A sustained rally in the face of a historic economic collapse is not sustainable, something will change, writes Joe Duarte.

As many made special arrangements or eschewed Mother’s Day celebrations, investors should prepare for what could be a significant and surprising set of events in the not too distant future. Several distinct variables: political, behavioral and economic seem to be moving toward some sort of decisive move simultaneously.

If history is any guide, once the dam breaks we are likely to witness what could be a significant transformation in the complex adaptive system composed of the markets, the economy and people’s lives (MEL) and financial decisions as it evolves to the next level of function in the post new normal world.

Last week I noted: “if liquidity fades, the market will fall. And right now, it looks as if liquidity is shrinking. As a result, it makes sense to raise cash, consider hedging, and to refrain from deploying any new cash into this market until things clear up just a bit,” while adding, “I’d love to be wrong. But just in case, I’m playing it safe.”

I haven’t changed my mind; I remain long with a slight hedge. Moreover, the liquidity issue remains worth keeping an eye on, as the Federal Reserve once again trimmed its weekly bond purchases, now taking them down to $7 billion per day. So, you have to start wondering about what the Fed is thinking and whether it’s relying on the algo led technically derived buying spurts to prop up stocks, or an alternative thought which would go against any set of reasonable expectations, which would be that real money is actually coming into the stock market.

My thought is that it’s most likely that the robots are responsible for most of the upside these days, as cash levels in money market funds remain high and hedge funds reportedly sit on the sidelines. Moreover, even in this risky market it’s not wise to fight the upside momentum or to fight the Fed, until it’s clear that they’ve cut the liquidity beyond whatever the critical level may be.

But here is something to consider: If the market keeps rising, how long can those sitting on the sidelines wait before they miss whatever is left of the rally?

MEL is not Dead, Yet

The reopening of the economy is under way, but it’s too early to tell how things will work out. Moreover, there are no guarantees of success or any way to predict whether the system will fail or thrive. All we know is that the agents in MEL are now fiercely interacting with one another and the environment and that the system is likely to make a move, perhaps in the next few days to weeks. Of course, the direction of the move will depend on the events that trigger the emergence of the system to its next level, and how each individual component of the system reacts with circumstances as it makes its move. Nevertheless, one thing is clear, something is about to happen.

Of late, the markets have been the most influential component of MEL, with the net effect being that anyone who has a 401 (k) plan and who either timed the market correctly or just sat things out and waited has benefited from the recent and ongoing bounce in stocks while waiting for a return to work in order to have enough disposable non retirement related money with which to make financial decisions.

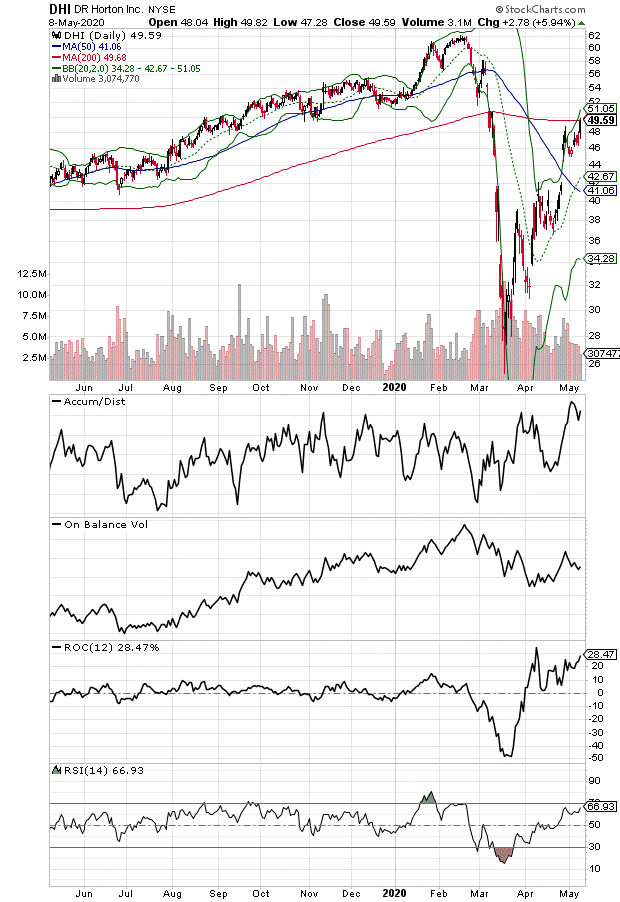

Last week I featured homebuilder DR Horton (DHI) noting that since homebuilders were bellwethers during the economic period prior to the Coronavirus crash, the performance of homebuilder stocks may offer clues to the pace of recovery in the Post New Normal present.

