Either Starbucks executives are experiencing a bout of hubris or it is a strong play in the age of Coronavirus, reports Joe Duarte.

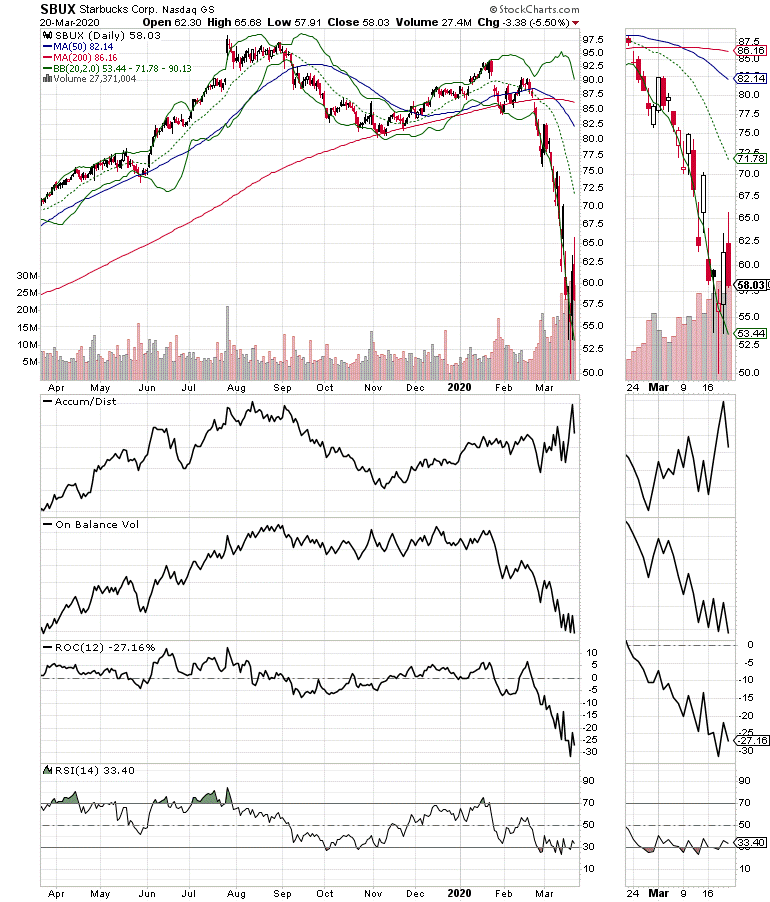

Shares of coffee shop giant Starbucks (SBUX) fell nearly 47% from their January 2020 highs as of the recent low on March 17. And although it may be premature, it’s not a bad idea to have a look at the shares. We certainly had a successful short term trade featuring SBUX at Joe Duarte in the Money Options.com last week (see chart).

Starbucks is an interesting company with a widespread global footprint, and a contrarian bent. Moreover, as other companies are panicking and hitting their lines of credit, Starbucks is doubling down on its business plan via its recently announced plans to further expand its China footprint to 6000 stores by 2022, while adding another 40 million shares to its already existing stock buyback program. Thus, management is either showing a lot of hubris, a great deal of confidence in its business, or there is a high level of testosterone in the board room which may lead to unfortunate developments.

That said, for us, it’s not about making judgments or discussing biology. It’s all about price action, and whether the stock is worth nibbling at for more than a day or two as it bounces around with the market.

Of course, the truth is that it may be too early to put a big chunk of money into this or any other stock. But you just can’t blow this corporate strategy off either. Moreover, we can certainly stipulate that it’s a big company with deep pockets ($3.1 billion in cash on balance sheet as of Dec. 31), which will suffer some but maybe not too much as long as people can drive up to their shops and stay in their car to avoid the Coronavirus in order to get their caffeine fix.

Clearly from a technical standpoint, the stock was extremely oversold. Its relative strength index (RSI) was well below 30 in mid-March with the indicator making a nice higher low on the lowest low for the stock, a very positive technical sign signifying a loss of selling momentum. Moreover, money took its cue from the technicals and the company’s announcements and moved back into the stock as signaled by a big jump in Accumulation Distribution (ADI) and no new lows in On Balance Volume (OBV).

The stock didn’t just bounce but actually moved well above its lows, certainly helped by short covering. But, maybe that’s the point, at least in this case, and perhaps in the whole market. If the shorts are bailing out then maybe the real buyers will be coming into the SBUX and other stocks soon. And that’s what the next few days will tell us, not just about Starbucks but also the rest of the market.

Is it time to jump in? Not likely until we get the all clear signal or you are willing to be very patient perhaps for a long period of time. The stock is cheap enough, especially after it took a beating at the end of the day on March 20 as options expiration hit the entire market.

But things could get a lot worse in a hurry, for SBUX, and for the whole market as no one knows what the future holds, and all stocks could still get cheaper. Yet at this point, in a market which is full of dead stocks, it’s good to see even tentative signs of life in severely oversold stocks with solid businesses even during tough times; even if they maybe fueled by caffeine at the storefront and testosterone in the board room.

Joe Duarte is author of Trading Options for Dummies, and The Everything Guide to Investing in your 20s & 30s at Amazon. To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit here. I’ll have more for subscribers in this week’s Portfolio Summary. For a 30-day Free trial subscription go here. For more direction on managing the GILD trade, go here.