Last week’s rally has the Cboe Volatility Index (VIX) in oversold territory, reports John Rawlins.

Last week stocks rallied sending the S&P 500 to all-time highs and the Cboe Volatility Index (VIX) to near recent lows. While the VIX did have a minor spike in May when the S&P 500 tested its March low, it has pretty much defied our long-term QuantCycles Oscillator pattern higher.

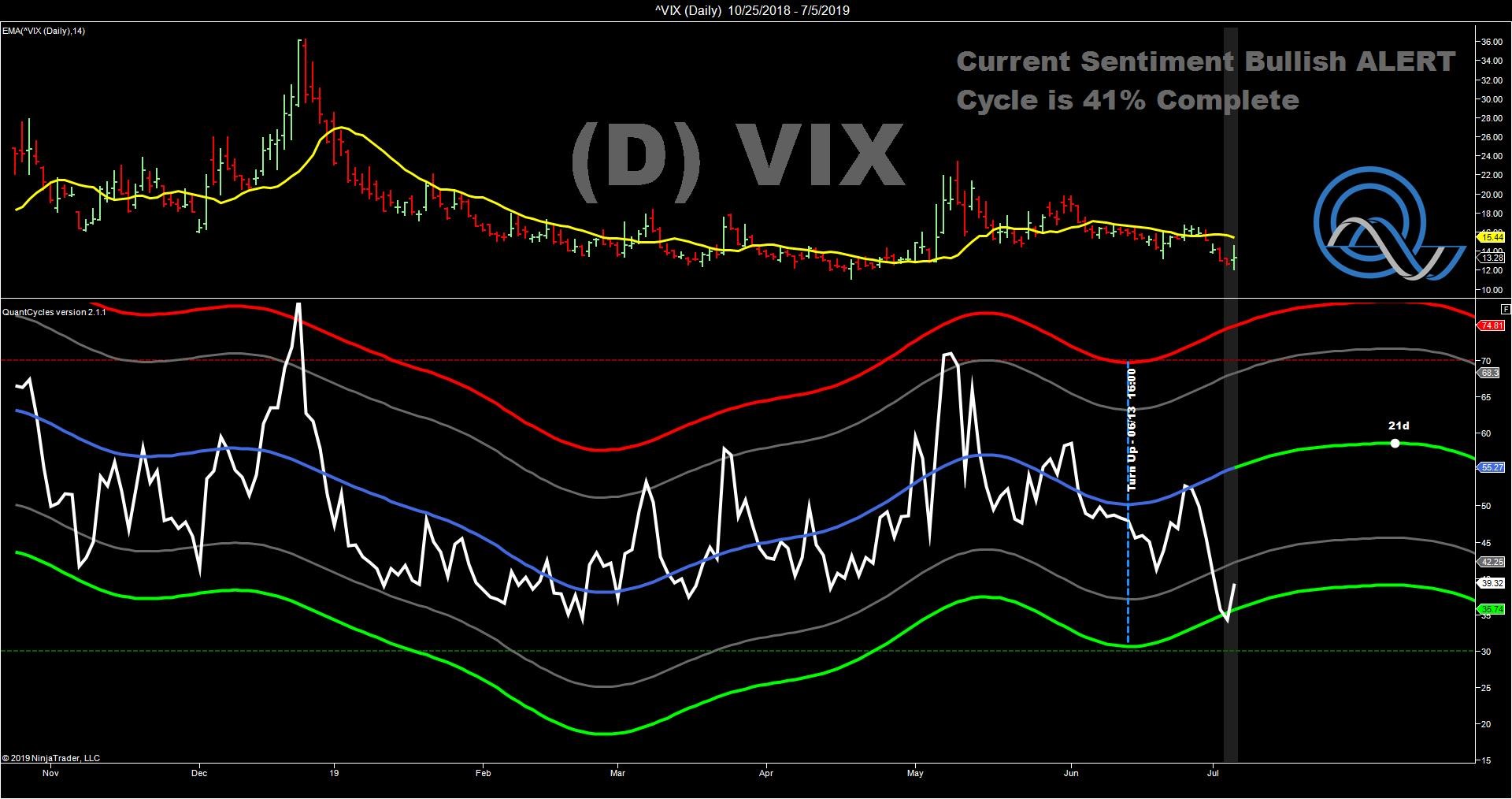

While the VIX hasn’t set new lows, its steady performance given the QuantCycles outlook has pushed the weekly chart close to extreme oversold territory with the QuantCycle expecting the VIX to move higher through August (see chart).

Last week’s sell-off in VIX pushed the daily oscillator into oversold territory as well. While not as steep as the weekly oscillator, the daily QuantCycles chart anticipates the VIX rising over the next three weeks.

This has also been confirmed by the four-hour chart. While the short-term chart turns lower today, it also breached oversold territory and resumes its upward trend after a brief dip.

Given conflicting fundamentals, this is a sign that the market may have reached a near-term top (Volatility, a near-term bottom).

This has been confirmed further by a turn in our daily chart on the Dow Jones Index (see chart). The daily QuantCycles Oscillator has the Dow moving lower over the next three weeks.

John Rawlins described the value of the QuantCycles Oscillator recently at The Orlando MoneyShow.

The QuantCycles indicator is a technical tool that employs proprietary statistical techniques and complex algorithms to filter multiple cycles from historical data, combines them to obtain cyclical information from price data and then gives a graphical representation of their predictive behavior (center line forecast). Other proprietary frequency techniques are then employed to obtain the cycles embedded in the prices. The upper and lower bands of the oscillator represent a two-standard deviation move from the predictive price band and are indicative of extreme overbought/oversold conditions.