Markets are navigating various risks, investors need to manage risk, writes Joe Duarte.

Investors should prepare for a possibility of a positive reversal in stocks if the reports of successful treatments of the Coronavirus prove to be reliable.

The action at edge of Chaos continues to accelerate as the Washington politics reach a crescendo, the Coronavirus situation continues to evolve, and the Markets-Economy-Life (MEL) complex adaptive ecosystem continues to react. In fact, given the rapid decline in the market, and the reports of some success in treating the Coronavirus with antiviral drugs, the possibility of a recovery in stocks is not just plausible but likely and potentially explosive.

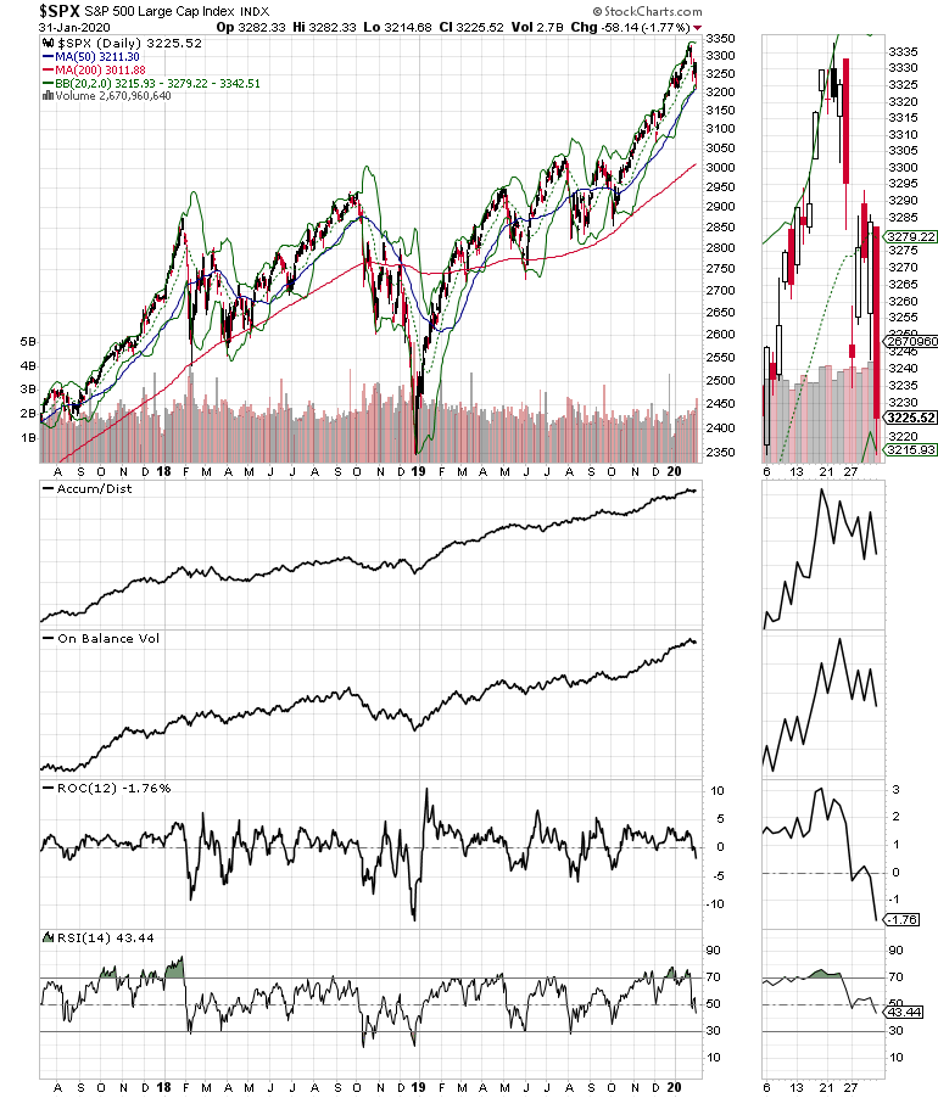

Readers are well aware of my focus on the Markets – Economy – Life Ecosystem (MEL) and the fact that it has been heading toward a decision point over the last few weeks. Indeed, I have been expecting a minor pullback in the stock market since mid-January and as of the close of trading on Jan. 31, the S&P 500 (SPX) was well into that correction range at 3341 (- 3.23%) off of its Jan. 22 intraday highs.

