The reality of the economic number is affecting the markets, economy life (MEL) dynamic, reports Joe Duarte.

I don’t like that phrase: “sell in May and go away.” But it certainly looks tempting these days, especially after a dismal earnings report from Warren Buffet’s Berkshire Hathaway (BRK.A) and news of the Federal Reserve reducing liquidity hit.

I am much less bullish now than I have been in several weeks as the technical underpinnings in the market, even prior to Buffet’s weekend bomb, were suggesting that stealth selling was increasing just as the Fed announced yet another decrease in its QE bond purchases from an initial $75 billion per day to the recently announced $8 billion per day.

As weird as it may seem, it makes sense to think of the stock market as a bloodthirsty vampire that needs to suck blood from the living fountain of Fed liquidity on a regular basis in order to continue its gallop higher in a dismal economic environment. Indeed, what we’ve seen over the last couple of months is that as long there has been liquidity, stock prices continued to rise, regardless of economic fundamentals. But it seems that is changing.

So what it means is that, unless the Fed starts to jack up its bond purchases again, regardless of what that may or may not mean to the long term health of the global economy or whatever economic theory anyone adheres to, risk for stock traders is rising.

Weak Stocks Point to Weakness in MEL

Last week, I noted: “in what remains a very fluid situation, it pays to be prepared for all possible contingencies, including considering hedging some bets while continuing to pick stocks near the sweet spot of the complexity zone,” and I am not budging from that general conclusion other than pulling back from buying stocks in the near future until things clear up.

Specifically, in this Post New Normal world where insurmountable debt has tied up the money supply and people are out of work, central bank liquidity and government bailouts are the only things keeping any type of economic activity going. Thus, the stock market, because it is the primary beneficiary of central bank money, is also the primary indicator of where things in the real world are likely to head.

Moreover, if the stock market can’t continue to move higher, then the premise that stocks are the leading influence on MEL, the complex adaptive system composed of the markets (M), the economy (E), and people’s financial decisions (L) may be short lived as the economic data has been clearly dismal. In other words, if 401 (k) plans start to lose their value, people will start pulling back on their willingness to take risks and economic weakness will ensue.

Indeed, there is nowhere to hide from the macro data at this point, at least looking in the rearview mirror, as housing, retail, and employment numbers are all in collapse mode. Indeed, Buffett’s woes may be largely related to his wide diversification into real estate, leisure and travel over the last few years.

Perhaps, as I have also noted over the last few weeks, the worst possible scenario is that the market decides that regardless of how much money the Fed prints, the structural problems of the global economy: insurmountable debt, intractable political divisions, generally poor leadership and the potential for widespread supply chain problems will overwhelm monetary policy. I should also note that whether this is true or not, all it will take is that a consensus that this is the case forms in order to reassert the down trend.

On the positive side, with the United States trying to restart its economy, there is always the potential for positive surprises. This, of course, is not guaranteed, but it is worth watching. For example, I went to the bank on May 1 and for the first time in several weeks, there were actually lines of people making deposits especially on the business drive through lane.

Of course, this may have been stimulus money that just hit the mailbox instead of money earned by businesses doing work, so time will tell; but that was interesting for sure. That said, and especially in light of last week’s market decline, it’s important to consider where we’ve been and whether, if when and how, MEL rebounds, what that rebound may look like.

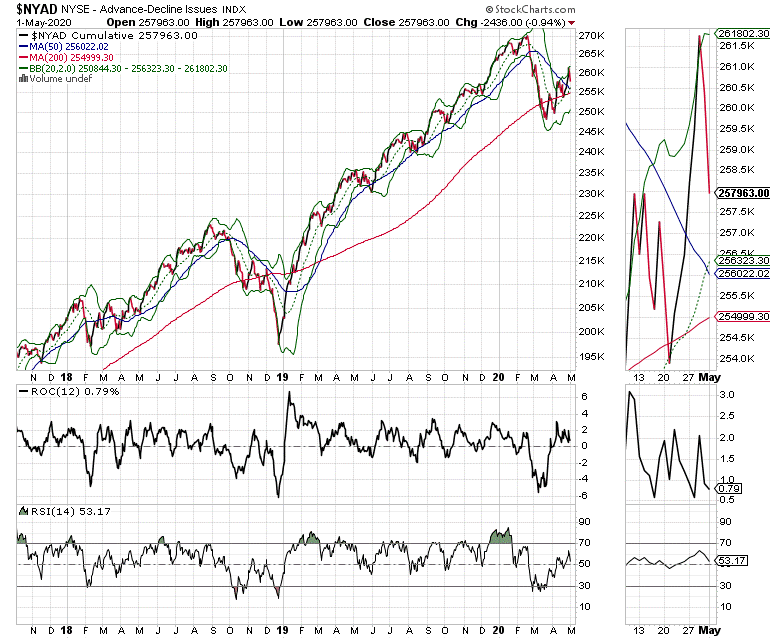

NYAD Runs into Resistance

The New York Stock Exchange Advance Decline line (NYAD) made a new high from its recent bottom last week but almost immediately took a hard hit, reversing course on May 1. Still, it remained above its 50- and 200-day moving averages, so the trend remains technically up, even if the chart looks a bit ugly suddenly. But if the descent continues and those two key support lines give, the odds of a full blown reversal in the market are very high.

