Short interest on American Express stock rose by 15.4% in the most recent two-week reporting period, according to Elizabeth Harrow.

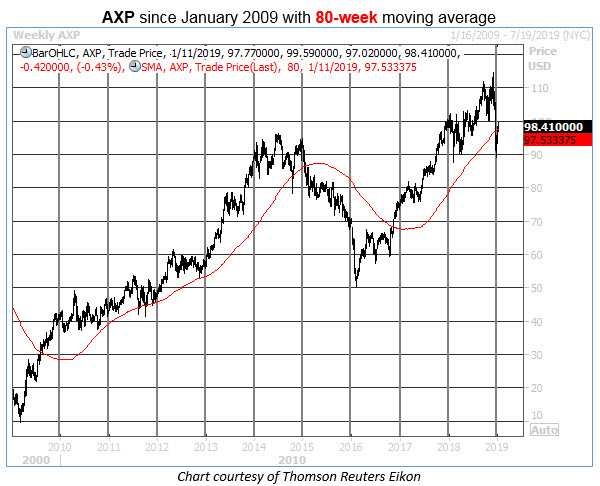

Financial services stock American Express (AXP) briefly revisited its April lows in the $90 area during the market's bruising late-December slide, but the Dow component has joined in the broad-based rebound. AXP is now up about 10% from its Christmas Eve close at $89.50, and the shares are on track to close a second consecutive week back above their 80-week moving average -- a long-term trendline that has historically signaled buying opportunities (see chart).

In fact, Schaeffer's Senior Quantitative Analyst Rocky White found previous occasions where AXP was trading less than one standard deviation from its 80-week moving average, after having spent 80% of the time above it over the past 20 weeks. There have been 13 such signals over the past 15 years, and the stock's returns going forward are compellingly bullish— especially for a "boring" blue chip like AXP.

Looking out four weeks after one of these 80-week pullback signals, AXP was 3.62% higher, on average, with 77% of the returns positive. And expanding the time frame to three months after a signal, the stock's average return climbs to 6.34%, with 85% of the returns positive.

However, Wall Street seems unprepared for an extended AXP rally. Among the 18 analysts tracking the shares, only seven call them a "strong buy," with 11 doling out a lukewarm "hold" rating. Any upgrades from this group could bring some fresh buyers to the table in the weeks ahead.

Meanwhile, short sellers have been piling on. Short interest on American Express stock rose by 15.4% in the most recent two-week reporting period, and was up by 27.1% over the past two reporting periods. The current supply of 7.86 million AXP shares sold short represents an eight-month high, and points to a healthy supply of sideline cash that could unwind to fuel short-term upside in the stock.

Options players are also bearishly skewed. During the past 50 days, speculative players on the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) have bought to open 1.45 puts for every call on AXP. This ratio arrives in the 86th percentile of its annual range, as options traders have shown a greater preference for bearish bets over bullish only 14% of the time in the past year.

With AXP set to report earnings on Jan. 17, prospective call buyers may wish to see how the post-event price action shakes out — and how low implied volatility falls before placing a trade based on this bullish buy signal. That said, given the strength of the three-month returns following prior 80-week pullbacks, it's worth pointing out that AXP’s at-the-money April options are currently pricing in just 24.8% implied volatility, which is about 14 percentage points "cheaper" than the stock's current 30-dayvolatility.