Joe Duarte, editor of In the Money Options states; there’s an old saying: “you’re not paranoid if they really are after you.” And in this market, you’ve got to wonder what gives.

Last week in this space, I noted that earnings season could be bumpy and that a host of macro trends were converging. Here they are again:

- The Federal Reserve delivered unprecedented QE and is now in the midst of raising interest rates to quell inflation.

- The shutdowns, some of which are still being deployed in China, snuffed out production and there are now supply chain snags everywhere, which have become structural.

- Geopolitical power shifts led to a change in the White House and elsewhere.

- This power shift has led to the Russian invasion of Ukraine.

- Population migration from the third world is increasing but is also evident within the US.

Unfortunately, Fed took the lead in the macro influence race as multiple central bank speakers seemed to send a newly congealing message to the markets: 0.5% increases in the Fed Funds rate are coming.

Of course, the market responded with a two-day 1000 point plus a decline in the Dow Jones Industrial Average (DJI).

The Fed is Chasing Windmills

Here’s what could be considered an outlier analysis. Like Don Quixote and his windmills, the Fed is in a weird hallucination based on the Volcker era where inflation was at least partially fueled by factors not in place today, such as a weak dollar and wage controls.

In fact, the central bank is raising interest rates based on the fact that inflation is a monetary phenomenon, based on the combination of these two factors: too many dollars chasing too few goods.

But that’s only part of the story.

First, I agree, there are too many dollars chasing too few goods. But the problem is not all about the amount of money sloshing around in the system. Today’s inflation is more about not enough goods being available because manufacturing can’t deliver on the demand.

Moreover, in a highly indebted global financial system, excess dollars are actually beneficial as they offer capital for companies to not just service debt but also to take care of their operations.

So, it’s really not strictly about supply or supply chains. The clogged ports and the ups and downs of trucking are really just symptoms of the basic problem, not enough supply.

The fact is that today’s inflation is a reflection of this: not enough stuff is being made because not enough factories are operating. You can blame Covid, you can blame politics between the White House and China.

You can blame companies for offshoring their factories. You can blame the war in Ukraine or you can blame planetary alignments and the wheel of time.

But at the end of the day, nothing is going to change the fact that there just isn’t enough stuff being made to satisfy global demand. Moreover, because of the macro environment outlined above, demand isn’t going to wane anytime soon. And that’s because people on the move are like an army in the midst of a campaign: they need constant supplies. So, the Fed isn’t really fixing anything by raising interest rates. That’s because higher interest rates won’t open new factories—in China, Wisconsin. or Bangladesh.

In other words, the Fed can raise interest rates until the end of time and there still won’t be enough stuff available for what will likely be stable or even rising demand. Only when enough manufacturing capacity becomes available with this dynamic change.

In fact, higher interest rates may actually slow down the reversal of the globalization trend toward regional economies by making it harder for companies to borrow in order to restructure their operations.

So, what’s the bottom line? There isn’t enough stuff to fuel a major global population shift and higher interest rates aren’t going to help anybody except bond short sellers.

I will leave the conclusion of how this could all end to you.

Sellers Gaining Strength

Last week, in this space, “the New York Stock Exchange Advance-Decline line (NYAD) remains below its 50-day moving average while the RSI also remains below 50. And while that’s a Duarte 50-50 sell signal, a market crash is not etched in stone. That’s because these signals can quickly reverse, but they are always reasons to be cautious. However, the Bollinger Bands around the S&P 500 (SPX) are closing in on the 20-day moving average as it fluctuates in a tight trading range near the 4500 area. That’s a sign that a big move is coming.”

And a big move did come, to the downside as the Fed talked up its likely upcoming aggressive interest rate increases.

Last week, NYAD moved lower but did not break below the recent low. So it could have been worse. Still, there is no reason to get bullish here. At least not yet. On the other hand, the market is starting to get oversold, whatever that means these days.

