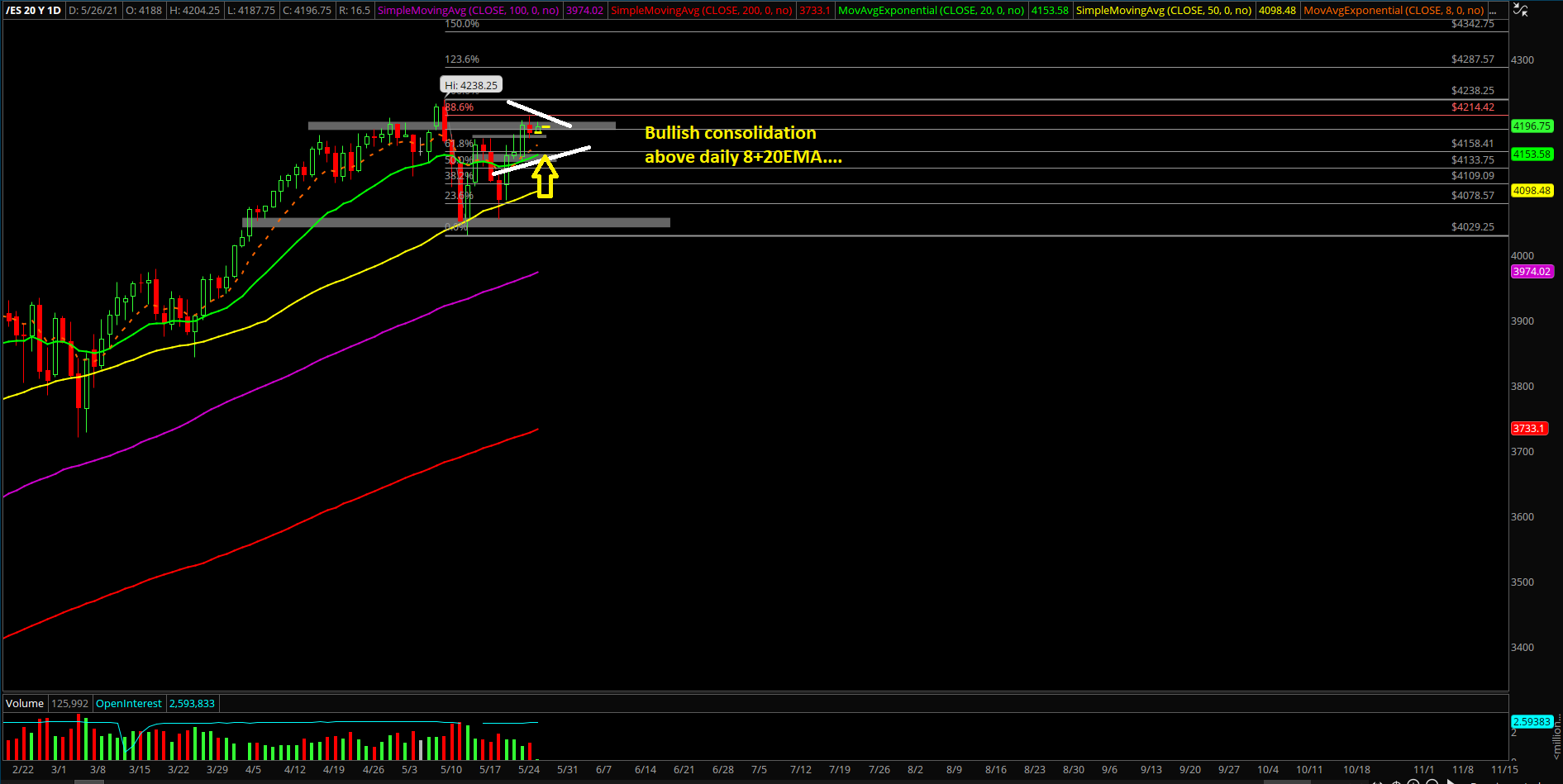

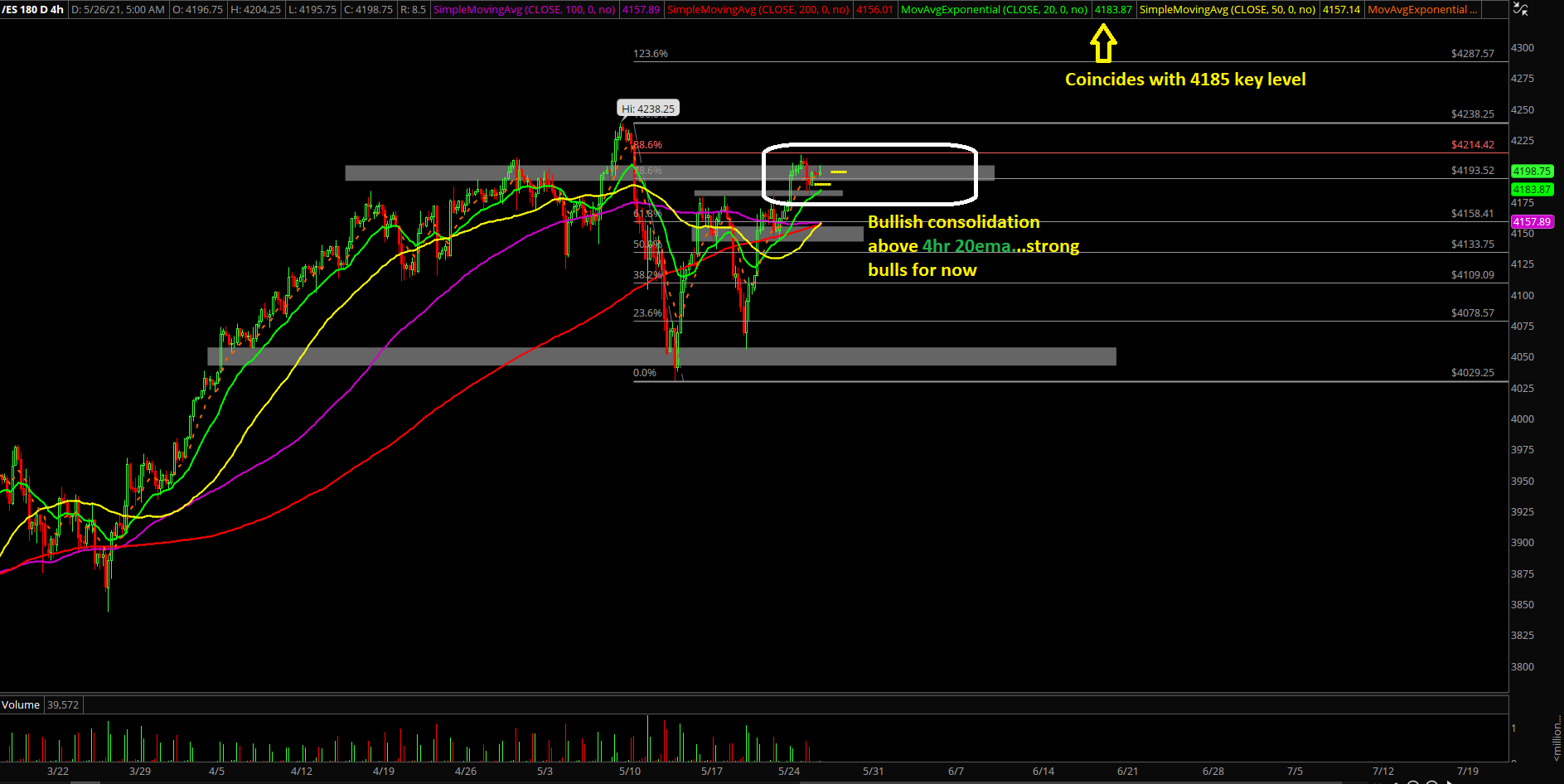

Mid-week sessions played out as expected with a range. Price action backtested against our key level of trending support at 4185 on the Emini S&P 500 and produced an intraday higher low of the day setup, reports Ricky Wen of ElliottWaveTrader.net.

