Bulls and bear are balanced in bonds, but a breakout is coming, writes Al Brooks.

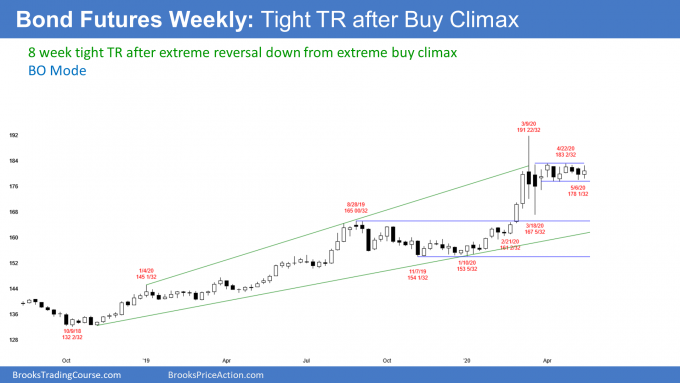

U.S. 30-year Treasury bond futures have been in a tight trading range for eight weeks. The long bond should fall to the March 18 low by this summer, but they might have a test of the March high first.

The 30-year T-bond futures’ tight trading range comes after a sharp reversal down from the most extreme buy climax in history (see weekly chart below).

The tight trading range represents balance and indecision. Traders are deciding if the March high will be the start of a bear trend. The alternative is the reversal down is a bull flag and the bulls will get a rally from here to a new all-time high.

Bulls & Bears on equal footing

A tight trading range is a balanced market. The bond market could not be going sideways for seven weeks if traders believed that it would ultimately break to the upside or downside.

Think about it. Let’s say everyone believed bonds were going higher. They would immediately buy because if they wait, they will have to pay more.

The reason why bonds are not going up or down is that there is no indication of the direction of the breakout. This is Breakout Mode. Traders know that there is a 50% chance of a bull breakout and a 50% chance of a bear breakout. Furthermore, they believe that there is a 50% chance that the first breakout up or down will fail.

Interest rates control the bond market

The problem that the bulls face is interest rates. They are preventing a further selloff because traders think that the U.S. might join many other countries and have zero interest rates. If traders become more confident that it will happen, they will buy bonds aggressively again.

Remember, interest rates move in the opposite direction of bonds. Here’s a simple explanation. If you lend someone $100 and he agrees to pay you $2 interest every year, that is 2%. But if interest rates fall to 1%, then other people selling bonds that pay $2 interest will sell them for $200. You could sell your bond for $200 because of the drop in interest rates.

Are we headed for zero interest rates?

There has been a lot of discussion about this lately. Many institutional investors are betting it will happen (as well as the Fed Fund futures). President Trump has said many times that he wants it to happen. He believes it would help the stock market in the short run, which would improve his chance of re-election.

If interest rates fall to zero, many people will look for alternative investments. An obvious one is the stock market. Most stocks pay at least a small dividend. Even Apple (AAPL) pays a 1% dividend. That is better than zero, plus it has the advantage of an increase in the stock price over time.

Will America tolerate zero interest rates?

I have been writing for months that I do not think it is possible in America. So many seniors depend on interest paying accounts. If interest rates fall to below zero, seniors have a significant reduction in the quality of their lives. This will make their families mad, too. They would see the government as breaking a solemn pledge to make sure that seniors can earn some passive money on their life savings.

If interest rates fell to below zero, you would pay a bank for the right to have a savings account. The value of your home would fall. And I believe the stock market would briefly rally, maybe into November, but it would fall as well.

Negative interest rates represent deflation. Everything goes down in value. Fed Chair Powell knows this and has forcefully said that he does not see it happening. He understands the risks, and he is not worried about a November election.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed E-mini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a two-day free trial.