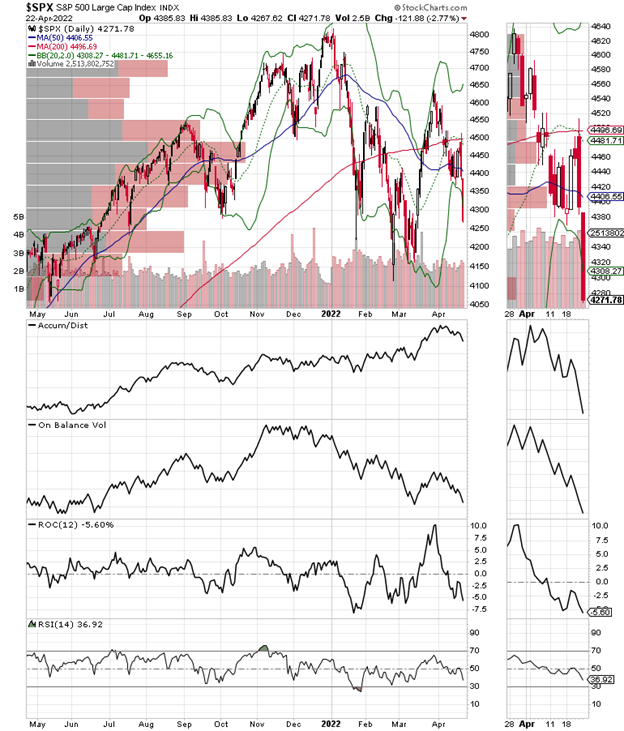

SPX failed to rise above 4500 and could test 4100 in the next few days. What happens there will be important for sure. Moreover, this could go on for longer as Accumulation Distribution (ADI) is signaling heavy short-seller activity while On Balance Volume (OBV) shows more buyers than sellers.

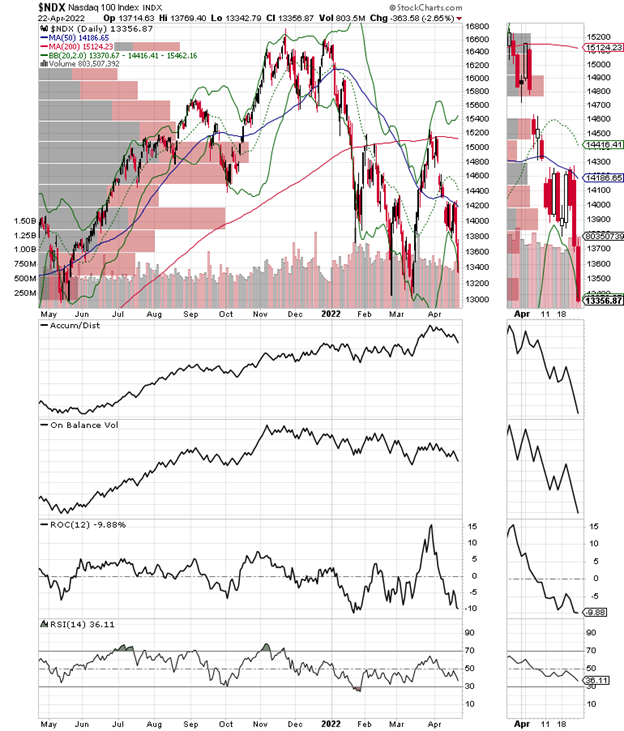

The Nasdaq-100 Index (NDX) shows similar action with support near 13,000. However, the Volume by Price (VBP) bar at 13,000 does not look very stout so it may not hold.

VIX Rallies with Room to Rise

The CBOE Volatility Index (VIX) moved decidedly higher last week, as put buyers came out of the woodwork. This is bearish for stocks at the moment. VIX has resistance at the 32.5-35 area.

Remember that a rise in VIX signals that put option volume (bets that the market is going to fall) are on the rise. What follows when put volume rises is that market makers sell puts and simultaneously hedge their bets by selling stocks and stock index futures.

This causes the market to fall.

To learn more about Joe Duarte, please visit JoeDuarteintheMoneyOptions.com.