One week after our Crash Alert, the market meltdown gets juiced by algo-driven selling. Behavior may not be historically classic either. It’s a continuation after ongoing stealth-selling all year, writes Gene Inger. Reasons for the selloff. Trade ideas: T, YGYI, LPTH.

Re-calibrating expectations for profitability, for monetary policy and of course for corporate earnings has dominated the ongoing rationalizations or interpretations, of what’s going on. What’s happened. Or what it means.

We all know what led up to the market break: the selling in FAANGs as well as others that has gone on for weeks and in some cases months. The tighter monetary policy and the ridiculous assertion by President Trump Wednesday night that the Fed is crazy. As well as a strong Dow (DJI) and S&P (SPX) that masked lots of underlying distribution for months.

Reuters: Wall Street sells off Thursday as worries mount ahead of earnings season.

Nevertheless, aside forecasting this, let’s review known prospects as well as unknown risks.

Wednesday’s wall-to-wall financial media reflections are certainly a good effort at explaining what is going on. Generally focused on the Fed, focused on most recent (or current) defensive action. And less so on several other factors that we believe dominate the topic ofwhat’s really afoot.

**

Those realities that are often ignored include:

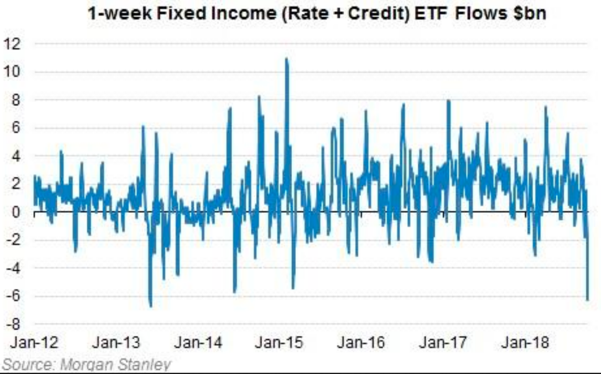

a) The Federal Reserve very clearly shifting monetary policy to snugging-up rates and offloading their balance sheet, without comparable quantifiable replacement (tightening reduces liquidity regardless of rates especially as paper matures).

b) The recent spike by rates that was on a short-term basis more than they had expected even from the last Fed Funds rate hike (hence debate about the concern regarding China simply holding but not being a participant in the 10-year auction).

c) The trade & tariff issues, which to a degree override some other concerns.

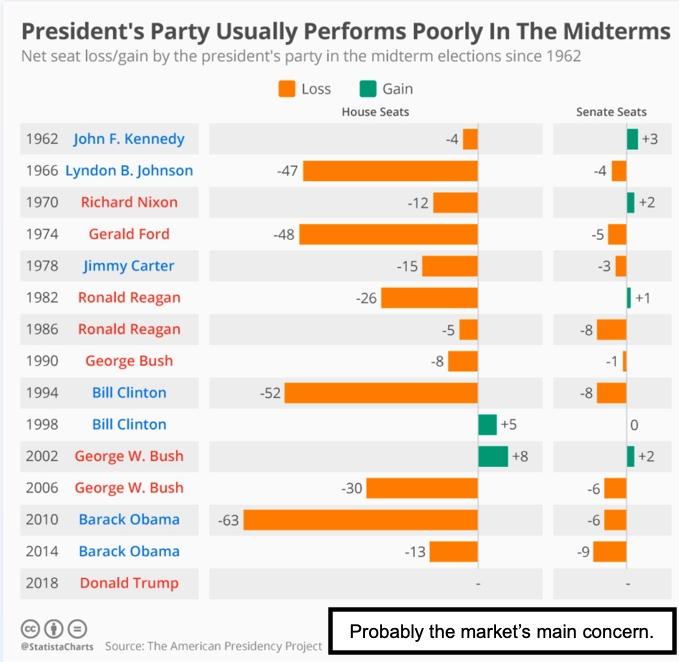

d) The soft-pedaling of the upcoming midterms, which risk shifting virtually everything with respect to projections regarding another growth leg-up.

