Starbucks looking to buck analyst expectations, reports Joe Duarte.

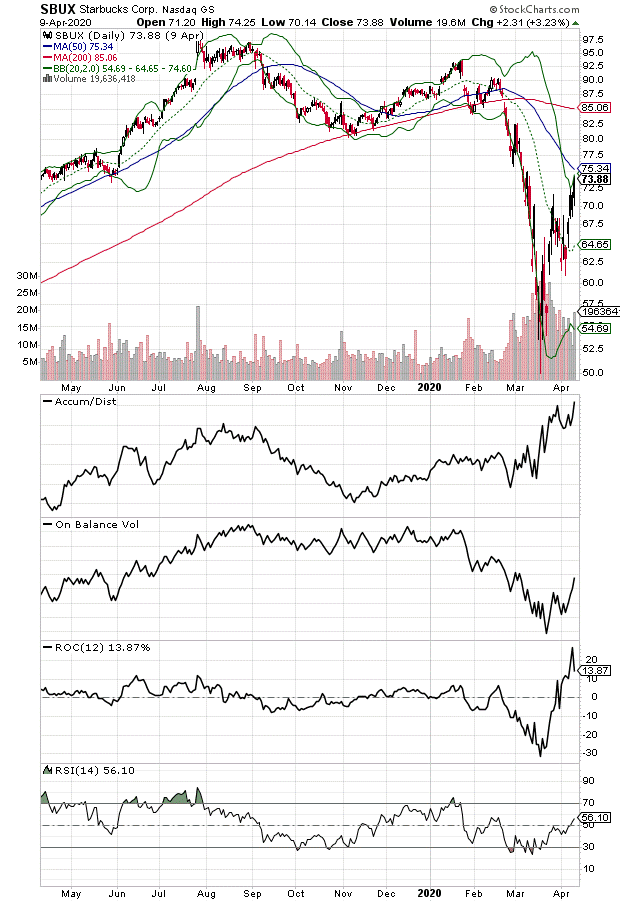

I’ve traded in and out of Starbucks (SBUX) in both my personal account and have recommended the stock here and to subscribers profitably over the last few weeks. Three interesting things happened to the stock last week, which were very bullish (see chart below).

First, the company announced that it was closing stores in Japan as it issued below consensus earnings while pulling future guidance for now. All of which prompted several Wall Street analysts to turn bearish on the stock, well after the stock had bottomed and was in the midst of a nice rebound. Indeed, as soon the ink was dry on the downgrades, the stock rallied to a new high from its recent lows and now has the potential to move back toward the $85 area if it can clear resistance near its 50-day moving average.

This is a sign of relative strength and should be taken seriously. Certainly, the stock has come a long way in a short period of time and we could see a stall in the price at any point. But as I noted here a few weeks ago, the company’s board of directors and management showed some serious spirit when in the face of the pandemic they doubled down on their China investments and adapted their U.S. model to the current conditions.

The analysts may be wrong on this one because what I’m seeing is a well-financed company with a solid balance sheet and the ability to withstand more of the current situation than others in the restaurant sector. Furthermore, even though store traffic may have slowed, because the company sells coffee and other products through grocery stores and other outlets, their future sales may prove to be much better than anyone expects by the next earnings report. Moreover, it seems the market is recognizing that as well.

For more details on SBUX and other stocks you can sigh up for a free 30-day trial. If you’re not a subscriber yet take a 30-day Free Trial HERE. Joe Duarte is author of Trading Options for Dummies, and The Everything Guide to Investing in your 20s & 30s at Amazon. To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit here. I’ll have more for subscribers in this week’s Portfolio Summary. For a 30-day Free trial subscription go here. For more direction on managing the GILD trade, go here.