Furthermore, I’ve also focused on whether the late 2019 rally in stocks and the ensuing current correction in stocks might be the transition point between a 10-year bull market and the start of a new bear market in MEL. And while the answer is not clear, it seems that the key question is whether the Coronavirus and its potential economic ramifications may be enough to derail the Fed’s aggressive monetary accommodation via its daily injections of money into the repo market, which is essentially QE 4, regardless of the central bank’s terminology. So, let’s look at both sides.

On the downside:

- The bond market is pricing in a recession based on the worst case scenario for the Chinese economy in response to the Coronavirus and the potential for a global contagion in economic terms.

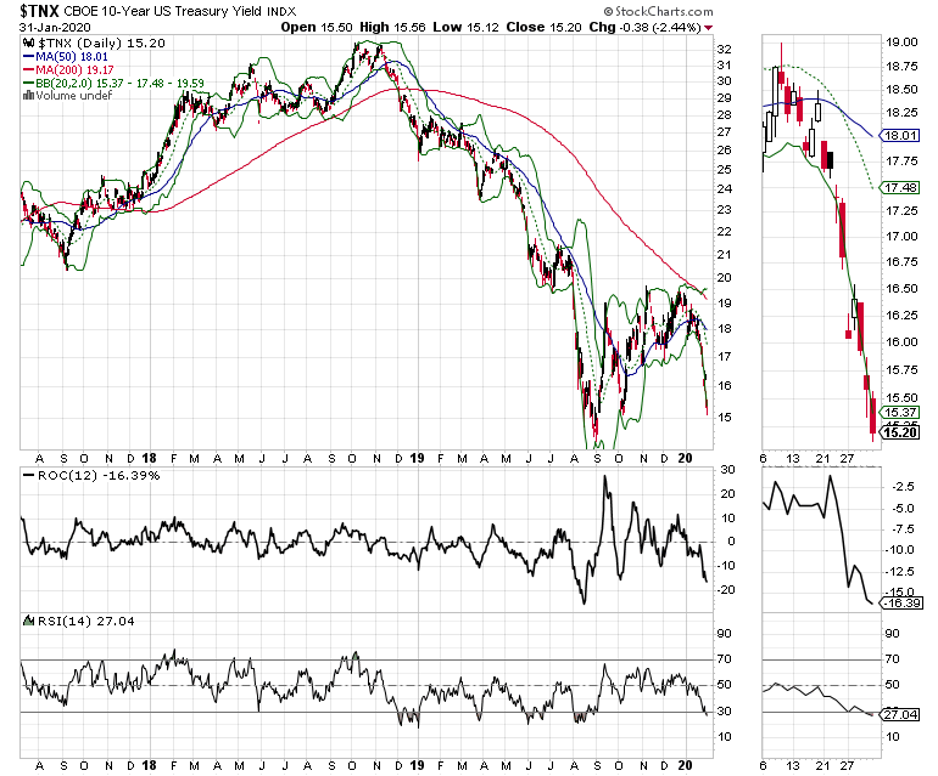

- This is increasingly plausible based on a muted U.S. GDP and steadily falling PMI data in the United States and Europe. This is important as bond yields are crashing and bond prices are rallying (see TNX chart above). Stocks are falling in expectations of the worst case scenario in everything and the effects of algorithmic trading.

- Programs hitting sell stops and accelerating the trend (see SPX chart below.)

