E-mini S&P has been grinding higher during the day and offering opportunities in overnight sessions, reports Ricky Wen.

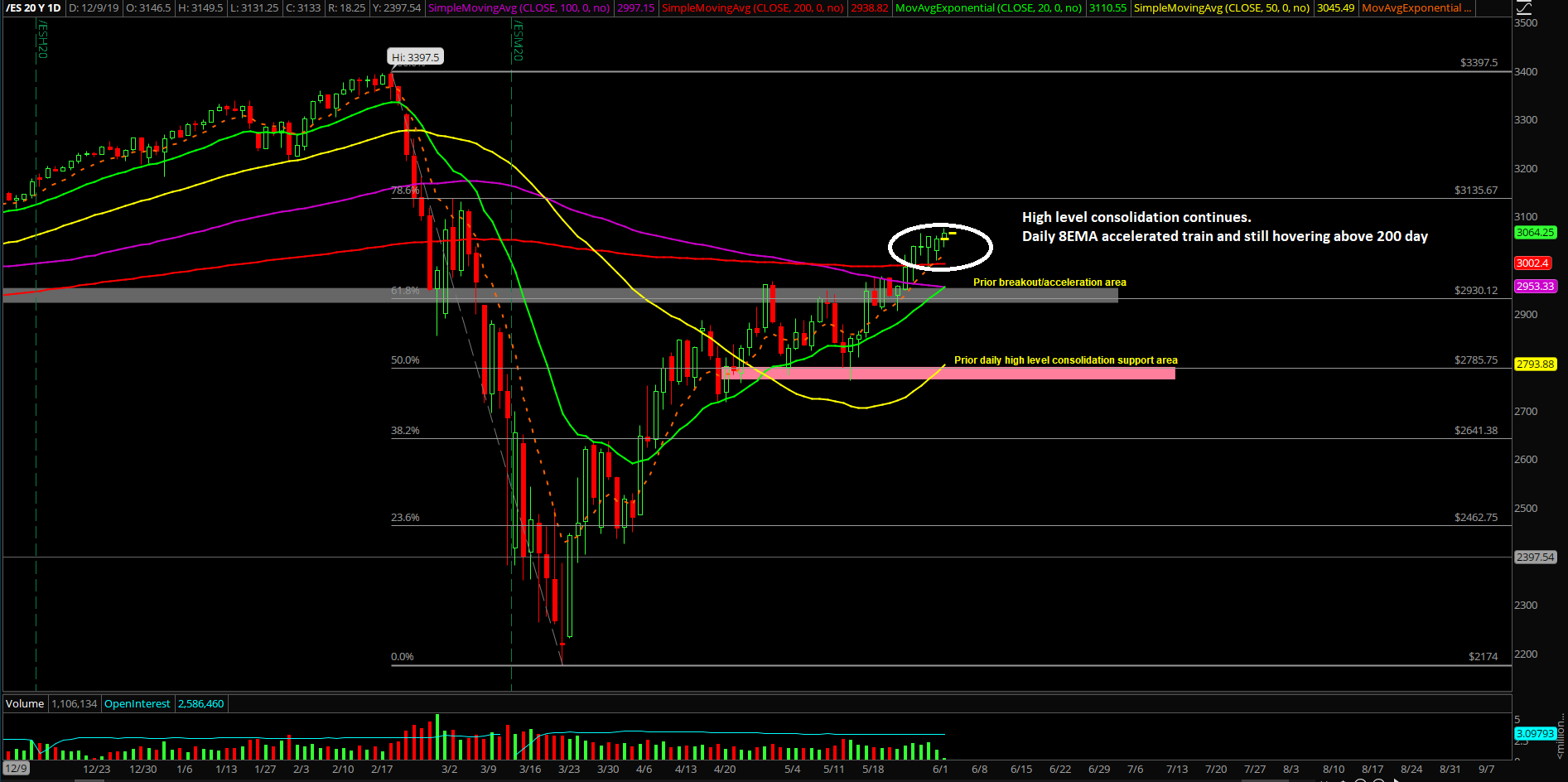

Monday’s stock market session was an inside day within a potential inside week/high-level consolidation context. Basically, the regular trading hours session was confined to a 3059-3027 range on the E-mini S&P 500 (ES), which is about 1%.

In addition, as you may be aware by now, the average range per day has been narrowing for the past few weeks due to this methodical grind up and slower momentum when compared to Feb-April 2020. As previously discussed here, the recent action is very similar to 2019 as we’re seeing flashbacks from all the market tendencies of the easier overnight grind up and then chop around during regular trading hours. Recently, most gains have been made during the overnight Globex session, hence easier setups during the overnight.