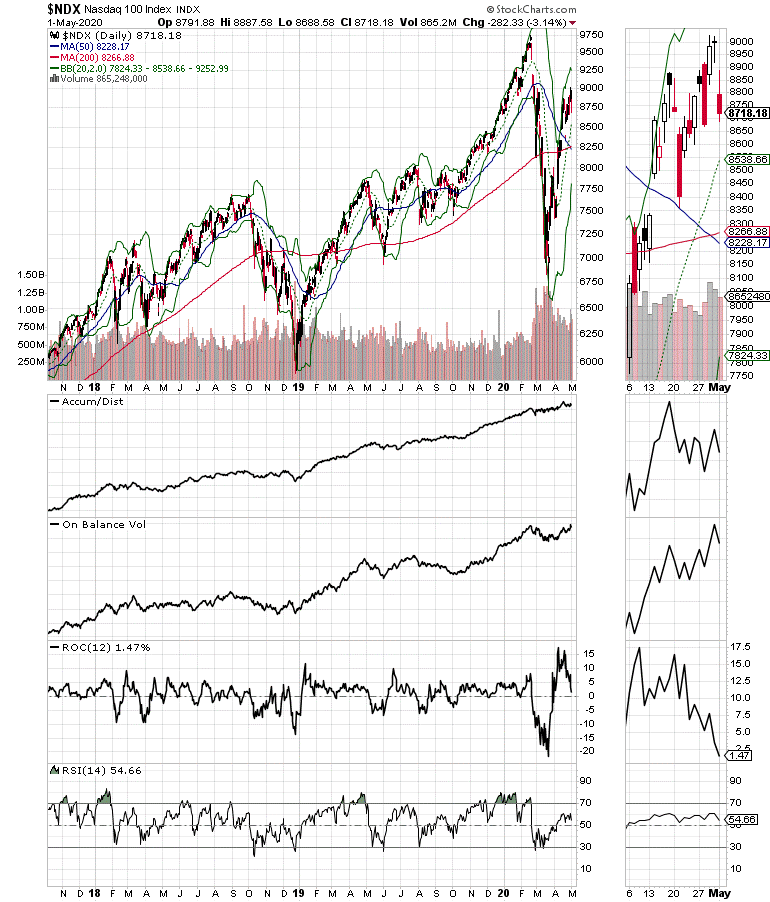

The Nasdaq 100 index (NDX) also had a troubling reversal but remained above its own key support levels. The problem there is that Accumulation Distribution (ADI) is looking a bit top-heavy and On Balance Volume (OBV) is not acting all that well either.

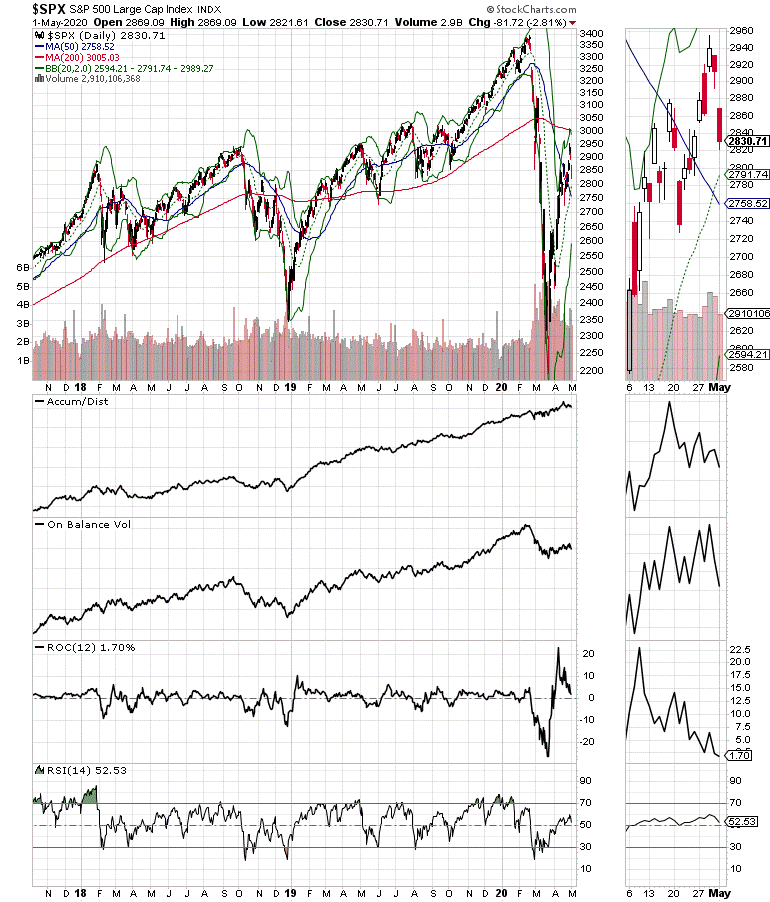

The S & P 500 (SPX) has even bigger problems, as it is clearly under distribution with ADI and OBV on the verge of turning negative.

The bottom line is that sellers seem to be overtaking buyers at the moment as the bad news may be overwhelming the Fed’s money printing as the major influence on stocks prices.

Liquidity is the lifeblood of this Market

When liquidity dries up, stock traders have a problem. Thus, regardless of anyone’s understanding of how the world is supposed to work, the world isn’t what it used to be. Therefore, when trading stocks it’s best to be in tune with what’s working now, and now it’s all about liquidity, so don’t hold positions overnight. If liquidity fades, the market will fall. And right now, it looks as if liquidity is shrinking. As a result, it makes sense to raise cash, consider hedging, and to refrain from deploying any new cash into this market until things clear up just a bit.

I’d love to be wrong. But just in case, I’m playing it safe.

If you’re not a subscriber yet take a 30-day Free Trial HERE. Joe Duarte is author of Trading Options for Dummies, and The Everything Guide to Investing in your 20s & 30s at Amazon. To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit here. I’ll have more for subscribers in this week’s Portfolio Summary. For a 30-day Free trial subscription go here. For more direction on managing the GILD trade, go here.