When we sell cash-secured puts, we have selected a stock or ETF based on sound fundamental, technical, and common-sense principles, explains Alan Ellman of The Blue Collar Investor.

We generally select out-of-the-money put strikes that meet our stated initial time-value return goal range. Once the trade is executed, we move to position management mode. This article will highlight the choices we have available should our cash-secured puts be exercised, as our plan for this potential event must be in place prior to entering our trades.

Real-life Example with Etsy, Inc. (ETSY)

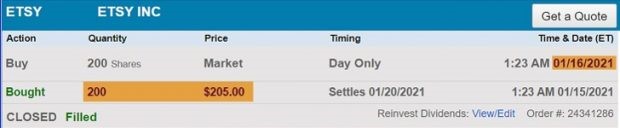

On expiration Friday, January 15, 2021, I had 2 x $205.00 ETSY cash-secured puts in place and the market declined significantly that day, moving the original out-of-the-money put strike to in-the-money as 4:00 PM EST approached. ETSY was trading at $204.68. I could have closed the short put position, thereby avoiding exercise and assignment of the shares. However, that was not part of my plan. Instead, I allowed assignment and, on the following day, 200 shares of ETSY were put to me at $205.00.

200 Shares of ETSY Assigned on 1/16/2021

Choices After Assignment of Cash-Secured Puts

1. Retain shares as part of our buy-and-hold portfolio.

In scenario #1, we sell cash-secured puts to buy a stock at a discount, instead of using limit orders. Since we are selling out-of-the-money puts, the breakeven price point is the put strike minus the put premium. The BCI put-selling calculators will generate this information.

2. Write a covered call.

Scenario #2 is the PCP (put-call-put) strategy where our objectives are to generate premium cash-flow or buy a stock at a discount. If this were my objective, I could have sold in-the-money (defensive) or out-of-the-money (more aggressive) calls, depending on the overall market assessment and personal risk-tolerance. All strike premiums should align with our initial time-value return goal range.

3. Sell the stock if share price recovers.

Scenario #3 is an adjunct to scenario #1. ETSY, at the time of these trades, was a security I would otherwise want to own for the longer-term. My plan, prior to entering the initial put sale, was, if exercised, retain the shares unless I could generate a substantial short-term profit.

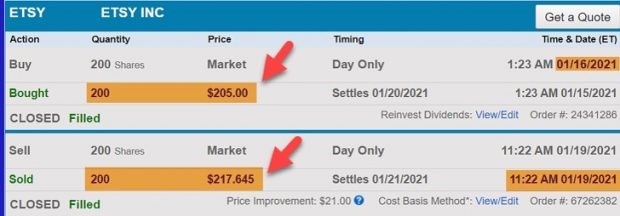

The Final Outcome

On Monday, January 19, the market—along with ETSY—bounced back, and I decided to sell the 200 shares at a net profit of $2529.00.

ETSY Sold at a $2529.00 Profit

Discussion

Our entire plan for selling cash-secured puts must be in place prior to entering all trades. Stock and option selection will launch our trades, and a detailed game plan for position management must be in place so that we can react in a non-emotional manner for every potential outcome.

Learn more about Alan Ellman on the Blue Collar Investor Website.