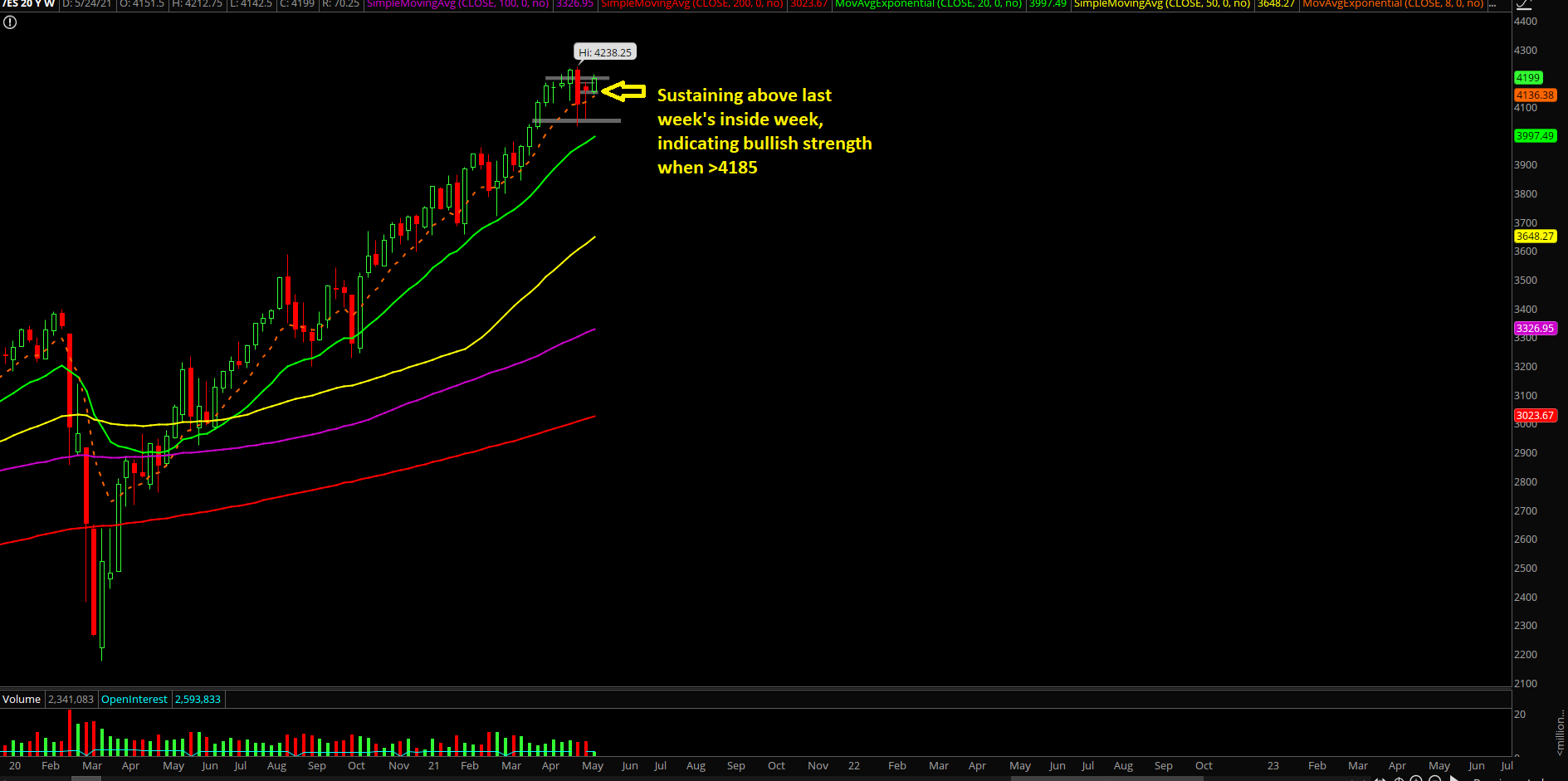

If you recall, last week’s range was 4185-4055, creating an inside week within the previous week's range (4238-4029).

Immediate support levels are 4185 and 4150, so manage risk exposure and know your timeframes.

We maintain the same basis going into this week and June; The ES target is 4238-4250 when above our key trending supports. Every dip is an opportunity given the clear risk versus reward for the next 5-15 sessions.

