If you’ve been following this post over the past few months, one of the few conditions I warned about that did not materialize to this point is a major drop in the US Dollar. Instead, we’ve had a reaction since August in the Ten Year, explains Jeff Greenblatt of Lucas Wave International.

Along the same lines, the stock market has held up very well during its ‘go away in May’ seasonal cycle. I found it incredibly hard to believe that from the end of October through the Santa Claus euphoria seasonal cycle the market would not absorb some type of correction. It's with that in mind that markets are finally taking the hit. In my work, Santa season for the market does not start Christmas week, it starts the day after Thanksgiving. The bears waited until the last possible moment to make it happen. The news of the new variant came out right there on a low volume holiday session. One almost has to wonder if it was by design to take some of the air out of the bubble.

With that in mind, there are two charts that I consider must-see television. Let’s start with the 10-year note. It is testing critical support from the March low. It finally found a low at 444 days off the March 2020 high, which doesn’t mean much all by itself; but when you combine it with the actual date on November 24, this is the 243dg vibrational day of the year. In a few short days since the new variant hit, the price action has jumped up to the descending trend line. What this amounts to is a 249dg vibrational day for November 30, and the significance is that it's also a 49% retracement.

What does it all mean? If this high is taken out and breaks through the trend line, odds are it can at least retest the August high. With decent readings on both ends, we could end up in a trading range. Here’s the problem. We are in a heads, I win, tails you lose scenario. If the bond market keeps going up, the indication will be for a weaker economy. This economy is weak enough. Did you notice Powell has retired the word ‘transitory’ as far as inflation is concerned? As I’ve been explaining to anyone willing to listen, how could inflation be kept in check with supply chain problems and an administration that shut down the Keystone Pipeline?

Let’s say the market decides not to focus on the new variant. Well, bond prices could drop, as they’ve been doing, and spike the cost of borrowing capital. Neither of these scenarios is good.

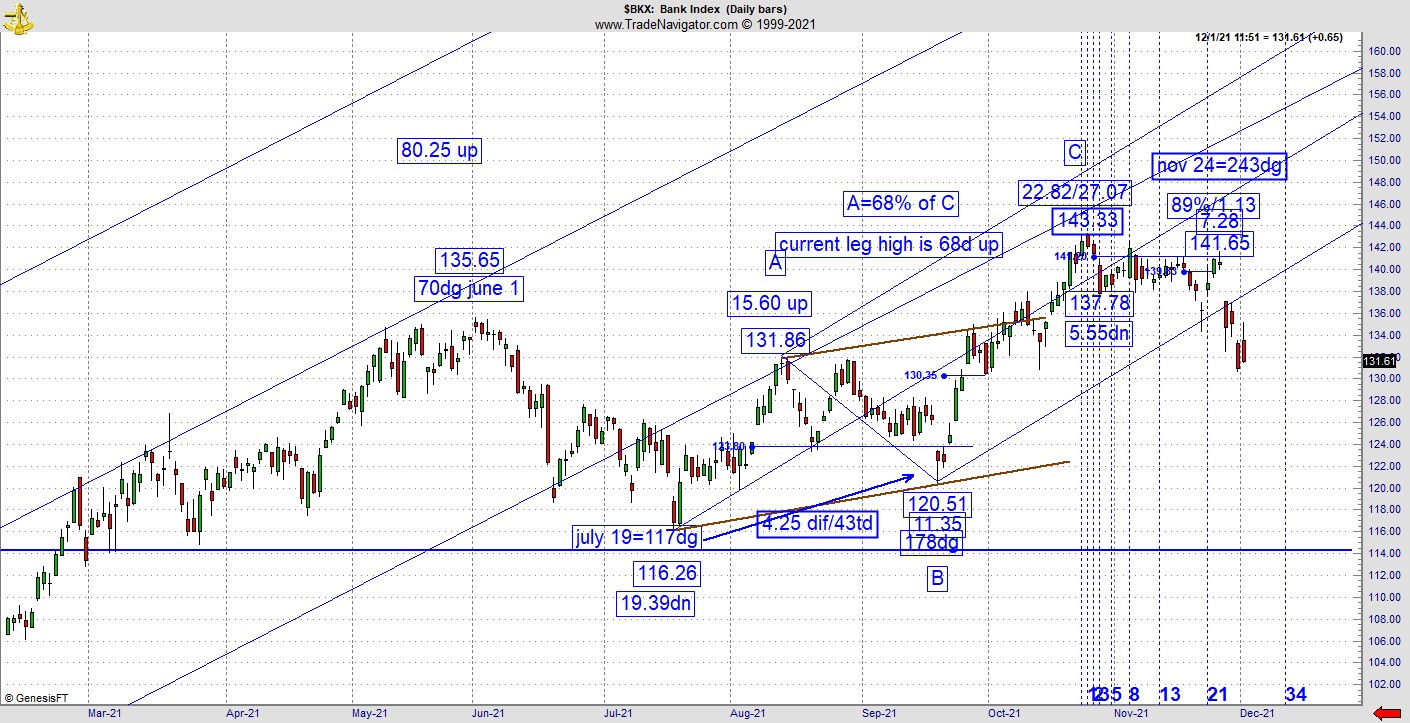

That leads to a discussion of the KBW Nasdaq Bank Index (BKX). As you know, I’ve been tracking the readings to the point we had a remarkably interesting high, where A is 68% of C while the C high is 68 trading days up. My only point of contention was whether we were dealing with a third or fifth wave high. In the latest sequence, the price action broke below the trend line, and for the first time since the summer has violated the trend and made a new lower low. The numbers don’t lie. The BKX was hinting of a problem since the October high. It did not stay sideways. If you follow the BKX every day and want a positive resolution to our economic issues, it surely would’ve helped if the pattern would’ve held the latest trend line. But its four days since it broke and now looks like it still wants to go lower.

Here’s the bottom line. As a trader, I put politics in the rear-view mirror. I need good intel to make rational trading and investment decisions. The only reason the market is up is because of all the money printing. Those who believed things were returning to normal should read Extraordinary Popular Delusions and the Madness of Crowds. To see what has happened since March 2020 and believe things would go back to the way they were is a delusion, and we are seeing it on a massive scale. Let’s not forget longer term cycles call for 2022 being a hard down. That means next year could be the roughest year we’ve had since at least 2008, if not longer.

I want to leave you with an optimistic message. What is the solution? If you are a big socionomics fan like I am, you know there are times where conforming with the crowd is a dangerous thing to do. The problem the book points out is: for those who don’t conform to the crowd, it could be psychologically painful. But if you are going to succeed in this business, you must have access to valuable information. As K. Anders Ericsson said in his numerous studies, mastery requires a special type of practice called deliberate practice. Henry David Thoreau stated most people lead lives of quiet desperation. Goethe completed that thought by stating the pursuit and achievement of mastery is the means for the average person to get out of that quiet desperation.

Ericsson’s message over the past 30 years is that innate talent only gets you so far. The prevailing wisdom is such that many believe talent plays a role in determining ability. While these natural prodigies believe they need far less practice than those not as talented to reach greater heights. The truth of the matter is its not true. That gives a lot of hope to the rest of us.

He proved it takes much more than God-given talent to master any profession in his study, “The Role of Deliberate Practice in the Acquisition of Expert Performance.” Finally, it was Nietzsche who said, “Speak not of gifts or innate talents. One can name all kinds of great men who were not very gifted but as they acquired greatness the became geniuses. Anyone can do it if they desperately want it. You’ll need to raise your level if you want to prosper in 2022.

For more information about Jeff Greenblatt, visit Lucaswaveinternational.com.