On the upside:

- The Fed has little choice but to continue with its stealth QE 4

- Earnings are not as bad as anyone has expected, at least not yet

- If the correction ends fairly quickly, the odds of new highs before the year is out are above average as the Fed will continue to put money in the system

Certainly, this is no time to be cavalier, as the stakes for every person in the world are about as high as they get. Nevertheless, there is a bit of a wrinkle which may be a big positive for MEL, at least over time if not immediately; 401 (k) plans, the lifeblood of the wealth effect and the core of people’s long term financial decisions.

Recent data suggests that retail investors have been buyers of bonds and sellers of stocks over the last several weeks. And if that is true to any significant degree than the current market, stocks crashing, and bonds rallying could mean that losses to investors with higher bond allocation in their retirement plans may be less than those of professional momentum algo investors who have been going all in on stocks of late.

In other words, Mom and Pop may have been playing it safe, while the algo fueled “pros” who have been buying stocks aggressively over the last three months as the Fed addressed the repo market situations may now be the ones caught in the robotic selling spree. Thus, much of what happens next depends on how MEL is affected by the effect of the stock market’s effect on 401 (k) plans. The crucial factor may be the aggregate 401 (k) plan allocation to bonds.

Accordingly, if this is a quick correction in stocks and 401 (k) investors don’t panic, triggering en masse mutual fund redemptions the net effect on MEL may not be as bad as it might be otherwise. This, of course, could easily change if we enter a protracted bear market in stocks, which leads to 401 (k) stock fund liquidation. If that happens, it could then spread to the economy as people’s financial life decisions are affected, while at the same time possibly creating a very low yield on the U.S. 10-year note, which will eventually reverse and perhaps cause even more problems (see chart below).

Bellwethers Send Mixed Message

Last week, I described several stocks whose performance during the current period could provide clues as to the outcome of the current situation.

First, technology giant Texas Instruments (TXN) was heavily sold and ended the week just above its 200-day moving average. If the stock breaks below this key level it would suggests that investors are increasingly worried about the global demand for semiconductors, a big negative for the overall economy.

Meanwhile shares of housing sector bellwether KB Homes (KBH) and other housing stocks held their own, suggesting that for now, the inverse relationship between falling U.S. 10-year note yields and expectations for a continuation of the good times for homebuilders remains intact.

NYAD Continues its Decline

The New York Stock Exchange Advance Decline line (NYAD) rolled over two weeks ago and continues to signal that the path of least resistance in the short term for stocks is to the downside. If NYAD falls below its 50-day moving average it is likely that we will have to wait for an oversold reading below 30 on the Relative Strength Index (RSI) before looking for a meaningful bounce.