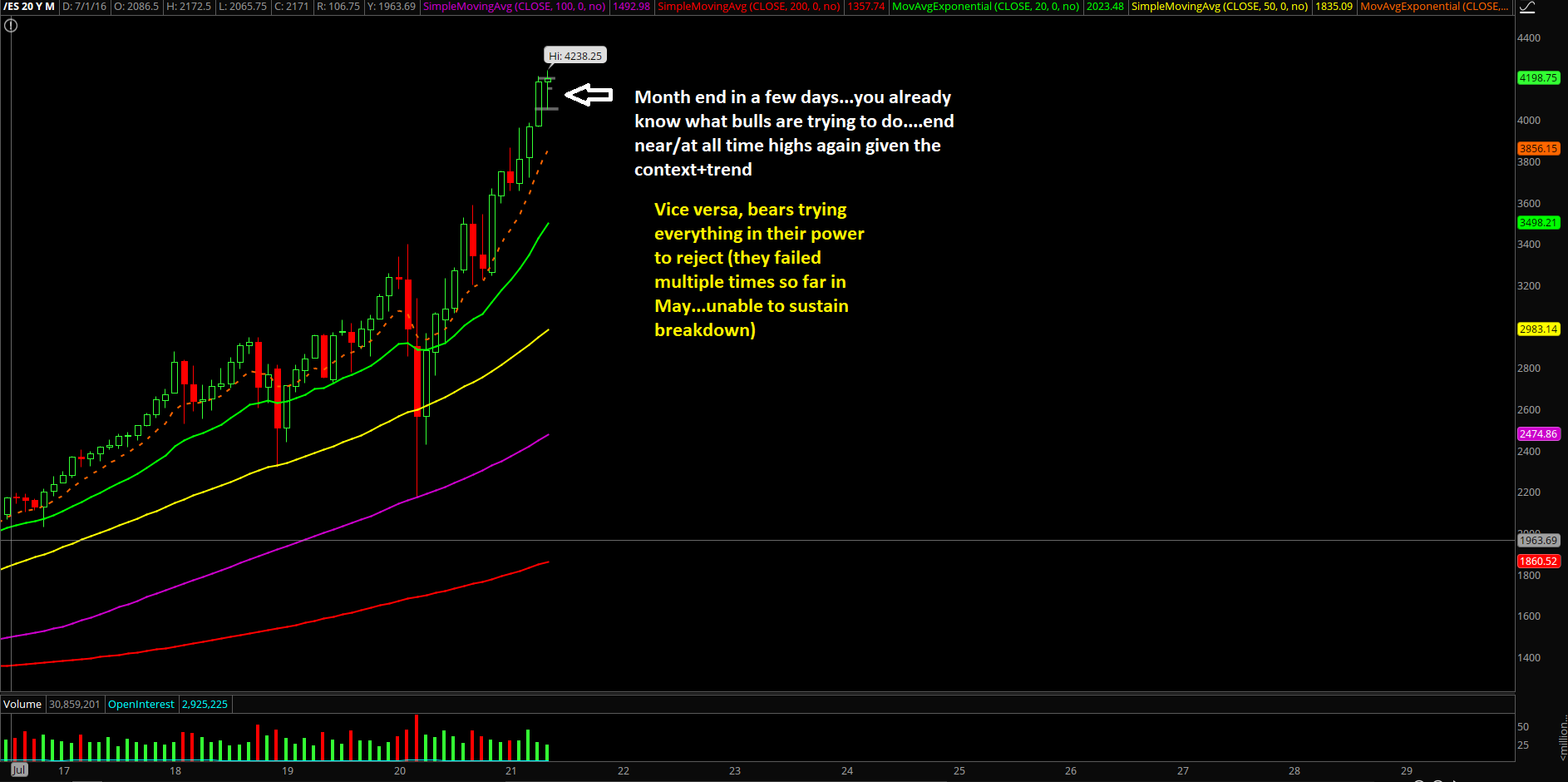

Bigger picture wise, the month of May is just a consolidation setup in a massive bullish trending monthly context. It’s resting and digesting before the market attempts higher highs into rest of this year. This picture is in effect as long as it remains above the 3965 SHTF level.

Ricky Wen is an analyst at ElliottWaveTrader.net, where he hosts the ES Trade Alerts premium subscription services.