Dollar looking to rebound as markets awaits a record breaking jobless claims number, with expectations running from 1.5 to 4 million claims, reports Joe Perry.

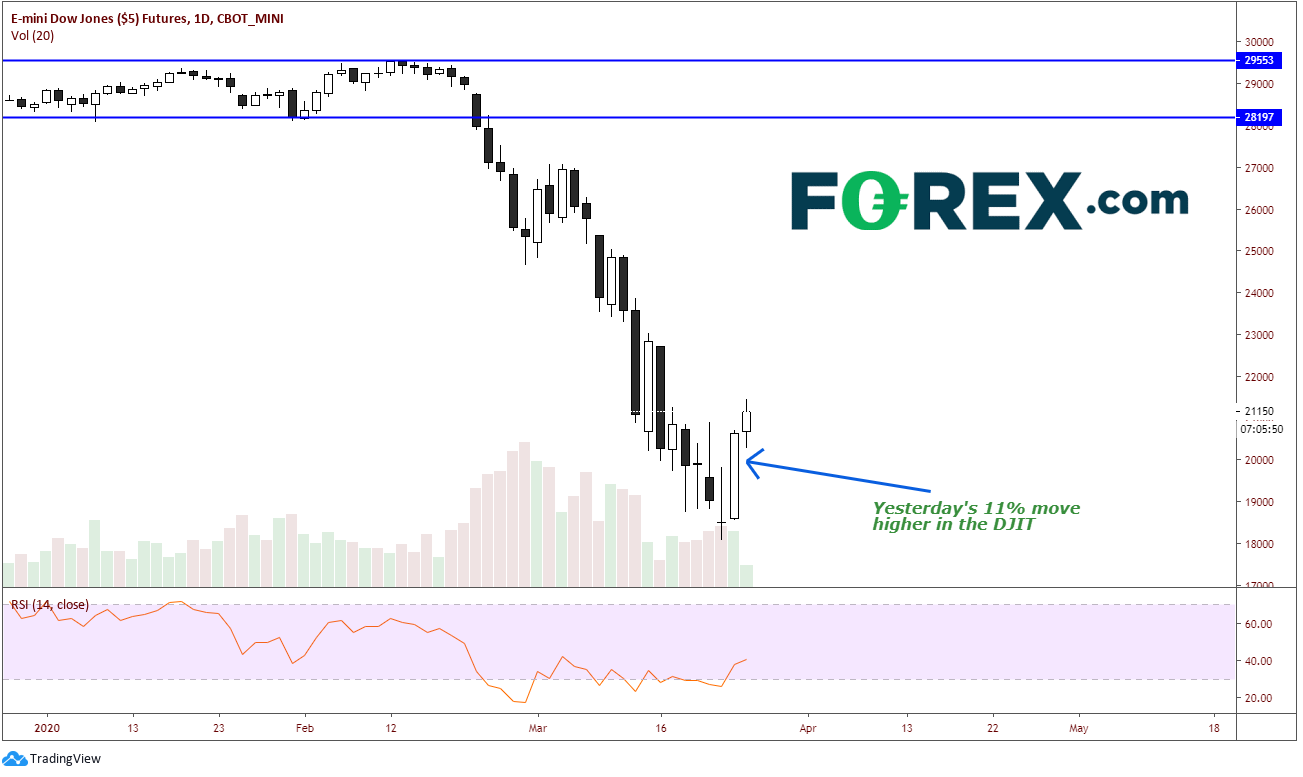

The U.S. Senate and White House reached a bi-partisan fiscal stimulus deal worth an estimated $2 trillion. The deal was reached at roughly 1:00am EST Wednesday morning, though traders have been expecting the agreement, as the Dow Jones Index rallied more than 11% Tuesday in its largest one day move since 1933.

Source: Tradingview, FOREX.com

As global stock markets caught up to yesterday’s U.S. equity close, the US Dollar began to pull back. However, on a 240-minute the U.S. Dollar Index (DXY) has already been consolidating in a pennant formation since reaching the 161.8% Fibonacci extension from the highs in mid-February to the lows on March 9. The consolidation is near a trendline dating back to May 2018. If the DXY does break higher from here, the target is near 109.80 (see chart).

Source: Tradingview, FOREX.com

The euro (EUR/USD) often trades the inverse to the DXY, as the Euro makes up almost 58% of the U.S. Dollar Index. So, it would make sense to see a similar, opposite move in EUR/USD. On a 240-minute Price action in the EUR/USD has been moving lower since the high on Feb. 20, stalled on March 20, and began consolidating in a flag like formation. This too seems as its ready for its next move. If price does break lower out of the flag formation, the current target is near parity (1.0050). The EUR/USD can still move higher, as high as 1.1070, and still be in a valid flag formation, just note that from wherever price breaks lower from the flag, the flagpole needs to be adjusted to that breakdown point.

Source: Tradingview, FOREX.com

On a daily British pound (GBP/USD) chart we can the pair is trading in a resistance zone, just below 1.2000. If price holds below this key psychological resistance area and pulls back, it would provide more evidence that the DXY can move higher.

Source: Tradingview, FOREX.com

The set-ups and resistance in these US Dollar pairs provide evidence that DXY may be headed higher. We have seen an extreme move off the lows on March 9 from 94.60 to roughly 103. It’s hard to imagine we could see a move like that again soon.

Initial Claims Expectations are Unimaginable!

Thursday’s Initial Jobless Claims for the week ending March 21st are going to be something we have never seen before. According to Bloomberg, the average estimate of economists surveyed is 1,500,000, with a high estimate of 4,000,000 and a low estimate of 360,000. For comparison, last week’s initial claims number was 281,000, while the prior week was 211,000 (see chart).

Source: Bloomberg

Service businesses have been forced to close their doors until the Coronavirus pandemic is under control. These include cruise ships, restaurants, bars, nightclubs, gyms, retail stores, etc. In addition, many non-essential factories were forced to temporarily shut down. As a result, many of these businesses have had to layoff workers, sending possibly millions of people to file for unemployment benefits.

To put this week’s initial jobless claims number in historical perspective, the highest number of claims ever recorded during a single week was 695,000 in October of 1982. The second highest initial jobless claims number was during the height of the Great Financial Crisis in March 2009, at 665,000. This week’s number is expected to be roughly 4 to 6 times those.

This is one of the reasons Congress is on a mission to pass a stimulus bill which would give people cash in hand immediately. Many in Congress feel this is a necessity for the plan, as opposed to a payroll tax cut. This is also one of the main reasons President Trump is battling senior health officials on reopening segments of the economy as soon as possible.

Thursday’s Initial Jobless Claims will serve as the new benchmark going forward. If initial jobless claims increase from Thursday forward, it’s going to be a long Q2. However, if the claims data starts to fall after this week’s number, it may be a sign that things are starting to improve.

Next Friday is the first monthly Employment Situation Report since the country began shutting down. One has to wonder how high the unemployment rate could reach over the next few months as the Coronavirus continues to plague the world. We’ll find that out next week. As for Initial Jobless Claims, don’t be surprised to see an extreme number. Keep in mind that the market is already pricing in 1,500,000!

Joe Perry holds the Chartered Market Technician (CMT) designation and has 20 years of experience in the FX and commodities arenas. Perry uses a combination of technical, macro, and fundamental analysis to provide market insights. He traded spot market FX and commodity futures for 17 years at SAC Capital Advisors and Point 72 Asset Management. Don’t forget that you can now follow Forex.com’s research team on Twitter: http://twitter.com/FOREXcom and you can find more of FOREX.com’s research at https://www.forex.com/en-us/market-analysis/latest-research/.