Several technical indicators turned soft last week, and the Fed has reduced its support through the repo market, notes Joe Duarte.

If the Federal Reserve Board drains liquidity from the repo markets the likely decline in global stocks may make the Coronavirus a page 2 story, especially when the unknown but certainly existing credit default swaps related to the current market scenario kick in and the margin calls arrive for those who bet the wrong way.

Moreover, investors should remember that the Markets, the Economy, and people’s Lives are now an interconnected system (MEL) with the centerpieces being the ease of obtaining credit (Home Equity Line of Credit) and the 401(k) plan. Thus, a disruption in the markets is likely to spill over into the economy as 401(k) plans drop in value and people put off making important financial decisions such as buying houses, cars, or taking expensive vacations.

Consider the following:

- U.S. Markit PMI has fallen below 50, suggesting the economy is in contraction mode

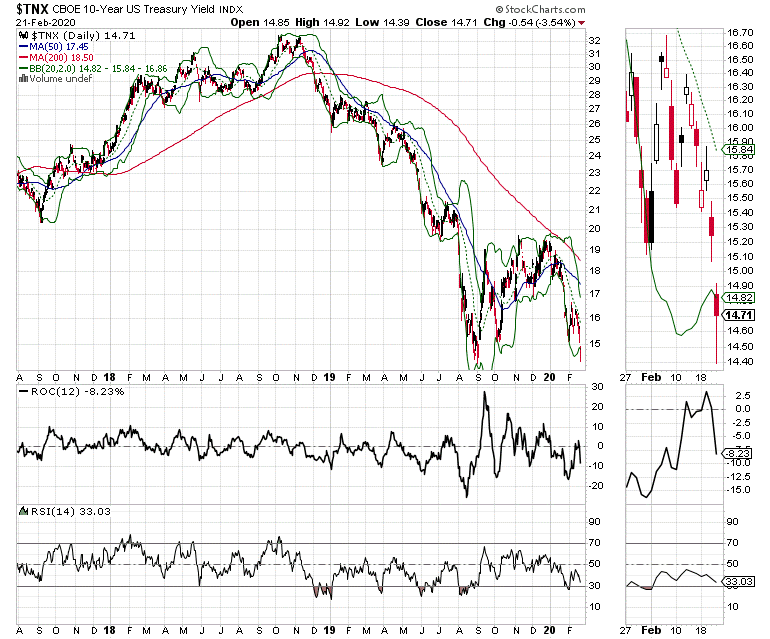

- U.S. Treasury bond yields are in freefall (see below as to why this is important)

- International shipping line Maersk, Fiat Chrysler (FCA), Samsung (XKRX) and others have joined Apple (AAPL) in voicing caution about the Coronavirus situation. Some are closing factories while others are warning about supply chain issues

- A recent survey noted that as many as one-third of companies doing business in China are considering moving their operations elsewhere on top of those who have already done so

- The White House has expressed concerns and has stated that the U.S. expects China to meet its trade pact commitments

- The number of people affected by the Coronavirus in China and around the world is not shrinking as South Korea, Italy, and Iran are reporting increasing numbers of infections

- Aside from electronic and technology related components, perhaps the most dangerous potential supply chain repercussions will be felt in key pharmaceutical products.

As noted above, the most striking feature of the current situation is the significant drop in U.S. 10-year Treasury note yield (TNX) and the U.S. 30-year Treasury bond (TYX), with the latter closing on Feb. 21 below 2%, an all-time low. What this says is that the bond market is pricing in the potential for a severe economic slowdown.

My point is not to be a Chicken Little, but instead to note what is increasingly obvious, and to echo what I recently stated during my presentation at the Orlando Money Show. The Coronavirus is a purely chaotic entity, which means that it is predictably unpredictable. Furthermore, when you consider that China is the world’s factory, and that we live in a just in time economy where there is little room for error, and where inventories are often measured in terms of weeks, if this goes on much longer, there have to be some major repercussions along the supply chain. This would be especially meaningful if shortages of basic goods such as medications, building materials, automobile parts and high tech components including semiconductors and other electrical equipment related articles develop.

And what would be the final nail in the proverbial coffin? What will happen if Fed pulls back on its backdoor QE liquidity push? ON Friday Feb. 21 the Fed only injected $25 billion into the repo markets, much lower than what they have been purchasing. The Fed has been too opaque regarding these operations to know whether this is a sign the emergency is lifting or whether the Fed is trying to ween the markets off of its largesse.