The stock certainly held up well enough after my article and even delivered a minor breakout, as it bumped up to its 200-day moving average. And why not, since the most overlooked economic data of the week was the fact that new home mortgage applications have been quietly climbing for the past three weeks behind record low interest rates.

The most recent data brings the year-over-year comparison to -19%, well up from -35% just three weeks ago. Furthermore, freeway traffic in Dallas, by my back of the napkin calculation based on personal observation, is about 65% of normal; well up from well below 50% just a week earlier. This suggests that the next number to watch for recovery clues is the weekly unemployment claims numbers and whether some sort of bottom develops there before any potential employment in monthly payroll numbers.

Indeed, what we know is that complex adaptive systems, such as MEL, adapt to the environment as they look for their next point of emergence. And we are watching that process unfold as the system looks to move toward the edge of chaos where its optimal level of function resides. Nevertheless, this won’t be a linear process, and there will be bumps along the way. What that means is that since Covid-19 is an agent of chaos, it remains predictably unpredictable and that its status could change at any moment forcing readjustments in public policy and human behavior.

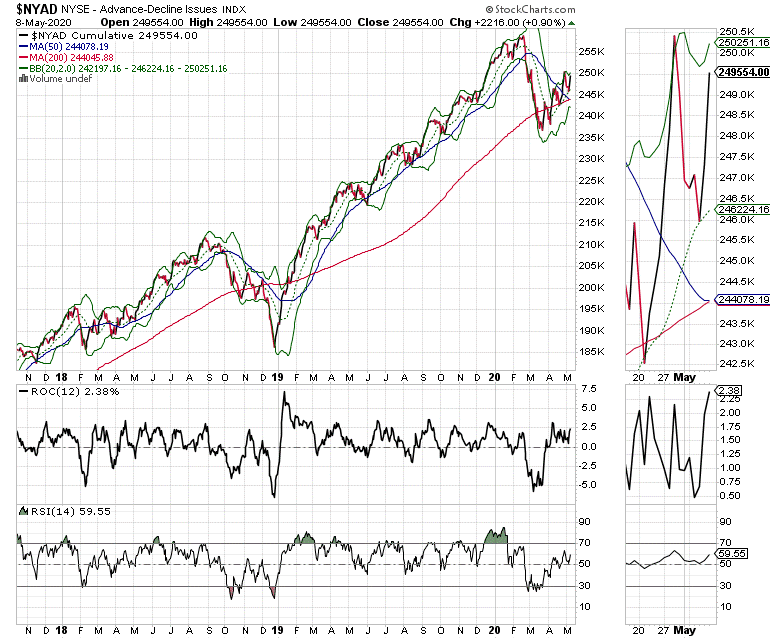

NYAD Bends but Does Not Break

The New York Stock Exchange Advance Decline line (NYAD) bounced off support of its 20-day moving average, while also remaining above its 50- and 200-day moving average. This signals that the U.S. stock market remains in an uptrend for now. Moreover, NYAD is now within one or two good up days from making a new high since the market bottomed (see chart).

