Will multiple fundamental drivers push crude lower, Jeff Greenblatt asks, is the low in crude in?

In case you noticed, the equity markets rallied since Monday but crude oil only decided to turn on Wednesday. In this latest sequence oil dropped to its lowest level since January 2019. Numerous sources have reported oil exporters like Saudi Arabia need $60 as a baseline to at least break even. If that’s the case, the recent sequence has been an unmitigated disaster. Part of the problem is the Coronavirus as China is a major importer of oil.

The problem goes deeper as major companies like Apple (AAPL) said they will need to shut down all stores and corporate offices in China. The Wall Street Journal reported on Feb. 1 the company will shutter all stores and corporate offices until Feb. 9 in response to the Coronavirus.

According to the same report the Chinese government demanded many factories remain closed through Feb. 10, a week beyond the Lunar New Year celebration. Regarding Apple, it relies on China for about 20% of its sales. As of this writing, AAPL is still trading near its all-time high. The obvious question is at what point does the stock take the big hit?

Apple is not alone. Levi Strauss Co. (LEVI) opened a store in Wuhan which is three stories tall and over 7,500 square feet, making it the largest Levi’s store in the country. Reuters reported several days ago the company closed half of its stores in China due to the virus. Starbucks (SBUX) and Tesla are also warning about financial hits. Tesla (TLSA) has had to keep their Shanghai factory closed and product scheduled for early February delivery has been delayed. SBUX has gapped down during this virus sequence but LEVI has not. TSLA hit an all-time high this week and is down more than 22% since it peaked on Tuesday.

In the meantime, markets are bouncing based on an okay near term reading in the E-mini but in the larger sense, last week’s acceleration to the downside aided by a Chicago PMI reading at 42.9 came in at the 232nd week since the Dow Jones Index bottom in August 2015. That means manufacturing is in the tank. It’s a tricky window because it opens the door to this surge at week 233 becoming an inversion of the cycle (low as opposed to a high) or even yet another high by the end of this week or next which is the back end of the window. Given the state of the virus and the cycles, market participants haven’t faced greater uncertainty in a long time. One thing we can all agree on is markets are allergic to uncertainty.

Demand for oil in China is down 20%, which translates to about 3 million barrels-per-day. OPEC must consider production cuts. According to president of Lipow Oil Associates Andy Lipow, speaking on CNBC., oil can get near $60 again but it will take time and he is not even sure a cut of 500,000 barrels-per-day will do enough.

At this point, it will depend on demand and how long the virus sticks around. Unfortunately, this is the wild card where nobody has the right answer. After reviewing what all media have to say, there is still no consensus of what is going to happen. It’s important to consider the unintended economic consequences and its clear the economic slowdown in China is still not baked in the cake for U.S. markets with the new exception of Tesla. Is the market going to say we are all TSLA?

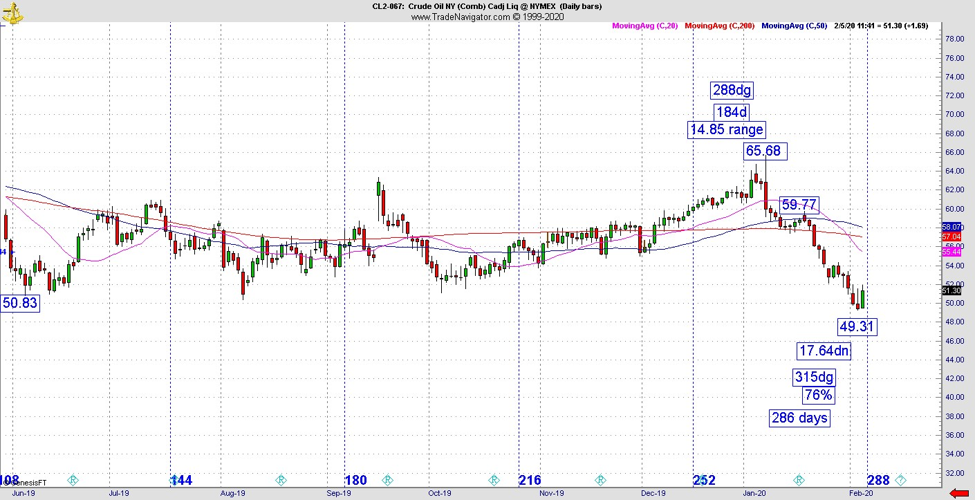

Yes, the oil chart is interesting right here and there are any number of symmetries that could ignite a bounce (see chart below). Wednesday’s short covering reaction is likely anticipating an OPEC production cut but in terms of the chart, its 17.64 range down at a 76% retracement and the high came in on the 288 degree vibrational day on Jan. 8, this low is 286 trading days from the January 2019 bottom. These readings are good enough for a change of direction and the reaction is already there. The wild card is how far it can go and whether the virus goes to the next level. After all, Apple and the Chinese government are anticipating the shut down only through next Monday. What if they must close for another week?

Putting these issues aside, traders are complaining they haven’t been able to take bigger positions or even swing trades in the current environment. This is a sequence where markets carry on in a direction for only two to three days then it changes sharply. What is one to do? Since nobody knows what is going to happen, the only thing a trader can do is be sure to have a good enough strategy to be able to take a trade with the best possible risk/reward ratio. Those who get in early have the most staying power, those who do not end up like a deer in the headlights.

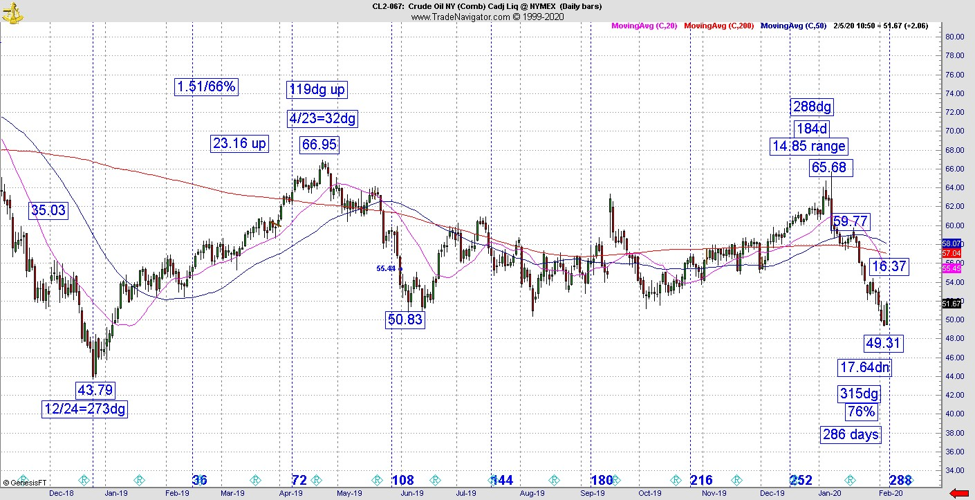

Take this oil chart example for instance (see below).

If you have a strategy that can identify a potential turn, you know where you’ll be wrong and the worst you can suffer is a smaller loss. Let’s Say oil does pop from here. If you wait two or three days to act, you could be too late and end up having to scramble in case the sentiment turns again.

One can sit on the sideline and wait it out. The problem with that approach is you may be waiting a long time because 2020 is going to be a year like none other. If it wasn’t the assassination of an Iranian General, it turned out to be a dangerous virus. Even if the virus burns out, chances are within a couple of weeks the market will have something else to worry about.

If you want more information, go to: Lucaswaveinternational.com and sign up for the free newsletter.