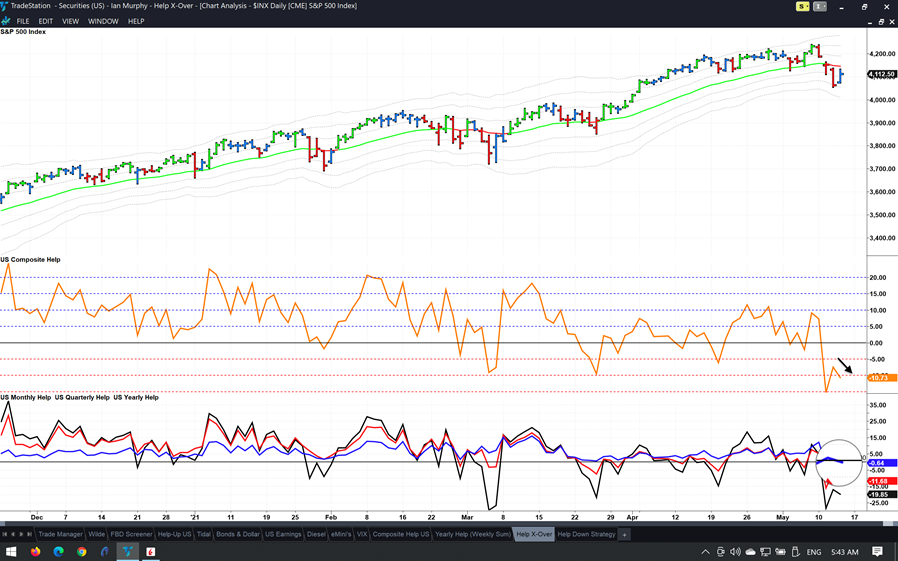

This week, the Yearly Help indicator crossed below zero was identified as a negative sign because such a signal has not been seen since October, explains Ian Murphy of MurphyTrading.com.

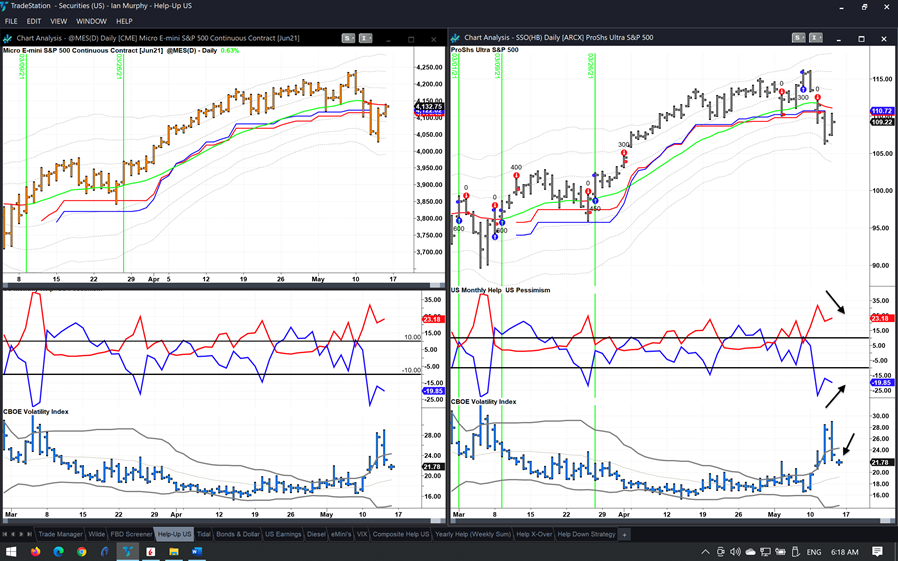

The all-important blue line ticked up for a day but closed back below zero again yesterday (magnified), while Composite ticked down indicating this market may have plans to go deeper. Meanwhile, conditions are lining up for a trigger in the Help strategy, possibly as soon as today.

And thus, we are presented with the constant challenge of trading. On the one hand, market internal indicators tell us the selloff may not be over, while at the same time we may get a trigger to go long the market based on proven back-tested results. What is a trader to do?

This type of thing happens all the time, in fact some of the best trades are opened when the risk appears to be the highest. If we are conservative by nature, we can sit out the trigger. If we are less risk averse, we can take it but must abide by our strategy and risk-management rules.

The short position in Micro E-Minis was covered yesterday for a gain of $1,040 (white arrows). These quick trades set up a few times a year and can be very profitable, especially after the trend-following position, which was stopped out on Monday.

Learn more about Ian Murphy at MurphyTrading.com.