Markets and the coronavirus have us confused, be hopeful but cautious, advises Joe Duarte.

I remain hopeful and continue to play the long side of the market, albeit more cautiously than I was a month ago. This is because the uptrend is looking a bit tired and if the bearish trend reasserts itself, the negative repercussions would be felt far and wide along the Markets, Economy and People’s Lives (MEL) system.

At the same time, hope is by no means lost. For if there are signs that people are being successful as they attempt to get back to a more normal life, an upside surprise may be in the offing. What that means is that if a couple of small, yet important things happen, especially on the technical side of the market, the bull trend could easily reassert itself, and perhaps in a spectacular way.

Nevertheless, in what remains a very fluid situation, it pays to be prepared for all possible contingencies, including considering hedging some bets while continuing to pick stocks near the sweet spot of the Complexity zone.

Last week I wrote: “We may be reaching a point where the balance between the components of MEL, the complex adaptive system comprised of the stock market (M), the economy, (E) and people’s lives (L) is nearing a point of emergence to a new level of operation. Foremost, if this is correct, then because of the way algos are programmed, the Fed’s actions are paramount.”

It went on: “My current analysis suggests that the markets are on the verge of becoming the leading component of MEL. This is because 401 (k) plans are central to the wealth effect for many people. Thus, the stock market’s rally has been a psychological positive of sorts to those who may be temporarily out of work or are working part time.” In other words, in this new Post New Normal world, the markets are leading the economy, which means that a negative event in the stock market could easily derail any potential positives in the economy.

Of course, because we are at the Edge of Chaos, at this point anything is possible. Yet, if the market does roll over decisively, then by its actions it will be sending the message that despite the Fed’s unprecedented actions the MEL system has reached a point where the long standing structural problems: insurmountable debt, mismanagement of capital, and the maldistribution of wealth cannot be overcome by monetary policy.

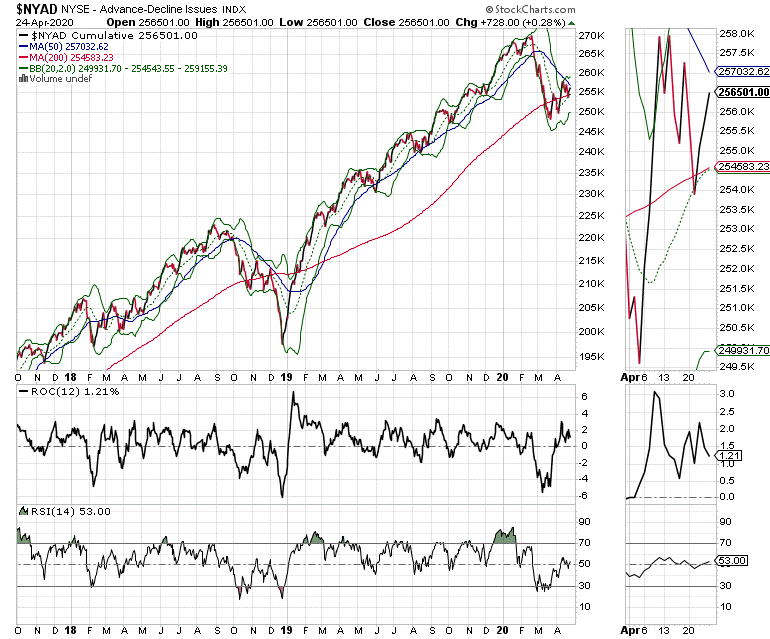

Indeed, given the current state of the NYSE Advance Decline line, the rally is at a crucial decision point. What that means is that for the first time since the market topped out and the rebound rally has developed, active traders may wish to consider hedging some of their bets, just in case the bear starts to growl again.

NYAD Replays Negative

The New York Stock Exchange Advance Decline line (NYAD), the most accurate indicator of the stock market’s trend since the November 2016 presidential election may be tracing a negative chart pattern reminiscent of its action in October 2019 prior to a 20% decline in stocks (see chart below).

NYAD is struggling to stay above its 200-day moving average as it struggles with the resistance provided by its falling 50-day moving average. This coupled with what could be negative divergences in the rate-of-change (ROC) and relative strength index (RSI) indicators suggests that unless this is corrected stocks could be close to entering a new down leg.

