Kohl’s poor number last week highlights the potential chaos markets are facing, notes Joe Duarte.

A few weeks ago, it seemed as if the stock market was about to power much higher, but last week’s action proved that unpredictability is at an extreme. For example, take the drubbing in shares of retailer Kohl’s (KSS), which I profiled in a positive light here last week, albeit with the caveat: “I do suggest a bit of caution as KSS reports earnings on Nov. 19. And even though the current trading pattern suggests that investors are expecting good news, keeping a well-placed sell stop under any shares will help you sleep at night especially if KSS delivers a negative surprise in the report and the shares get crushed.”

Of course, we all now know that Kohl’s got crushed as it missed its earnings and revenues while downgrading its future guidance. That the company missed badly suggests that despite its best efforts, its business model is not working, and that its attempt to be the next Amazon.com isn’t measuring up. Kohl’s failed its encounter with complexity and is now well into chaos territory, where the trading pattern is no longer reliable and is instead predictably unpredictable.

Accordingly, it seems logical to consider that what happened to Kohl’s can happen to any stock at any time in the not too distant future, as the Markets Economy Life (MEL) ecosystem starts to consider the general outlook for the future in an increasingly uncertain world. Consider that people make financial decisions based on how the interaction between the stock and bond markets along with Federal Reserve policy affects the value of their 401(k) plans and their ability to borrow money through the home equity lines of credit.

Customers make financial decisions based on the information that’s available at the time of transaction such as the price, need and general quality of merchandise they find at department stores along with their own financial situation. So, in this case, clearly something didn’t add up which means that even if Kohl’s stores may be full, the company’s results are more about whether enough people are making purchases while they are in the store or are plugged into their app. Furthermore, this seems like a KSS problem, not a retail problem given the positive results from rivals Target (TGT) and JW Nordstrom (JWN).

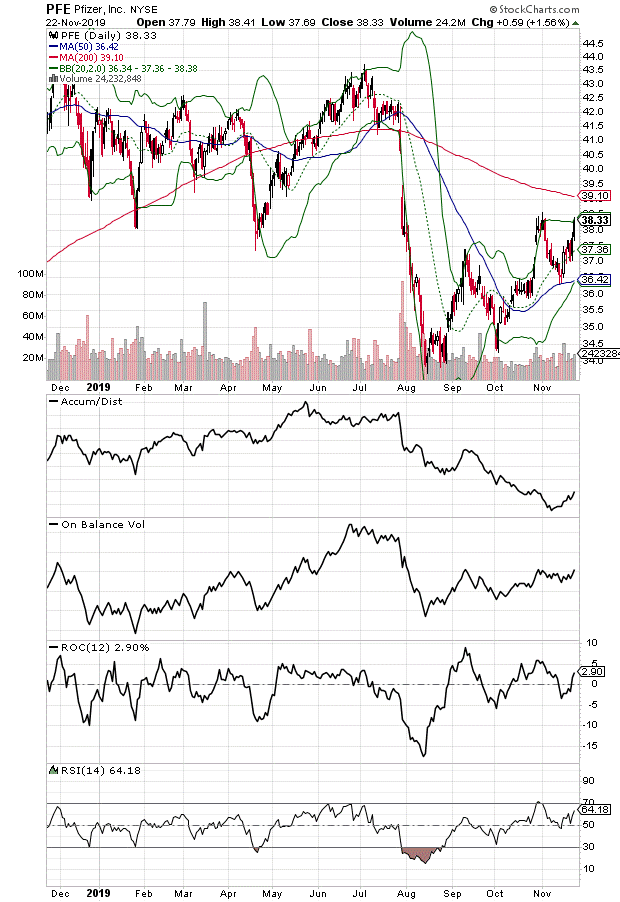

And while we can parse the retailing sector’s recent fate, shares of the pharmaceutical sector’s biggest wallflower Pfizer (PFE) continue to edge closer to a reversal of fortune as the stock is nearing a test of its 200-day moving average.

As I noted in my recent article, Pfizer’s shares have languished of late as it lost its patent on its blockbuster nerve pain drug Lyrica and made some questionable decisions such as trying to launch a long acting morphine tablet into a crowded market just as the opioid war was starting to heat up. Moreover, I also noted that there were some interesting pipeline and active drug developments that were worth noting, such as its Eliquis blood thinner and its growing Biosimilar (generic biotech drugs) portfolio along with a heart drug failure drug (Vyndagel) for the treatment of what may not be as rare a form of the disease as previously thought.

Moreover, it’s starting to become evident that Pfizer’s cancer drugs are gaining ground as Inlyta has been approved for combination treatment with Merck’s (MRK) blockbuster Keytruda in certain forms of renal cancer while PFE’s CDK inhibitor Ibrance delivered $1.3 billion in global sales in the most recent quarter.

Joe Duarte has been an active trader and widely recognized stock market analyst since 1987. He is author of Trading Options for Dummies, and The Everything Guide to Investing in your 20s & 30s at Amazon. To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit here.

Join Joe at the MoneyShow Orlando Feb. 6-8 where he will be discussing the ins and outs of the Markets-Economy-Life ecosystem (MEL) and how he uses it to pick winning stocks.

The shares are indeed starting to gather some momentum and there may be some further good news ahead if the FDA expands the indications for Xtandi, a drug that blocks testosterone in advanced cases of prostate cancer. The decision date is expected sometime in December 2019.

Joe Duarte has been an active trader and widely recognized stock market analyst since 1987. He is author of Trading Options for Dummies, and The Everything Guide to Investing in your 20s & 30s at Amazon. To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit here.

Join Joe at the MoneyShow Orlando Feb. 6-8 where he will be discussing the ins and outs of the Markets-Economy-Life ecosystem (MEL) and how he uses it to pick winning stocks.