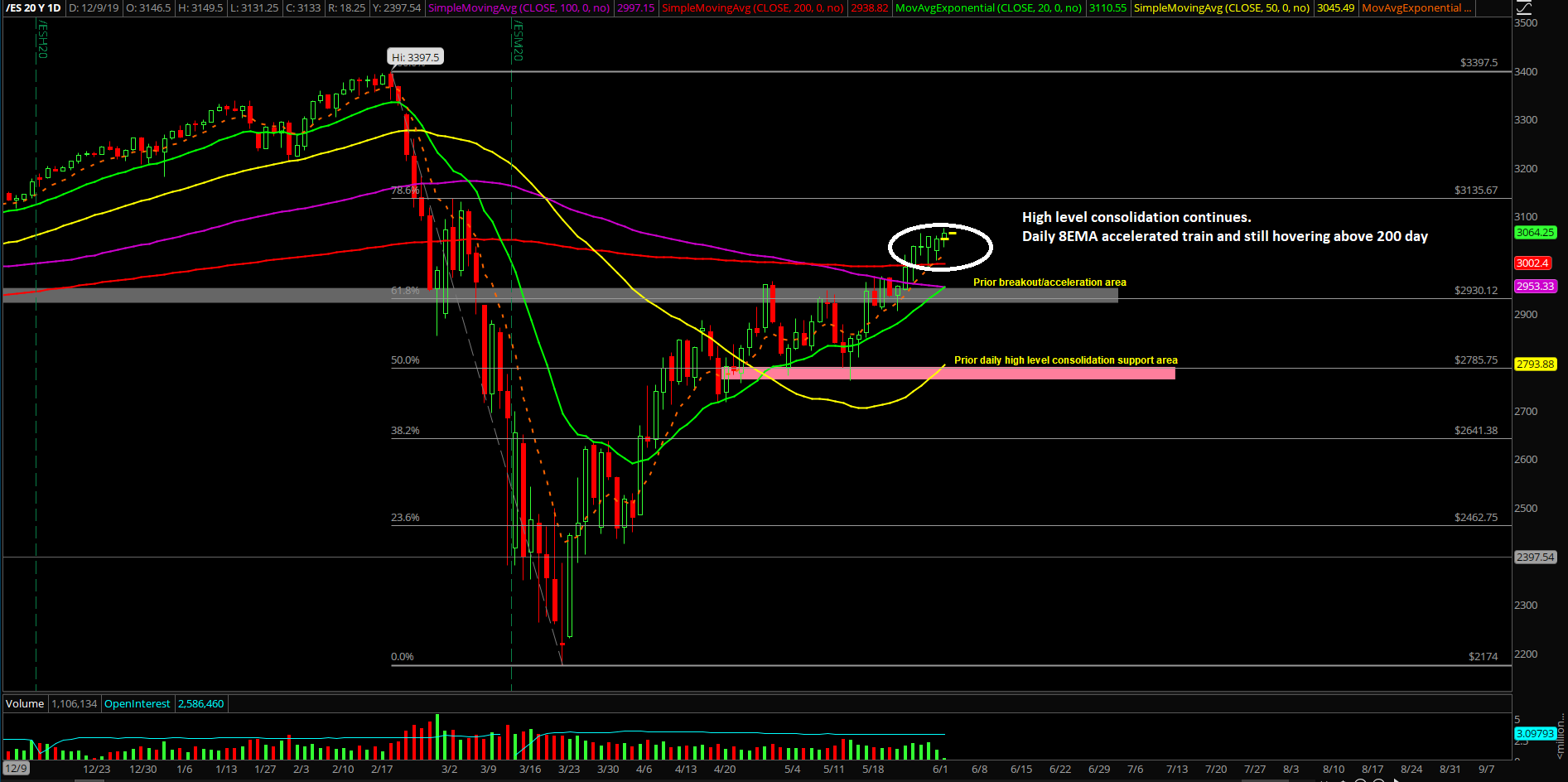

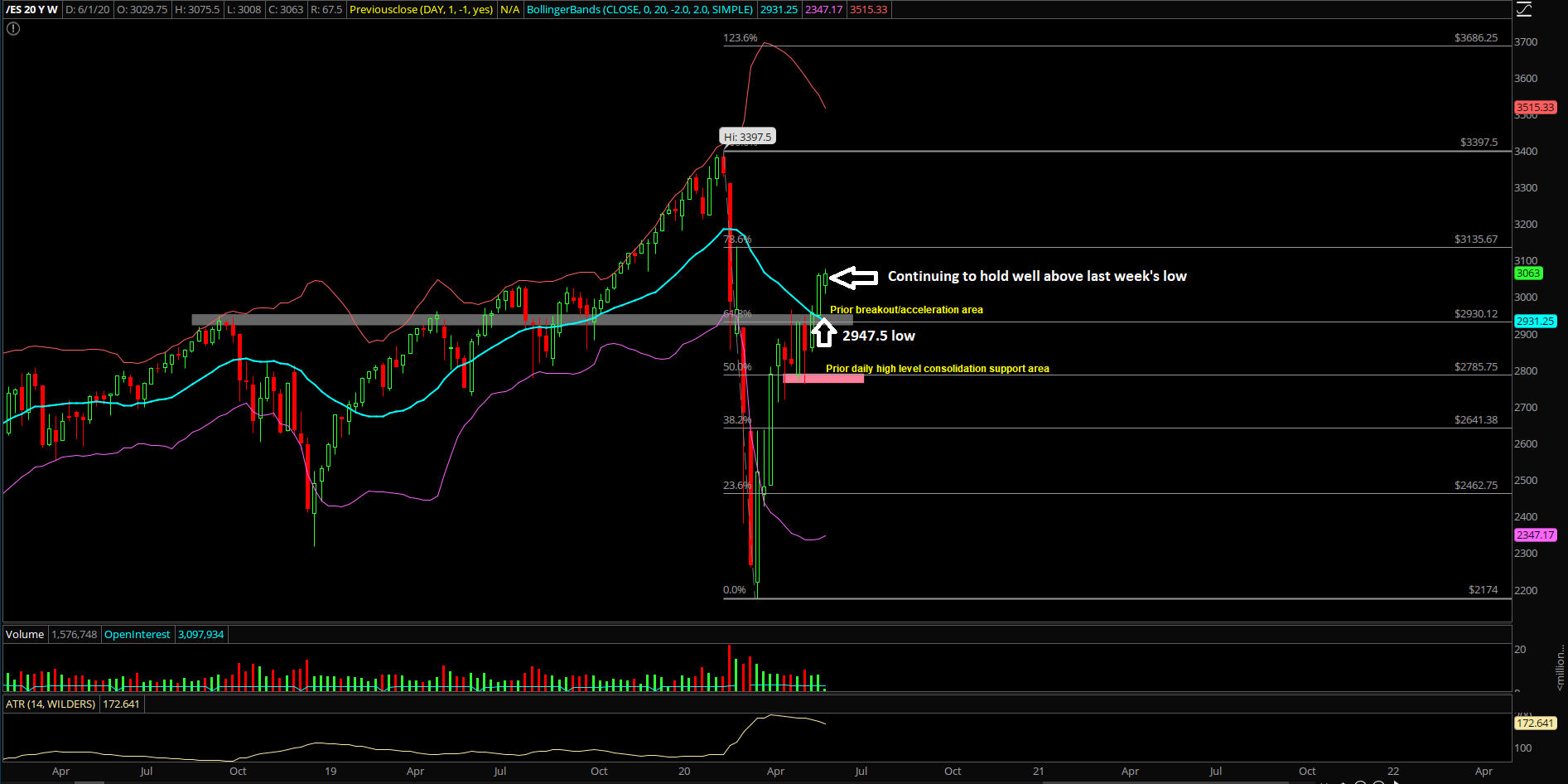

The main takeaway remains the same from the end of May given that the bulls accomplished their key goal by ending the May monthly closing print at the dead highs in order to enhance the odds for upside momentum. The bulls did what they had set out to do since April because it’s been an on-trend upside breakout back to the 61.8% to 78.6% Fibonacci retracement of the entire drop from 3397.5 to 2174 range (see chart). As discussed, the bears ran out of time as they failed to capitalize on all breakdown setups and the bull train has been on an accelerated phase riding the eight-day exponential moving average alongside with price action hovering above the 200-day moving average. All this is buying time for things to catch up and elevate even more by resetting price action, internals and momentum.

What’s next?

