John Rawlins updates recent QuantCylce forecasts and shows why copper may be confirming recent weak economic numbers.

Last week we recommended the meats pair trade: Buy Lean Hogs & Sell Cattle. That trade has not moved a lot, but the QuantCycle logic behind it has only grown stronger. It would have been marginally profitable depending on your entry. Take a look at both charts today.

On Valentine’s day we suggested that natural gas was at the precipice of a major reversal from weakness to strength. So far so good, and the QuantCycle is still suggesting a strong upward move. You may want to add to your long.

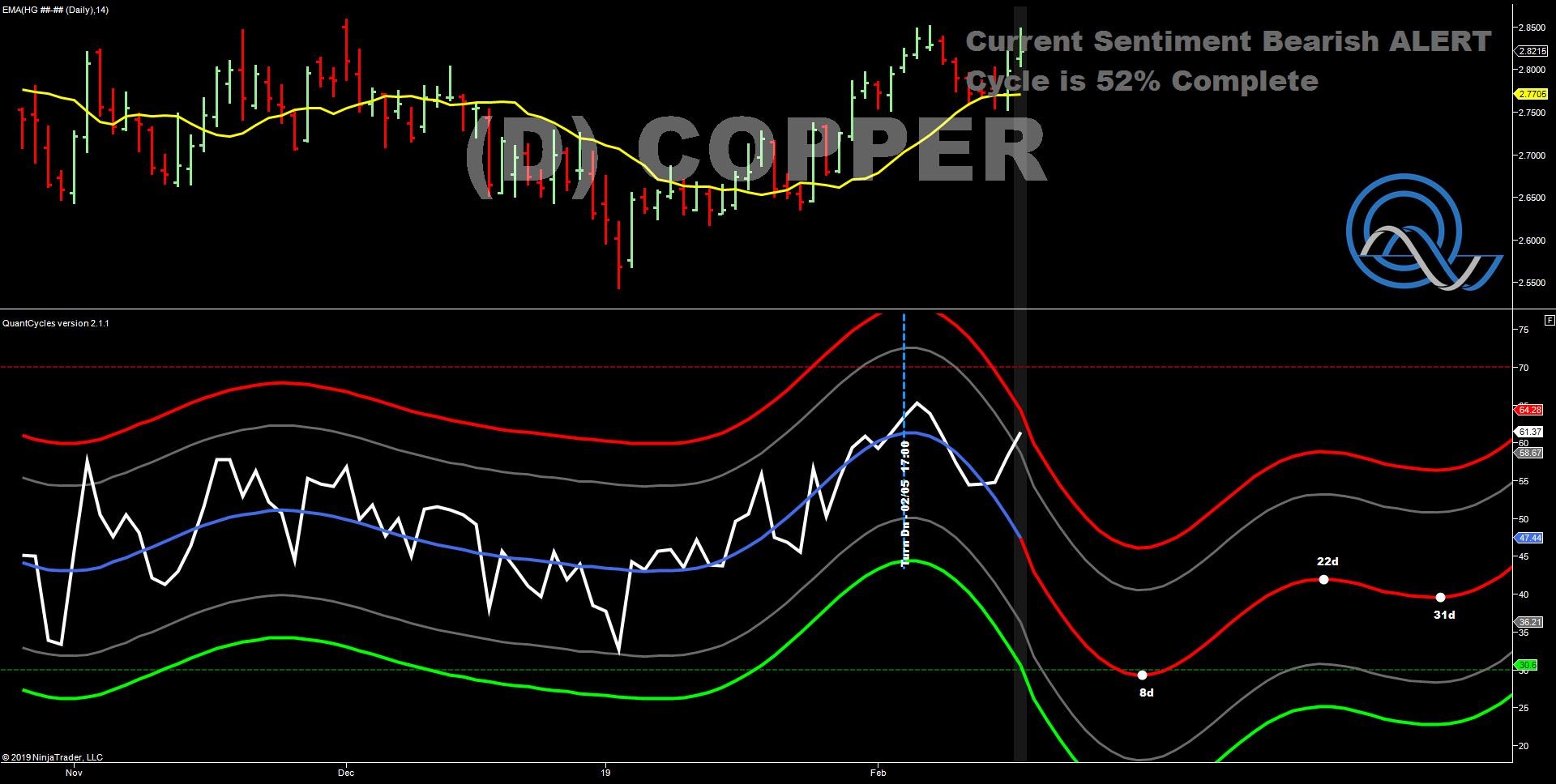

Copper

Copper is known as the commodity with the PhD, due to its important role as an indicator of growth. If you need to build more cars or more houses, you need a lot of copper. Copper demand is a strong indicator of economic growth.

The QuantCycle is showing that copper may be backing up recent weak economic indicators. The daily QuantCycle Oscillator for copper turned lower at the beginning of February, and copper responded accordingly. However, copper reversed the last couple of days, which has put it near extreme overbought conditions on the QuantCycle. This is a strong sell signal it expects copper to drop sharply over the next two weeks.