On October 6, 2020, Alex from Mexico shared with me a covered call writing trade he executed with Invesco Solar ETF (TAN). He was considering unwinding the trade using our mid-contract unwind exit strategy and wanted to know how I analyze these scenarios, explains Alan Ellman of The Blue Collar Investor.

This article will detail the calculations used in the Unwind Now tabs of the Elite and Elite-Plus Calculators to assist in these decisions.

Alex’ initial trade and status on 10/6/2020

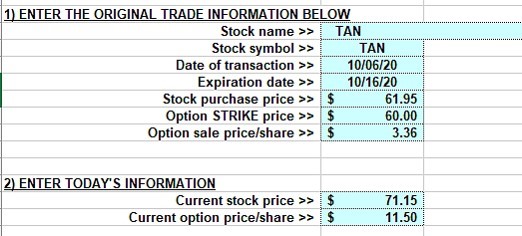

- 9/29/2020: Buy TAN at $61.95

- 9/29/2020: Sell-to-open the 10/16/2020 $60.00 call at $3.36

- 10/6/2020: TAN trading at $71.15

- 10/6/2020: Cost-to-close the $60.00 call is $11.50

Initial structuring calculations

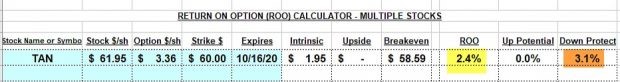

TAN: Initial Calculations on 9/29/2020

The spreadsheet show an initial 18-day time-value profit of 2.4% with 3.1% downside protection of that profit. The breakeven price point was $58.59.

Entering the unwind information into the Elite or Elite-Plus Calculators

TAN Trade Information on 10/6/2020

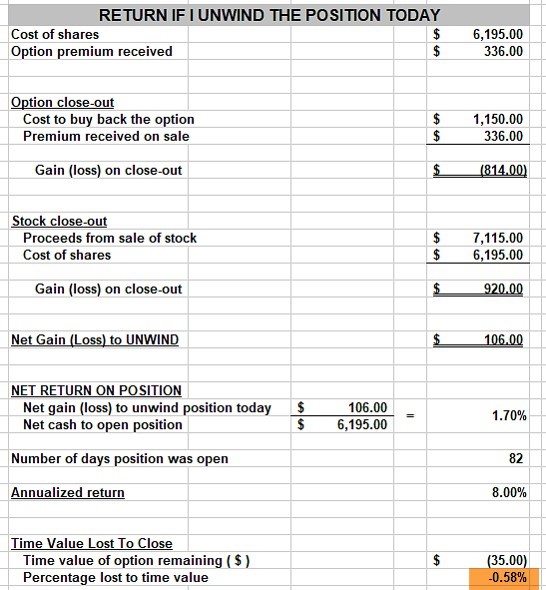

Unwind calculations if both legs of the position are closed on 10/6/2020

TAN: Final Unwind Calculations

The time-value cost-to-close (CTC) is 0.58%. There are 10 days remaining to contract expiration. We ask ourselves: Can we generate at least 1% more than the time-value CTC or 1.58% or more with a different security by 10/16/2020? If yes, we execute the mid-contract unwind exit strategy. If no or unsure, we take no action and continue to monitor the trade with possible rolling opportunities as expiration approaches.

Discussion

Exit strategy opportunities must be executed when beneficial to our overall portfolio success. To make these determinations, the BCI Calculators will assist as the formulas are built in to allow us to understand the mathematics of our trades. In the case of Alex’s TAN trade, a successful trade was executed with the possibility of establishing a second income stream in the same contract month with the same cash investment. Many thanks to Alex for sharing this trade with our BCI community.

Learn more about Alan Ellman on the Blue Collar Investor Website.