It looks like we are headed for federal gridlock, with Congress divided. Treasury bond prices are jumping, likely due to the now-unlikely prospect of new major deficit spending. However, the stock market is also jumping, especially the Nasdaq 100 Index ETF (QQQ), which is currently up 4.5%, states Marvin Appel of Signalert Asset Management.

The stock market is evidencing a flight to safety in the face of a potentially sluggish economic recovery, with economically sensitive areas such as the small-cap benchmark Russell 2000 Index is flat while the S&P 500 Index is up more than 2%. However, there are signs of optimism that the economy will not fare too badly.

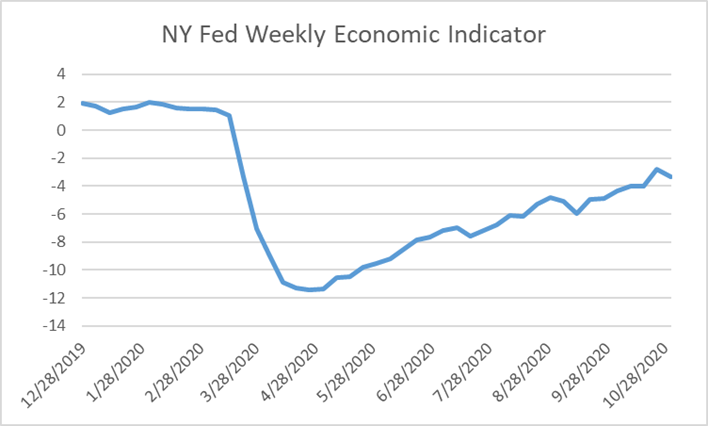

High-frequency economic indicators such as used to calculate the New York Fed’s Weekly Economic Index show continued recovery. Many feared that the expiration of the $600/week federal unemployment benefit would derail the economy, but fortunately that has not occurred. As of October 24, the economy recovered more than ¾% of activity lost at the nadir on April 25. (See chart.)

Corporate high-yield bonds are also signaling a stable economy. The chart below shows the largest corporate high-yield bond ETF (HYG, price-only). It has been in a trading range for more than three months, reflecting a balance between the improving economy and a surge in new high-yield bond issuance this year. On Nov. 2, Bloomberg reported that HYG lost almost 15% of its assets to redemptions, more than $3 billion, and that short interest in HYG represented 18% of shares outstanding. Today’s rally in HYG (up 0.9%) may represent a short squeeze, but either way it fortunately appears that bearish bets on the economy are not paying off.

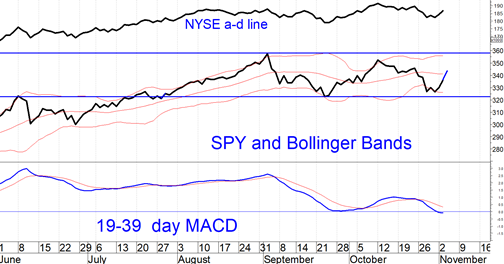

The chart below shows that the S&P 500 SPDR (SPY) has been in a 322-358 trading range for more than three months. Market breadth (NYSE A-D line) has likewise been moving sideways. Although we cannot guarantee that future results will match the past, historical precedent suggests that the November 2-4 pop of more than 5% in the S&P 500 Index is more than the average November-December gain of 3.1%, suggesting limited upside from here.

In this climate it seems reasonable to look for investments that do well in trading-range markets. Such strategies include corporate high-yield bond fund and floating-rate bond-fund trading, and covered-call writing. There are also bottom-fishing opportunities in high-yielding stocks.

To learn more about Marvin Appel, please visit Signal Alert Asset Management.