Sweet Comfort

Who doesn’t like chocolate, especially during difficult periods? Amidst the doom and gloom of the Coronavirus situation, and market reaction to this weekend’s news on that front there are some stocks with attractive chart patterns and equally interesting stories. One of them is Hershey Company (HSY), a leader in chocolate snacks, and home to highly familiar and delicious chocolate brands.

Technically, the stock is close to clearing long term resistance at $160 with the potential to move higher. It could be the type of comfort brand that outperforms in times of crisis. Tomorrow we will delve deeper into this tasty stock.

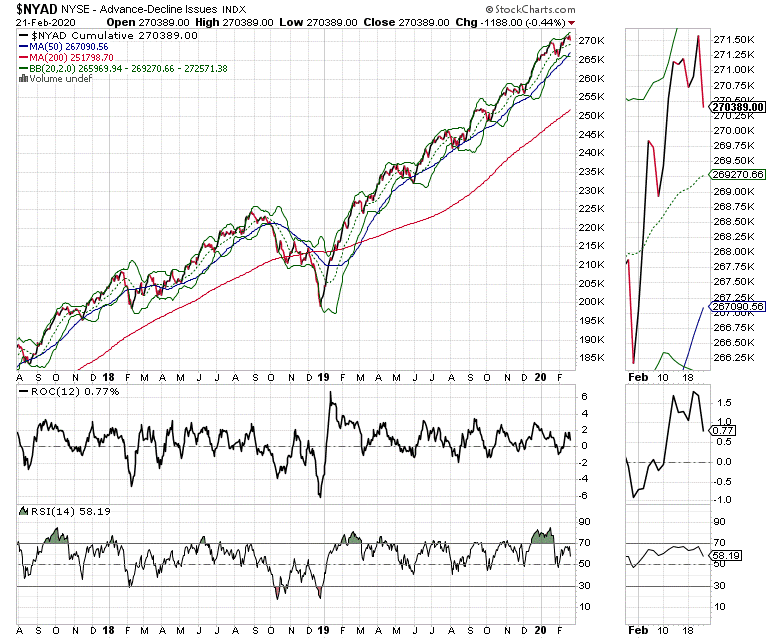

Market Breadth Continues to Lose Momentum

Over the last few weeks, I’ve been noting the lackluster performance of the New York Stock Exchange Advance Decline line (NYAD), the most accurate indicator of the stock market’s trend since the election of President Trump. And unfortunately, despite a couple of lukewarm new highs lately, NYAD continues to soften.

There are three worrisome signs:

- New highs in NYAD are not coming in groups of two or three in a row anymore as they were late in 2019

- The rate-of-change (ROC) indicator, which measures momentum, failed to make a new high with the recent new high in NYAD

- The Relative Strength Index (RSI) failed to move back above 70 with the new high on NYAD recently.

Thus, when all is examined simultaneously, the only conclusion is that the market’s breadth is softening, and we seem to be in the early stages of a potential serious technical divergence, which means that the uptrend is vulnerable.