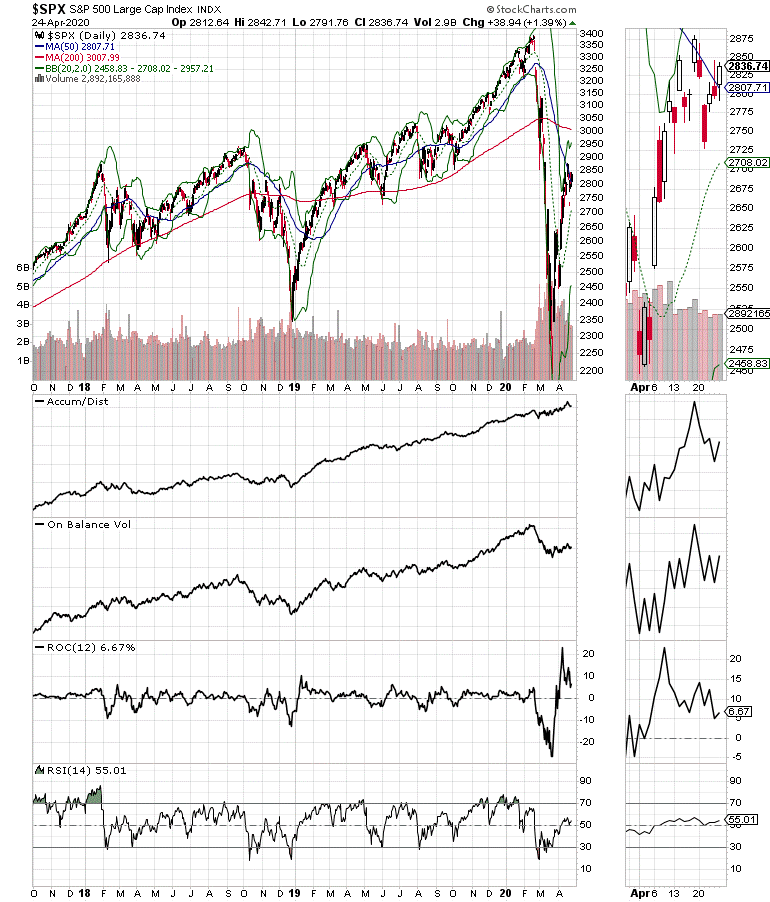

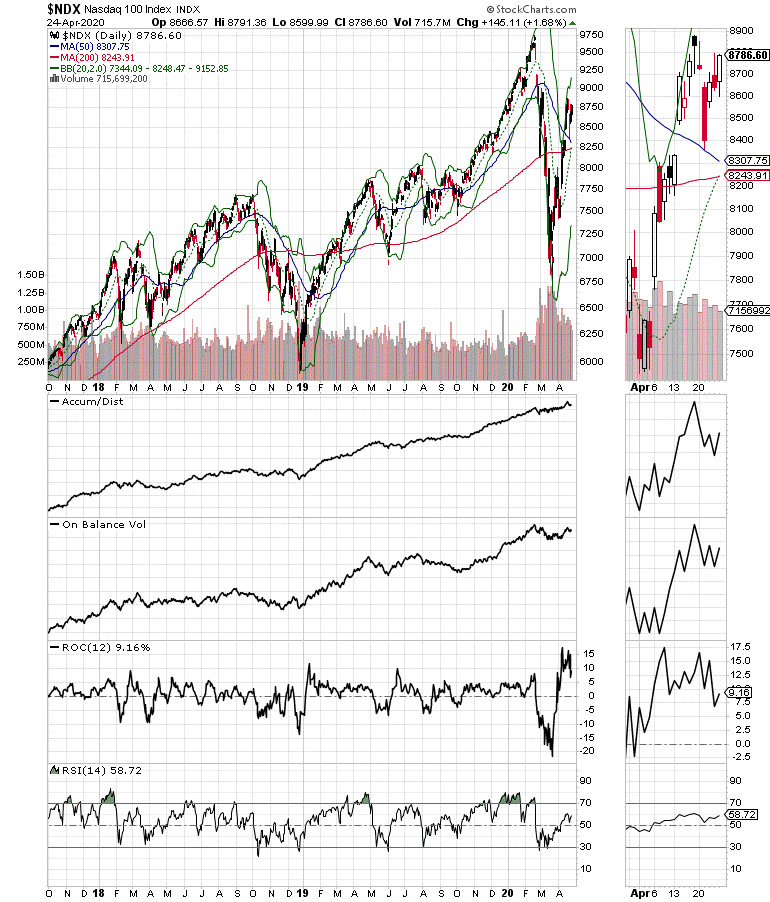

Meanwhile, the S&P 500 (chart above) and the Nasdaq 100 indexes continue to play cat and mouse with key chart points. The former continues to bounce around 2800 while the latter is having trouble getting back above 8800; although both indexes ended the week above their 50-day moving averages. The NDX closed above its 200-day line as well, which are encouraging signs (see chart below).

The Accumulation Distribution (ADI) and On Balance Volume (OBV) for both indexes stabilized by the close of trading on April 24. Therefore, if NYAD is able to take out the overhead resistance at its 50-day moving average, the likelihood of new down leg in stock prices will be greatly reduced.

Hedging Starts to Make Sense

We are clearly in a no man’s land scenario as NYAD is stuck between its 50- and 200-day moving averages while sellers seem to be quietly moving back into the markets. Therefore, hedging long positions via inverse exchange trade funds (ETFs) or put options may be a sensible trading tactic to consider along with tightening stops.

Nevertheless, it’s important to note that the uptrend, until proven otherwise remains intact. Thus, the focus of any trading strategy should be on stock picking along with risk management. Of course, risk management is a difficult concept as hedges become two-edged swords as multiple whipsaws makes any position vulnerable.

The bottom line is that in the short term, it’s not a bad idea to consider hedging to protect the gains we’ve attained since the recent market bottom.

I own shares in LDOS.

For more details on SBUX and other stocks you can sign up for a free 30-day trial. If you’re not a subscriber yet take a 30-day Free Trial HERE. Joe Duarte is author of Trading Options for Dummies, and The Everything Guide to Investing in your 20s & 30s at Amazon. To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit here. I’ll have more for subscribers in this week’s Portfolio Summary. For a 30-day Free trial subscription go here. For more direction on managing the GILD trade, go here.