**

But there’s more: the auction wasn’t great (sort of a C+ or B-), but paper was absorbed in Wednesday’s 3-year and 10-year auctions.

Growth is running above forecasts (by normal measures) justifying the normalization by the Fed.

If as we contend housing, autos and more are actually sluggish, well that’s why we’ve called for a reflection on whether an inventory build-up because of supply chainconcerns is also driving a perception of business activity at a higher level than reality says it is. To wit: pre-holiday hoarding of inventory without reliance on just-in-time deliveries due to China tariffs and a desire to maximize profits on what they can through the holiday season.

Liquidation

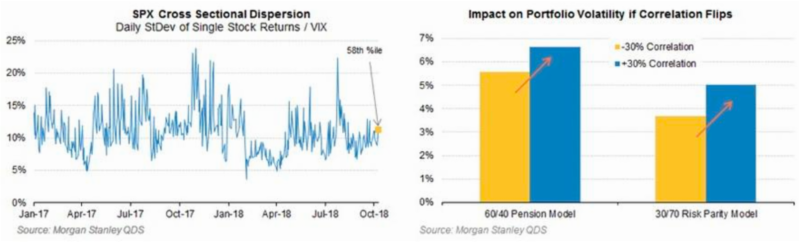

No, it’s not just the smart money sellingthat I contended is a factor on rallies all year. (Starting from our late January parabolic blow-off of course, but as persisted with more selling on ensuing Rinse & Repeat thrusts, to give an illusion of strength, masking distribution, as facts showed occurred.)

**

It goes beyond that. We contended thatbuybackswould dry-up with rates firming because most such programs were based on bond offerings.

And we believed as history bore-out that historic relative insider-sellingwas in fact occurring into strength as executives took advantage of the buybacks they engineered for additional indirect executive compensation.

I pointed out Facebook (FB), Apple (AAPL), or particularly Google (GOOG) and Amazon (AMZN) as such risky stocks, while warning particularly that Netflix (NFLX) was vulnerable to a decline and to the newly re-imagined AT&T (T) licking at their heels. T incidentally will introduce a new radically differentiated HBO service next year.

**

But there’s another kind of liquidation which contributes to not just a buyer exiting but that same buyer reversing direction and selling.

That’s China. With China’s serious debt concerns many Chinese investors urgently did move capital out of China. and bought American equities (not Treasuries only as some tend to think). They likely were liquidating those holdings so as to meet homefront obligations. That likely contributed to Chinese yuan (CNY) buying too.

Finally, the market did not respond favorably after the 10-year absorption. And that would support a view that there is more at play here than merely Fed and rate worries. For sure.

Bits & Bytes: Note that little LightPath Technologies (LPTH) of Orlando Wednesday announced the third order of 500k from the same customer. (This time the lenses will be coated in China, which might actually increase margins).

AT&T: the HBO deal I mentioned.

And a little coffee stock on NASDAQ that I looked at is quite wild; so might be a play if it first gets hit (goes to 'pot'). And, I won’t make it a formal pick as management is (or was) a bit sketchy, but if you’re interested in cannabis stocks, checkout Youngevity International (YGYI) if it sets back a bit after popping.

The San Diego firm (a merger of a health firm with a former Miami coffee supplier) aims to push cannabis-infused beverages, with (unproven) effects of aiding sleep, and filtered water run over pills that provide claimed benefits without the THC effect that creates a marijuana high.

I ‘m just pointing out a stock that was and is dangerous at the same time it’s sort of in play with hit-and-run moves at the moment.

So many cannabis stocks went up (and down). This one just announced a move into the field, and essentially doubled. Definitely not for investors or the faint-of-heart. So many ask for cannabis stocks, so I’ll mention this.

In-sum: The basic props under this extended market were giving way since January. And that’s how we’d forewarned building personal cash and being ready for a more visible correction by senior averages.

Rotational selling of course took many small caps. And later momentum favorites (FAANG+) to lower levels progressively while the rotation into conventional industrial types was insufficient to offset the selling in mo-mo stocks.