Getting a handle on contagion is proving to be tricky while occurring in the timeframe I suspected of greatest risk for market volatility as I travel in Europe, writes Gene Inger Tuesday from Paris.

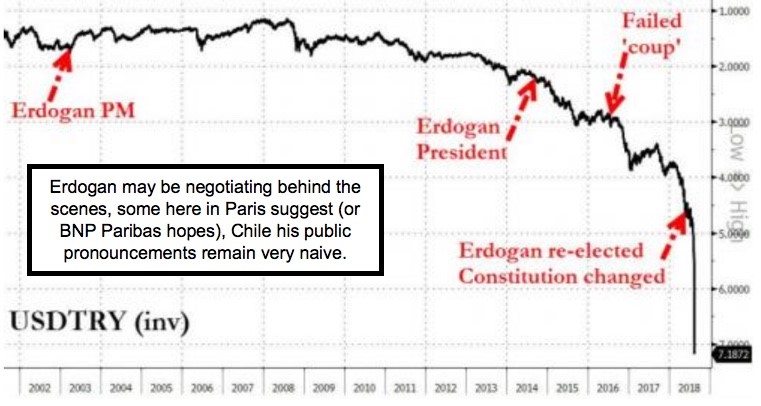

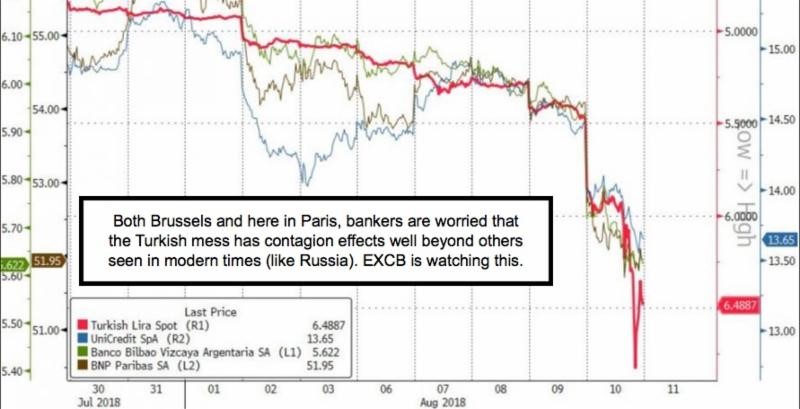

Right here in Paris we have various debates about the true extent of bank involvement in Turkey, such as BNP Paribas (BNP) and Deutsche Bank (DB); as well as the blame game trying to throw it on President Trump, mostly ignoring what Erdogan really did to himself.

Reuters: Wall Street gains Tuesday as earnings beat. Banks recover. Turkish lira rebounds.

I realize that Turkey is being viewed as a one-off crisis of the moment, not a revelation about the sizeable funds that could still be extricated from the EM’s (submerging markets as I’ve called them all year).

Aside all that, the Congressional Budget Office cut GDP growth estimates.

I believe we’re headed lower, daily-basis reprieve or not. And even if they put a Band-Aid on Turkey, which we know is being discussed currently, it’s more a question of whether Turkey is just spooking markets to a bigger or revealing event (about EM debt and so on).

And you might even have a crisis in the Brazilian real (BRL) causing deleverage conditions beyond what Wall Street is overtly concern about at the precise moment of course.

There is contagion risk across credit portfolios.