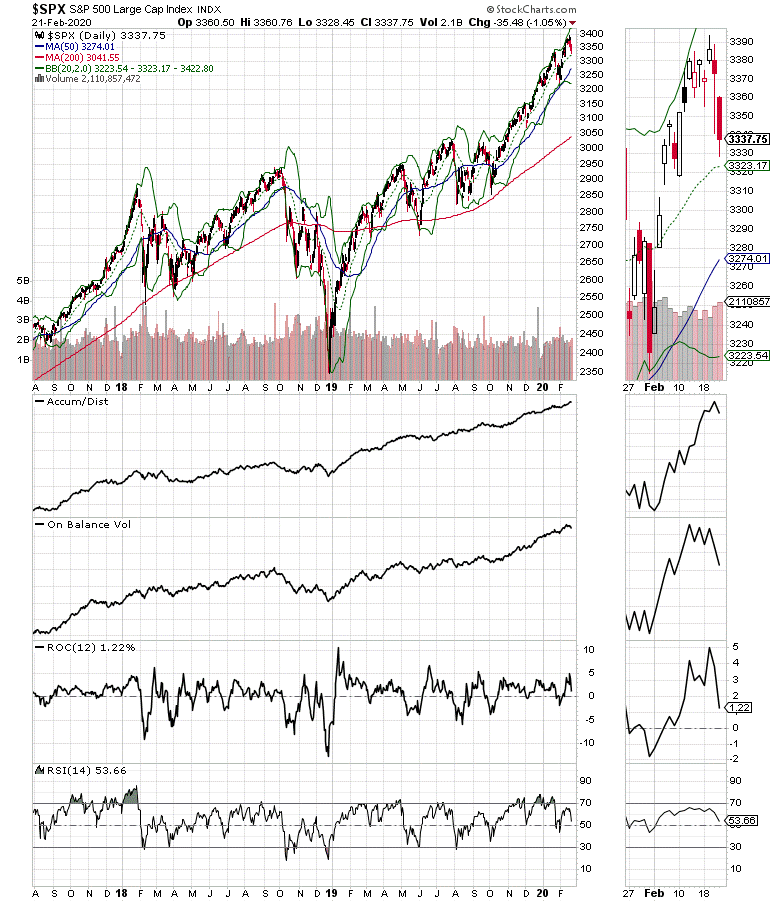

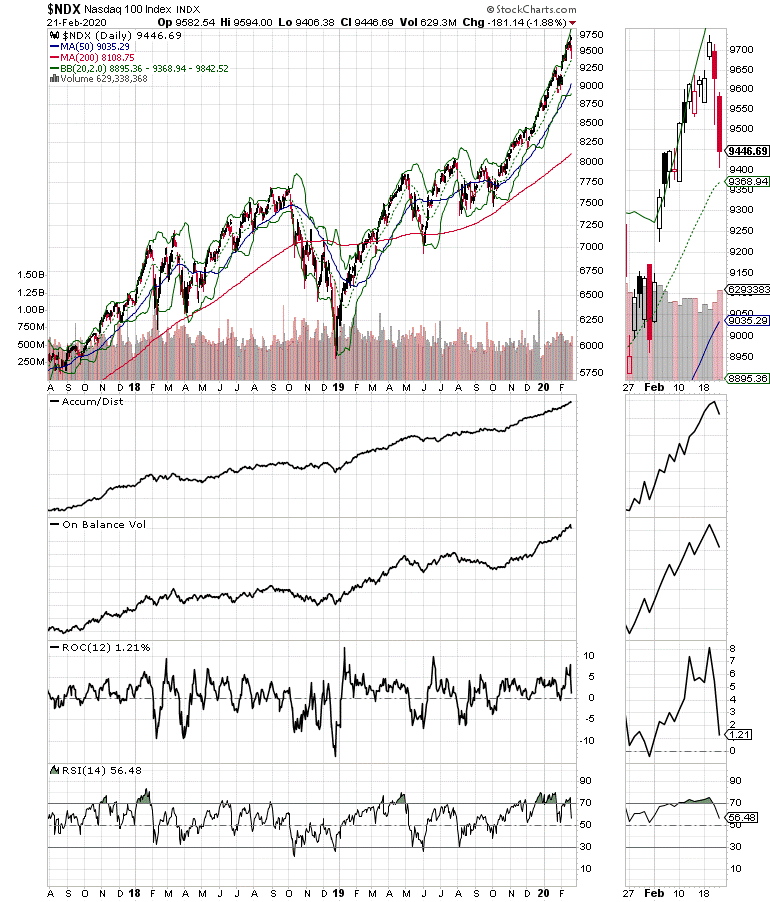

Both the S&P 500 (SPX) and Nasdaq 100 (NDX) indices had tough weeks although no major support levels were breached. Still, both indices registered a rolling over of their Accumulation Distribution (ADI) and On Balance Volume (OBV) indicators. Of the two, the OBV on SPX looks a bit more cautionary as it failed to make a new high on the most recent high of the index, thus delivering what may turn out to be a short term sell signal.

Of course, if there are some positive developments over the next few days, such as a credible treatment for the Coronavirus, it’s plausible that the current negatives will reverse. Still, they are there and should be noted.

Raise Cash

I am concerned about the financial markets over the next few weeks, especially if a Fed engineered liquidity squeeze triggers margin calls based on credit default swaps hitting their strike price in the next few days. As a result, I’m sticking with my recent recommendations of raising cash, making a shopping list, and avoiding short selling for now.

However, if the selling continues and key support levels give way convincingly in the near future being short could be very profitable at least in the very short term for nimble traders. Thus, I am now looking for opportunities to get short. The bottom line is that there is no sin in holding higher than normal levels of cash while there is always pain when one loses vast sums of money.

This analysis was written on Sunday Feb. 23

Joe Duarte is author of Trading Options for Dummies, and The Everything Guide to Investing in your 20s & 30s at Amazon. To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit here. I’ll have more for subscribers in this week’s Portfolio Summary. For a 30-day Free trial subscription go here.

By the way if you couldn’t make it to Orlando for my Money Show presentation, you can see it here.