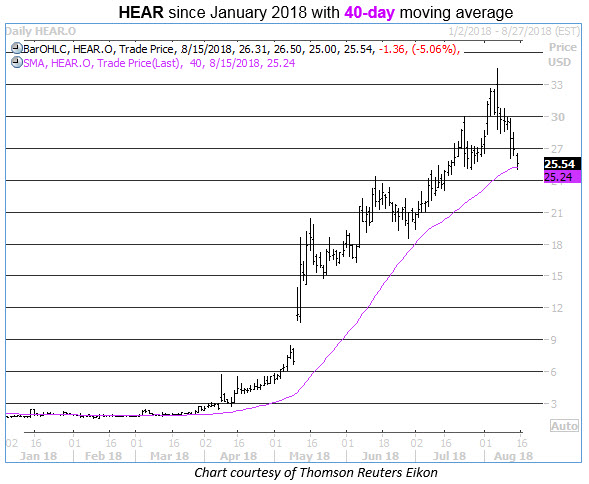

Gaming headset maker Turtle Beach (HEAR) has been on fire in 2018. After starting the year trading below $2 per share, it’s hovering around $25, and the stock’s recent pullback to a key trendline suggests it may be an opportune time, writes Elizabeth Harrow Wednesday.

It’s suggests opportunity for speculative players to buy calls in anticipation of another leg higher for HEAR.

As of this writing, HEAR stock has dropped 21% from its Aug. 3 closing high of $32.33 -- putting the equity’s correction in bear market territory. But the shares are so far finding support at the $25 level, which is also home to their rising 40-day moving average.

Over the past three years, there has been just one prior instance of HEAR pulling back to test the support of its 40-day moving average after such a prolonged period of trading above this trendline, according to Schaeffer’s Senior Quantitative Analyst Rocky White. Following that previous test, HEAR was up by 4.33% five days later, and the stock’s gain expanded to 26.57% over the next month.

From the equity’s current price, another rally of this magnitude would place Turtle Beach at $32.33 a month from now -- right back at the aforementioned multi-year closing high.

Plus, HEAR could benefit from short-covering support, should a bounce from its 40-day moving average play out to the upside. Short interest accounts for a substantial 38.63% of the equity’s float, which means there's a healthy supply of sideline cash that could help to support a resumed uptrend for HEAR.

And with HEAR fresh off its quarterly earnings report, short-term options on the stock are priced cheaply, from a volatility standpoint. Trade-Alert pegs the 30-day at-the-money implied volatility at 94.6%, which arrives in the low 11th percentile of its annual range. This points to favorable conditions for premium buyers.

In fact, the at-the-money September 25 call is currently asked at $3.20, and will double on a rally by HEAR to $31.40 -- just shy of the upside move predicted by the 40-day pullback signal.

View Schaeffer’s Investment Research for stock and options ideas, options education, and market commentary here