The Fed knows you don’t cut rates with the stock market sitting close to all-time highs late in an expansion, writes Jeff Greenblatt.

Like many of you, I’ve been following these FOMC meetings for at least 20 years. In that time, we’ve seen just about everything, until today. Chair Jerome Powell told us the main theme was to keep the expansion going as long as possible.

Does that mean that prior to today, they didn’t want to keep the expansion going? Everyone is fixated on the wording; I look at what they do. If you are going to look at the wording, nothing is going to be accomplished. For instance, they’ve penciled in one rate cut next year with a rate hike the year after, in 2021. How do they know what the economy is going to look like in 2021? I didn’t know they were in the fortune telling business.

Let’s get serious. Like the rest of you, I’ve been hearing about a rate cut very soon. According to the business media, there was an 80-85% chance of a rate cut in July. My response? That of course is based on the Fed Fund Futures traded at CME Group, and the fact that CME has created its FedWatch tool that easily calculates the odds of a move in the Fed funds rates based on the price of it futures contracts. Of course, the market could be wrong as it was prediction a much quicker pace of tightening a couple of years ago. If you are going to cut rates, why not right now? The economy either needs a boost or it doesn’t.

Now they said they aren’t expected to cut rates at all this year. The market had a knee-jerk reaction to the removal of the word ‘patient’ because they think there might be a rate cut soon. My wife used to worry because I actually understood what Greenspan was saying. With that in mind, I understand what Powell is saying as well. But hold the presses, as soon as Powell’s press conference was over, FOX Business reported there was a 100% probability of a rate cut in July. I don’t remember seeing anything like this.

We’ve always known the Fed was behind the curve. Trump is upset with Powell because he wants the Fed to cut rates. I’m upset for a different reason. I highly doubt they are capable of handling the hand they’ve been dealt. To understand what happened today, you must go back to the environment since 2012. You’ll recall that was a do-nothing Congress which didn’t want to use fiscal policy to stimulate the economy. This went on for an entire presidential term. Fed Chair Bernanke had to institute QE to compensate. We know it was the weakest recovery since the Great Depression and they had to keep rates low for far too long. To even the slate, the Fed had to raise too much to compensate. What should’ve been happening is a gradual rate hike over the past two years as opposed to what they did. Why did they raise the way they did? We were told it was because they wanted to have powder in case the economy weakened. Why not deal with the current situation as opposed to dealing with hypotheticals? We know the answer to that.

Now with a better economy, small rate hikes wouldn’t be such a big deal. But since they raised so much the crowd expected a cut which they didn’t get and probably shouldn’t expect. I wouldn’t pay much attention to the kneejerk reactions by the media either.

The Fed knows you don’t cut rates with the stock market sitting close to all-time highs late in an expansion, even one has weak as this. On the other hand, I also think they realize that cutting rates isn’t the solution against structural problems like tariffs, potential antitrust issues and cutthroat politics in Washington. The net result is they are divided and completely misleading the market. Its going to continue because if the market tanks there is going to be many rate cuts. If the market keeps going, they are going to be forced to raise. It finally shows a level of incompetence to talk about one rate cut next year and a hike the year after. Is it any wonder the crowd is confused?

Getting beyond all this, markets are coming to their seasonal change points and without a cut coming soon, odds have increased we could have a high in the coming days. The other point is markets rallied coming into this sequence based on a tweet from Trump stating he had a good conversation with Chinese President Xi and said they’d meet later this month at G20.

To sum up, markets were rooting for a rate cut because they believe the economy is weakening. Yet the Dow was up 400 points the other day based on nothing more than hope and a conversation. Nothing substantive happened and odds are nothing will happen on the trade front until the election. The Chinese have called their hand. They play the long game and won’t commit until they see if Trump is reelected. Why doesn’t anyone believe them? It’s yet another manifestation of the Extraordinary Popular Delusions and the Madness of Crowds. The book was published in 1841 but probably applies more today than any book ever written about mass crowd psychology.

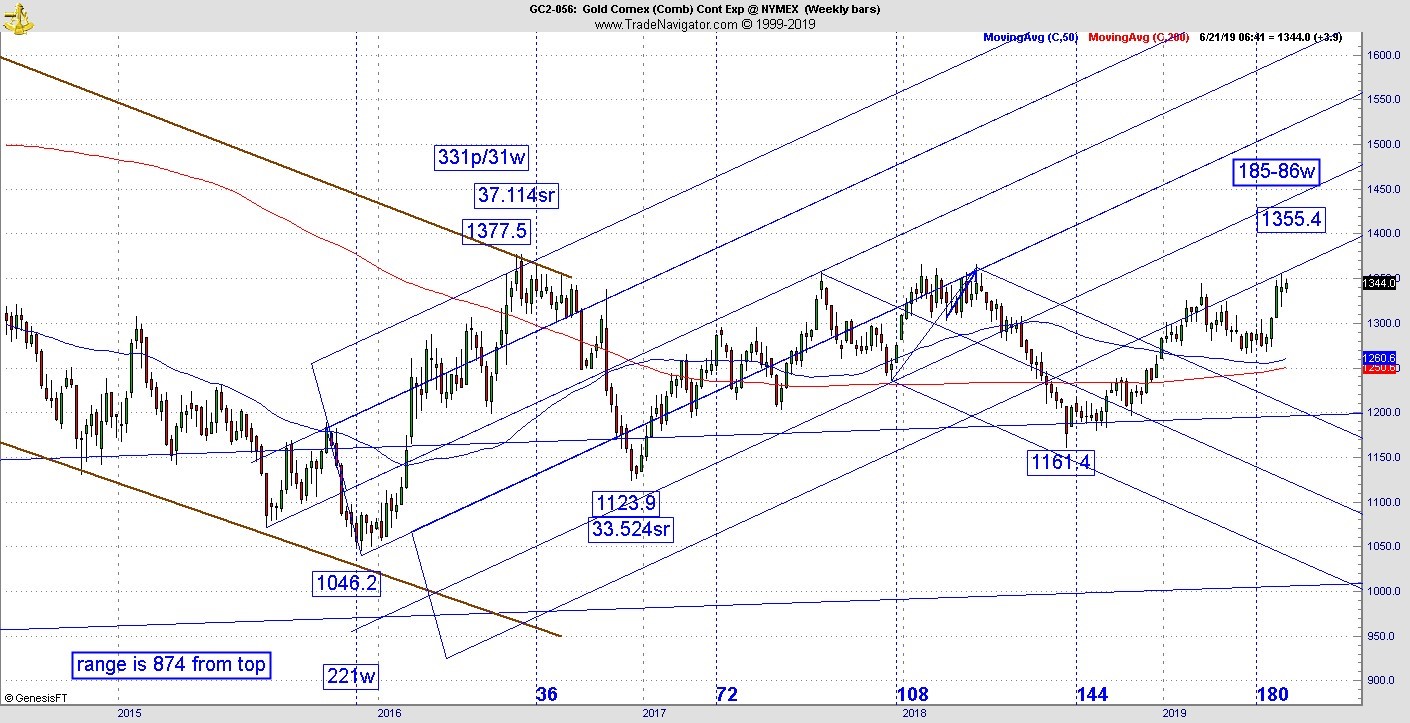

In other news, precious metals are likely checking in with the last guard at the gate. The rally in gold has passed every cyclical test on an intraday basis on its recent surge. Now with a range down of 874 points going back to the 2015 bottom its sitting at 185-86 weeks off that low. If it can survive this square out vibration, odds go way up a very long-term bottom gets confirmed.