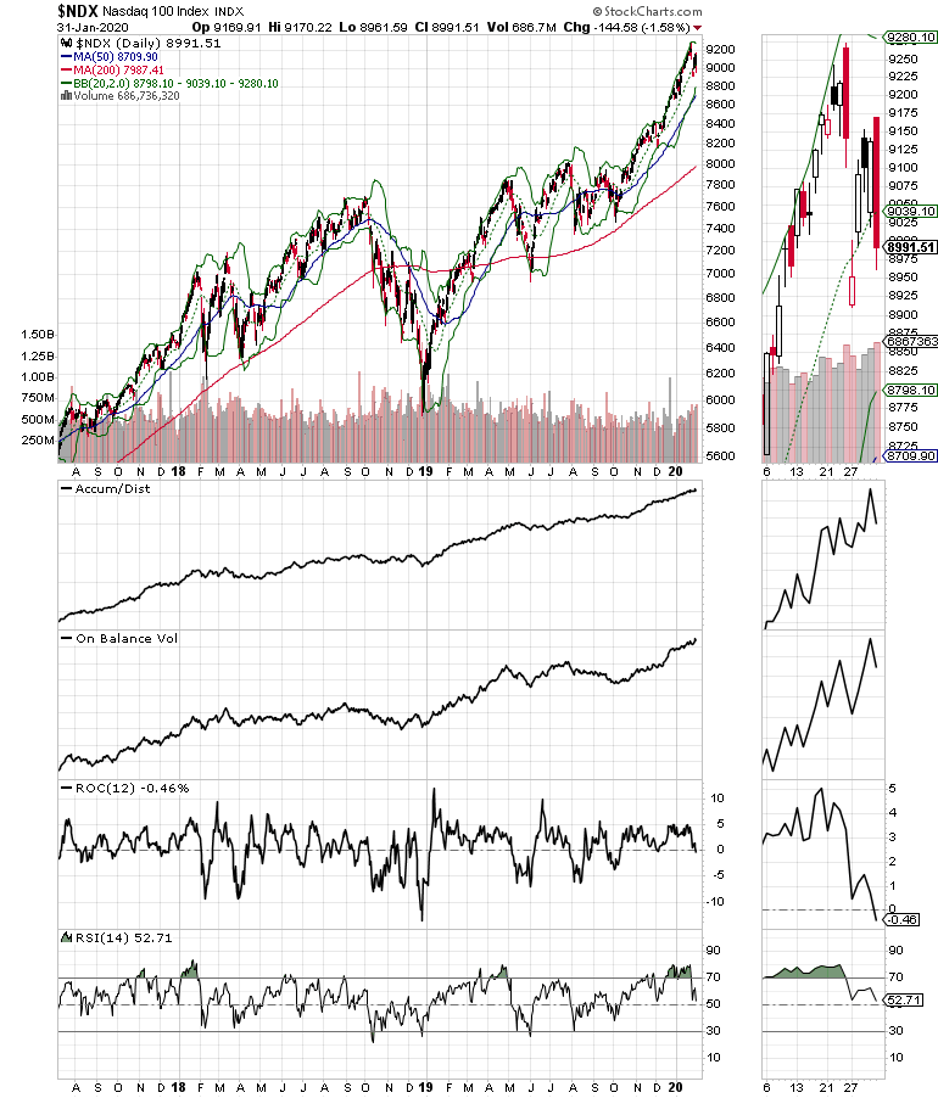

Elsewhere both the S&P 500 (SPX) and the Nasdaq 100 (NDX) indexes seized and reversed after early day gains on Friday. Both benchmarks seem destined to test short term support (20-day moving averages) and intermediate term support (50-day moving averages) in the not too distant future (see chart).

If the indices and the NYAD break key support levels we may see a move back toward the 200-day moving averages, which are roughly 10% to 12% below the Jan. 24 respective closing prices. Finally, here are some key support and indicator levels to watch:

- NYAD 20 and 50 day moving averages

- RSI 50 for NYAD

- NDX and SPX 20 and 50 day moving averages

- RSI 50 levels for both NDX and SPX

Patient Investors Will Reap Big Rewards

This remains a dangerous time for investors, but those of us who have raised our cash levels over the last few weeks are breathing a bit easier than those who didn’t. That said, the uncertainty in the stock market is clearly on the rise, but the bearishness is not quite where it would signal that a tradable bottom is at hand. That means that this correction is more likely to go further before things improve.

Due to the Coronavirus, traders have taken their eyes off of the long awaited Brexit and the Federal Reserve extending repo operations, both of which will be factors in the market—hopefully after the Coronavirus is well-contained. Don’t forget about them.

So, without minimizing the loss of life in China and elsewhere, along with the potential for a global tragedy economic and otherwise, the bottom line is that easy money will likely win over the Coronavirus unless this gets out of control (there has recently been mixed messages).

Finally, if there is indeed a pharmaceutical solution that can be rapidly deployed, I would expect a very large rebound in stocks over a very short period of time.

Hope to see everyone in Orlando next week.

Joe Duarte is author of Trading Options for Dummies, and The Everything Guide to Investing in your 20s & 30s at Amazon. To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit here.

Join Joe at the MoneyShow Orlando Feb. 6-8 where he will be discussing the ins and outs of the Markets-Economy-Life ecosystem (MEL) and how he uses it to pick winning stocks.