirecTV Nowas well. Personally it’s best-of-breed (streamers) and if bundled gives consumers great pricing, so I think it flies, plus brings (alone) enough extra income to service the debt associated with the Time Media acquisition.

In fact, the value-added proposition seems to make it a customer bargain (as well as for now at least a leap ahead of competition) and transform AT&T into a media stock, which over time should command a higher multiple.

It may perform erratically but with a 6% dividend commitment, it won’t get hit like others when (not if) this market finally cracks at least for correction.

Another special situation happens to be LightPath (LPTH).

Thursday, I saw glimpses of both an industry story about it, and a listing of prices for some of their newest IR (infrared) lenses, so I’m posting it.

Their portfolio is far larger of course, but I think this is the first time I’ve seen single-unit pricing. I have no idea at what point revenue exceeds (if they do) the existing guidance of 20% annual growth, but generally even that would be sufficient. More than that would affirm a broader transformation of the small company and justify their expansion efforts, and possibly run the shares higher.

It is sort of poised for a technical breakout now if a buyer in-size shows up.

I mention LightPath here as another example of low-risk entries versus the insanity pricing of so many FANG + and similar momentum stocks.

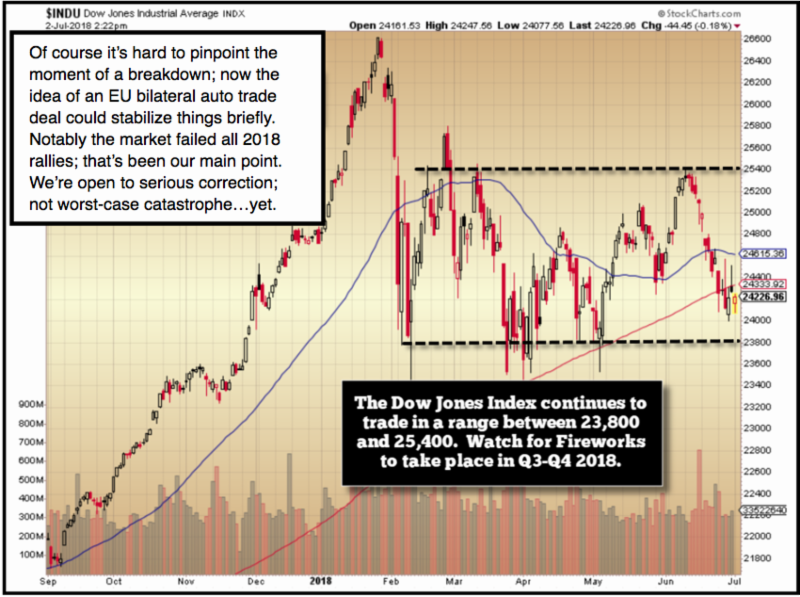

We don’t urge selling everything, just making sure one is prepared for serious correction activity as this Summer evolves perhaps into the Fall.

I’m far more comfortable in the beaten-down (but viable) or under-radar stocks as far as any newer holdings are concerned.

And it’s nearly time to warn those who are doing lots of option writing in calls of encroaching volatility. Depending on strategies, that can work or be painful quite rapidly.