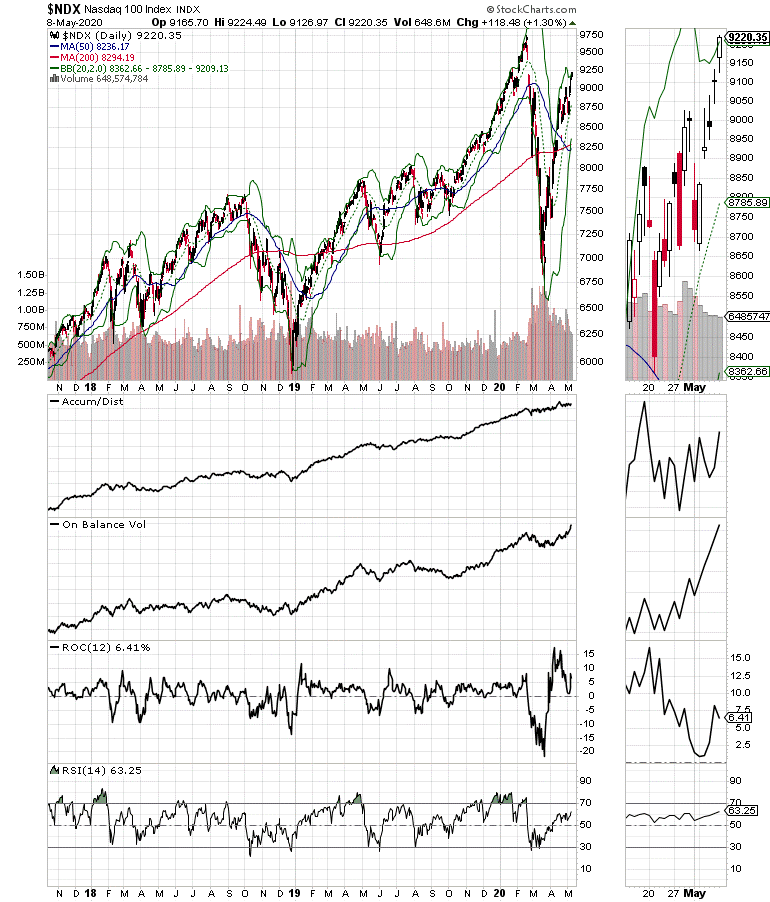

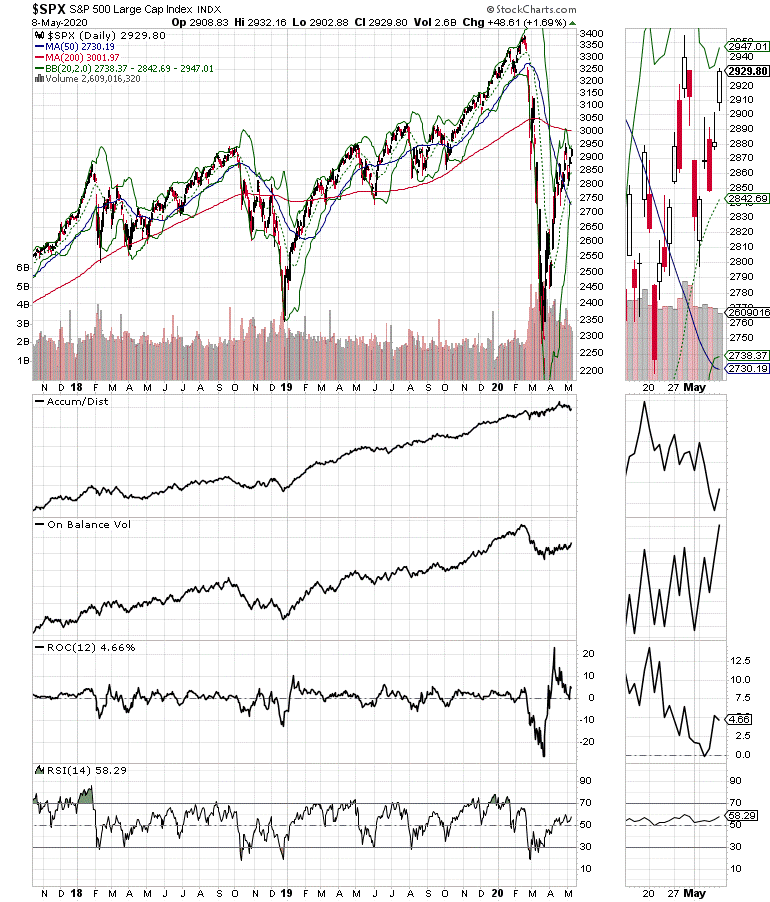

The Nasdaq 100 Index (NDX) continued to power higher delivering its highest close since the market bottom while the S&P 500 (SPX) continues to struggle in comparison. Specifically, SPX remains below its 200-day moving average, which is a negative divergence from NYAD and NDX.

Financial and industrial stocks continue to pull SPX down as money is now moving into housing related, technology and to some degree the very oversold energy sector.

Meanwhile other groups such as homebuilders and interestingly some restaurant stocks are more are experiencing improved money flows.

Trade One Day at a Time

It’s clear that we are in a strange world where the economic news worsens and the market moves higher as long as central banks keep infusing money into the banking system. Of course, this can’t go on forever, which means that either the economy will improve or the markets will fall.

Perhaps the take home message is that it feels as if we are getting closer to the point of reckoning, even in the presence of some wildcards out there which could surprise even the most astute of traders.

What it means is that trading with a day to day approach is a great plan. That doesn’t mean day trading necessarily, but it does mean that tomorrow may be a completely different day and that all positions should be evaluated, not just on their own merits, but also on their daily performance.

Finally, keeping an eye on what goes on in Washington and Beijing is not likely to be a waste of anyone’s time these days.

I own DHI and EBAY.

If you’re not a subscriber yet take a 30-day Free Trial HERE. Joe Duarte is author of Trading Options for Dummies, and The Everything Guide to Investing in your 20s & 30s at Amazon. To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit here. I’ll have more for subscribers in this week’s Portfolio Summary. For a 30-day Free trial subscription go here. For more direction on managing the GILD trade, go here.