Bonds have actually outperformed stocks for most of 2019 and one trader is betting on another big move, reports Jay Soloff.

One of the more intriguing investment stories in 2019 was the huge jump in government bonds prices. Long-term bonds, in particular, soared higher for a substantial portion of the year, outperforming stocks – and with lower volatility.

Stocks have since caught up with and passed bonds (year-to-date), but from a risk-adjusted perspective, bonds have arguably been the superior investment in recent months (or even years depending on your viewpoint). Keep in mind that bond prices are way less volatile than stock prices pretty much at all times.

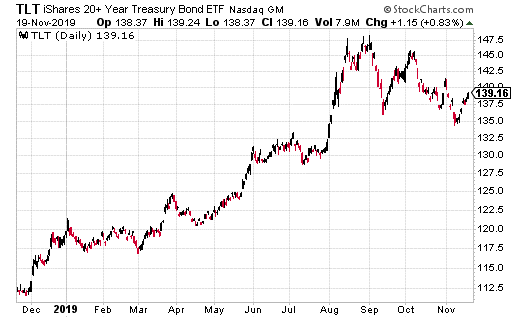

One of the easiest ways to invest in long-term government bonds is using iShares 20+ Year Treasury Bond ETF (TLT). For 2019, the SPDR S&P 500 ETF (SPY) has outperformed TLT from a return standpoint. But, if we go back a full year, TLT is up 21% compared to SPY’s 14% gain – not including gains from dividends.

In November of 2018, TLT was as low as $110. In September of this year, it was as high as $147.50 before pulling back below $140. That's quite the jump for a generally slow-moving asset like long-term bonds, as you can see in the chart below.

The climb in bond prices was due primarily to a combination of a fallout from the trade war with China and also in anticipation of the Federal Reserve's aggressive rate-cutting schedule. But what lies ahead? Can TLT return to its highs of September?

Right now, the Fed is only expected to cut rates one time in the next year (according to the futures market). What else could spur the demand for bonds if the Fed isn’t cutting aggressively? Perhaps negative rates in other major bond markets will continue to push global safe-haven investors to buy U.S. bonds.

Whatever the case, there’s at least one large options trader who’s either very bullish in TLT or is hedging against another big move higher. The trader purchased 12,000 January 147 calls for 41¢ with TLT at $139. Breakeven is $147.41 for the trade, or right near those September highs.

A straight call purchase like this is generally a bullish trade. The trader can only lose the premium spent on the calls, or about $500,000. Above the breakeven point, every dollar higher in TLT generates $1.2 million in profits.

Of course, bonds would have to go significantly higher in the next two months for this trade to become a big winner. More likely, the trader (if the goal is speculation) is looking for a smaller gain in premium, which of course, would be amplified by purchasing 12,000 calls.

If you are bullish bonds, this is a relatively cheap and easy way to get long exposure on a big move higher. If you don’t think bonds are moving that much higher, you can use a call spread instead and start at a lower strike. Regardless, it will be interesting to see if this large trade portends another big increase in bond prices.

Jay Soloff is the Options Portfolio Manager at Investors Alley. He is the editor for Options Profit Engine, an investment advisory bringing you professional options trading strategies, with all the bells and whistles of Wall Street, but simplified so all you have to do is enter the trades with your broker.