The rally in the EURGBP currency pair pushed it into overbought territory as the QuantCycles Oscillator is expecting a sharp decline, reports John Rawlins.

The EURGBP currency pair rallied sharply as the selection of Boris Johnson by Great Britain’s Conservative party to serve as Prime Minister increases the likelihood of a no-deal Brexit.

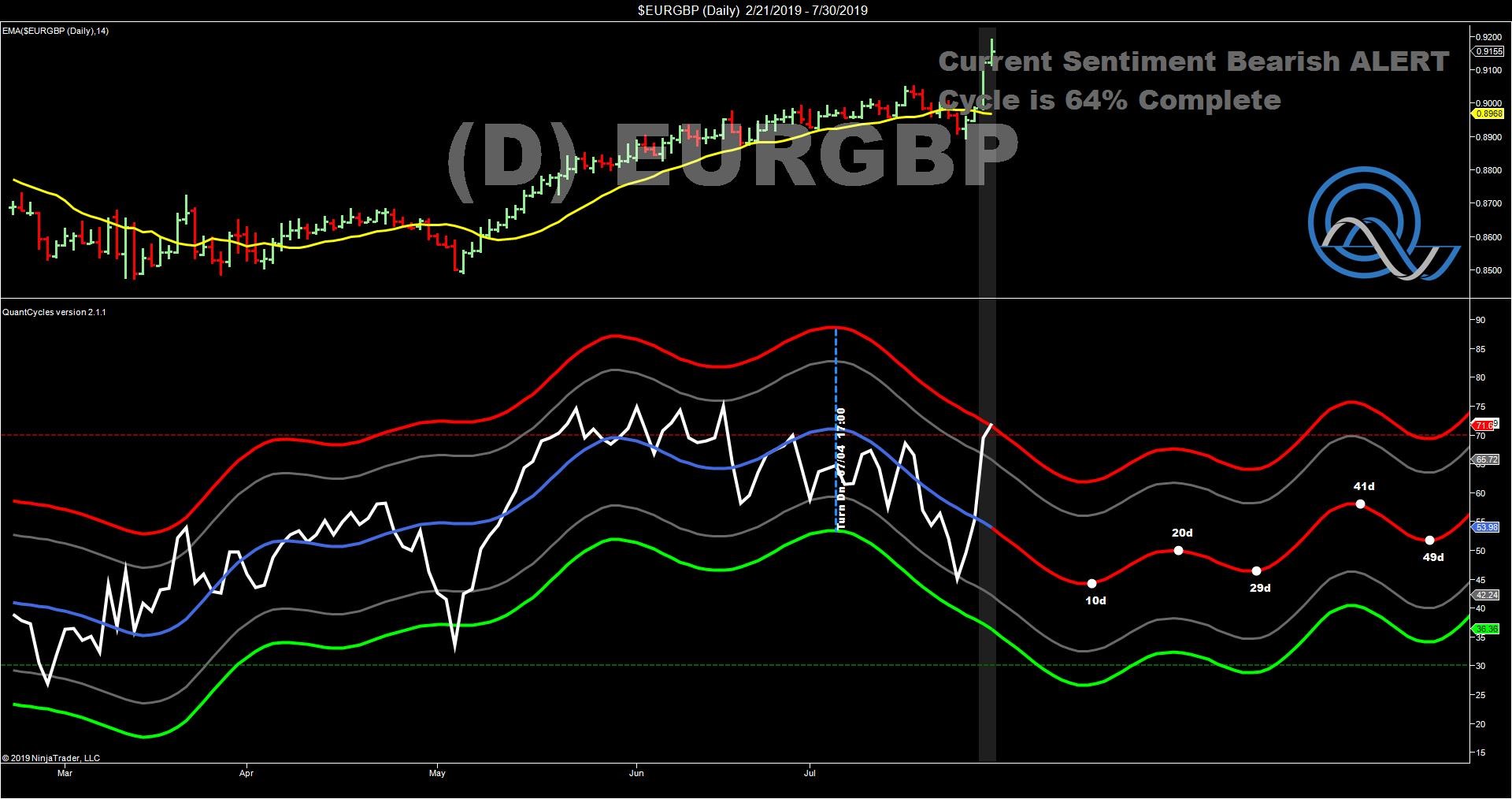

The euro rose in value vs. the pound against the current QuantCycles Oscillator prediction (see chart).

As you can see from the chart, the daily QuantCycles indicator for the EURGBP pair turned lower at the end of June. Though a bit early, the oscillator had it right as the EURGBP dropped considerably up until last week’s announcement. This reversal against the QuantCycles Oscillator pushed the oscillator to the edge of overbought territory with the oscillator indicating continued weakness for the next 10 trading days.

The longer-term weekly oscillator confirmed overbought conditions and further weakness (see chart).

The EURGBP pair leveled off at the QuantCycles top before last week’s rally which pushed it into overbought territory. The weekly chart anticipates continued weakness in the pair through October, suggesting a strong sell signal.

Looking at the shorter term, the four-hour EURGBP chart also moved into overbought territory and anticipates a sharp decline (see chart).

This is a strong short signal. The only question is how long do you want to play it? The shorter-term charts indicate that the pair will turn up after a few days or weeks, while the longer-term chart indicates weakness continuing through the fall. Traders may consider using micro futures to have the flexibility of taking short-term profits and moving their stops to breakeven and maintaining the opportunity of profiting from a longer-term down move.

One issue could be tomorrow’s Federal Reserve Open Markets Committee (FOMC) meeting. The opportunity was created by fundamental news overtaking the cycle to create overbought conditions. This could happen again so careful traders may wish to wait for the Fed and hope the markets moves in a way that create a stronger opportunity. Either way, this is a strong shorting opportunity in the EURGBP.

John Rawlins described the value of the QuantCycles Oscillator recently at The Orlando MoneyShow.

The QuantCycles indicator is a technical tool that employs proprietary statistical techniques and complex algorithms to filter multiple cycles from historical data, combines them to obtain cyclical information from price data and then gives a graphical representation of their predictive behavior (center line forecast). Other proprietary frequency techniques are then employed to obtain the cycles embedded in the prices. The upper and lower bands of the oscillator represent a two-standard deviation move from the predictive price band and are indicative of extreme overbought/oversold conditions.