Joon Choi, who recommended the crude oil based USO ETF in May, says its time to take profits.

As major U.S. large cap Stock indices are at or close to new highs, there is a major sector that is still well below its high this year. At $42.21, West Texas Intermediate (WTI) crude oil is still 33% lower than its $63.23 high in January prior to the Covid-19 pandemic. In a May article, I recommended buying the United States Oil Fund LP (USO) on bullish technicals and I want to update you on this issue.

Overview

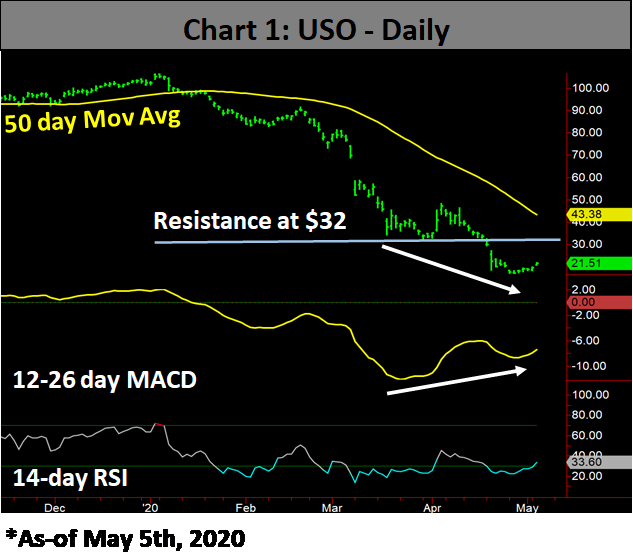

The USO daily chart (Chart 1 as of May 5, 2020) shows price lows from the end of March to May while the 12-26 day MACD put in higher lows during the same period. The positive divergence in this chart led me to set the price target at a resistance level of $32; almost 50% upside.

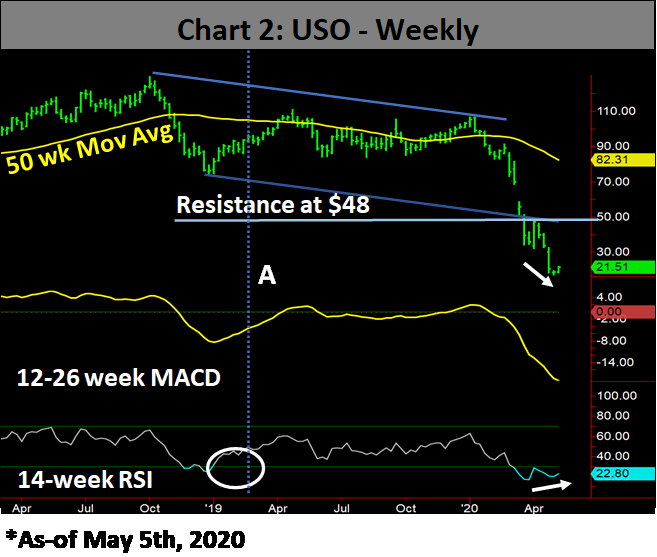

In addition, USO weekly prices formed a positive divergence versus its 14-week relative strength index (RSI). The weekly MACD had yet to turn up, which indicated the ETF was in the early stage of its potential rally and may possess a quick profit potential (see chart 2 below). I had a target price of $48 for the next few months; almost a 123% appreciation from its May 5 close.

Update

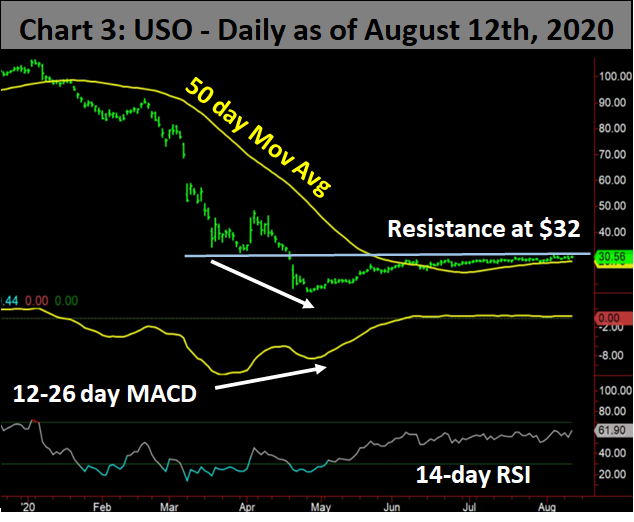

After the buy recommendation, USO went from $21.51 on May 5 to $30.56 as of Aug. 12, which is a 42% profit. However, most of the profit was realized in the first month and it has barely increased since (see chart 3 below). USO has failed to meet my initial target of $32 and I am not encouraged by how far the ETF is from its January highs; USO is down 71% while WTI is only down 33%. In addition, the position captured 42% of the initial upside target of 49%.

Fundamental challenges for oil prices

Potential economic shutdowns arising from students prematurely returning to school in the fall may serve as a headwind for oil prices. In addition, there are few more reasons why oil prices may have topped for the foreseeable future:

- Many workers who were displaced from office to home because of the pandemic may not be returning to the office anytime soon as companies look to save fixed costs, such as office space expense. This will result in less gasoline demand as fewer cars are on the road.

- As countries continue to print money and support their economy considering global economic slowdown, oil suppling countries, such as OPEC members and Russia, cannot afford to cut their production.

- Although alternative energy sources still meet very small percentage of global energy needs, they are becoming more widely used and should only grow exponentially. For example, Tesla (TSLA) sold 90,000 electric vehicles in the latest quarter and their sales are steadily increasing. Moreover, other players are entering the hot electric car market, such as Nikola (NKLA) which also uses a battery technology similar to Tesla’s, but they will be using hydrogen fuel cell technology to extend driving range for cars and trucks. Lastly, almost all car companies are playing catch up to Tesla which means we will see a significant portion of gas-powered cars being replaced with electric cars in the coming years, which will sag oil demand.

- Air travel may not reach pre-pandemic levels for two primary reasons – first, companies may be replacing the need for business travel with conferencing services such as Zoom and Microsoft Teams. Second, people may be more hesitant to get on a plane due to a possible Covid-19 infection. The current pandemic may have a lasting dent in air travel demand.

Conclusion

It is anyone’s guess how the current pandemic will turn out but there are shifts in corporate strategies as well as people’s behavior (i.e. electric cars over gas cars and less air travel). This will negatively impact oil demand while the supply is not likely to change. I believe we have seen the oil price top for the foreseeable future and I recommend selling USO and taking your profits.

Joon Choi is Senior. Portfolio Manager/Research Analyst at Signalert Asset Management. Sign up here for a free three-month subscription to Dr. Marvin Appel’s Systems and Forecasts newsletter, published every other week with hotline access to the most current commentary. No further obligation.