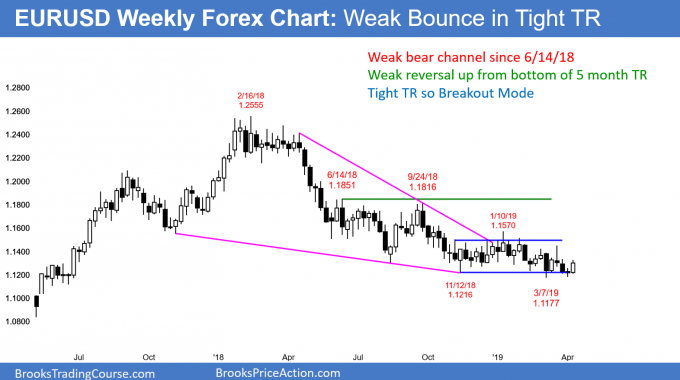

The euro is due for a breakout, but could take a while for the next trend to form, writes Al Brooks.

The EUR/USD currency pair bounced over the past two weeks. It is in breakout mode. While everyone is waiting for news on Brexit, traders need to understand that the breakout can come on any unexpected news, even if the news appears minor.

The weekly chart of the euro formed a bull trend bar last week after three bear bars. The body was not especially big and there was a conspicuous tail on top. This is not yet a strong bull trend reversal. Furthermore, the chart has been forming lower highs and lows since Jan. 10, and every leg up or down for six months has reversed after two to three bars. The bulls need much more before traders will conclude that a bull trend reversal is underway.

What about the bears? They keep getting lower highs and lows, but the bear channel is almost horizontal. Traders are trading it like a trading range. They are buying low, selling high and taking quick profits.

Since the bear channel is essentially a tight trading range, the weekly chart is in breakout mode. Traders are waiting for a strong breakout up or down before concluding that the trading range has ended, and a trend has begun.

The problem is, when a market is in breakout mode, there is a 50/50 chance on whether it will breakout up or down and a 50% chance that the first breakout will fail.

Until there are consecutive closes above or below the range, traders will assume that the trading range is still in effect. They will then continue to buy low, sell high and take quick profits.

This trading range has lasted five months. That is the longest trading range in two years. Consequently, traders expect a breakout up or down at any time.

Everyone assumes that the breakout will come on Brexit news. Europe and the Brits keep deferring the conclusion. It is a mistake to believe that this is the only catalyst. The breakout can come at any time and on any news. This includes news that initially appears insignificant.