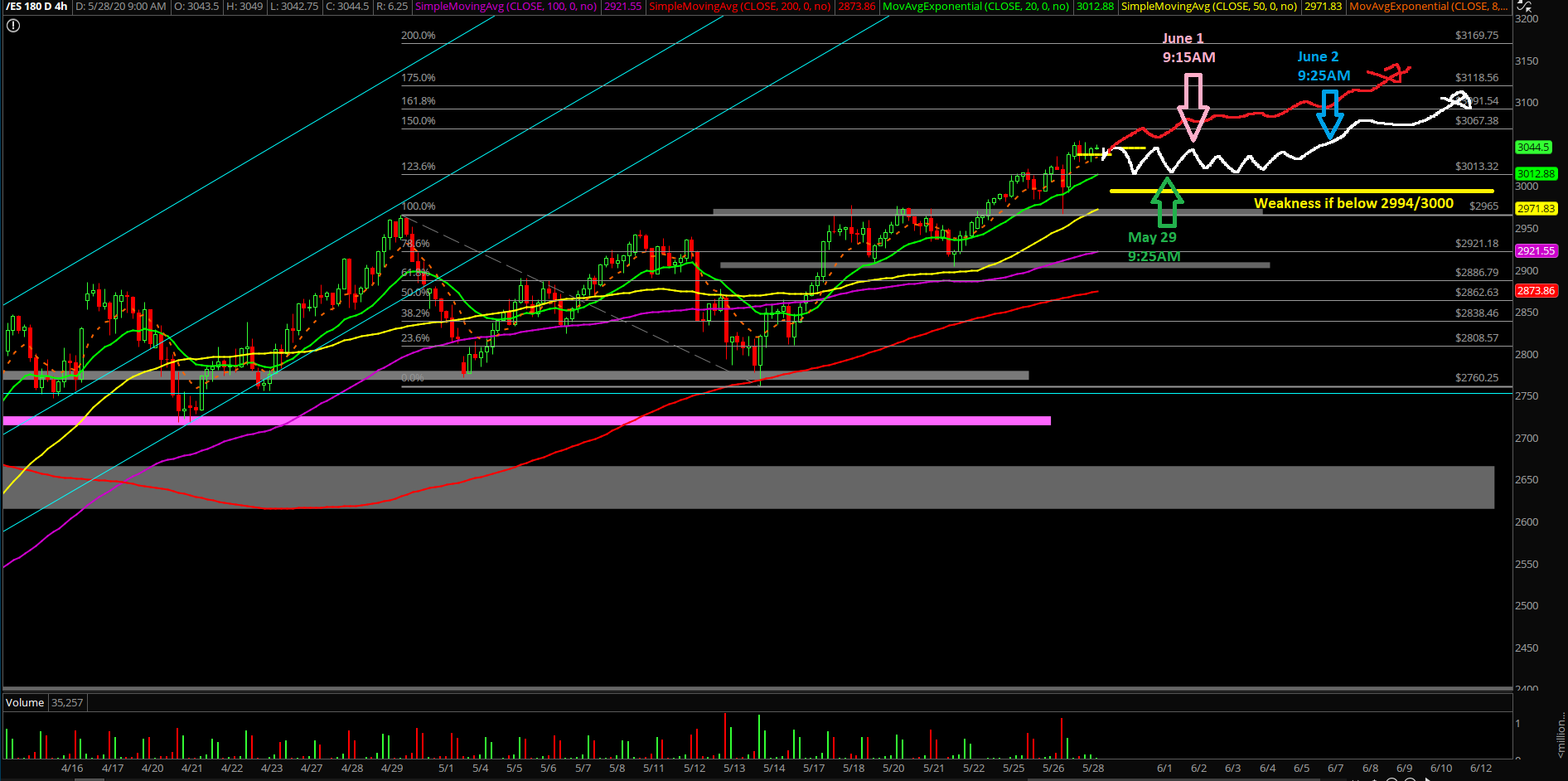

Monday closed at 3053.3 on the E-mini as an inside day around the range high area of the past few days. The overnight produced a decent long setup in the 3035-3040 region for the higher-lows and higher-highs play as the overnight bulls hit a high of 3075.5, which is just under our key resistance level of 3078. It means that price action has been acting very methodical lately during the overnights.

Key points in our game plan:

- For now, the four-hour white line projection from last week remains king given the high-level consolidation/grind up towards 3135 target (see chart).

- Our intermediate target is now confirmed at 3135 when price action remains above 2947.5 and specifically when above 2990s due to immediate momentum (see chart).

- Friendly reminder: the past ~18 sessions, the overnight session has showcased better/easier setups than during regular trading hours, so traders must be aware of the current environment when trading.

- Zooming in, treat 3000-3050s or 3000-3060s as a high-level consolidation/bull flag structure. Buy near support and don’t get caught in the middle because the edge becomes low. Wait for the eventual upside breakout towards 3135 if price action continues to remain strong.

- When above 2992/3000, the bull train is in an acceleration phase on the daily trend chart.

- Conversely, a massive breakout failure/trap would be considered if price action falls below 2992 and then close below 2947.50 on a daily closing basis.

Ricky Wen is an analyst at ElliottWaveTrader.net, where he hosts the ES Trade Alerts premium subscription service.