In March, I reviewed the Ukrainian war and its effect on certain commodity-based implied volatilities most influenced by the war, namely crude oil, natural gas, and wheat, states Brett Friedman of Winhall Risk Analytics.

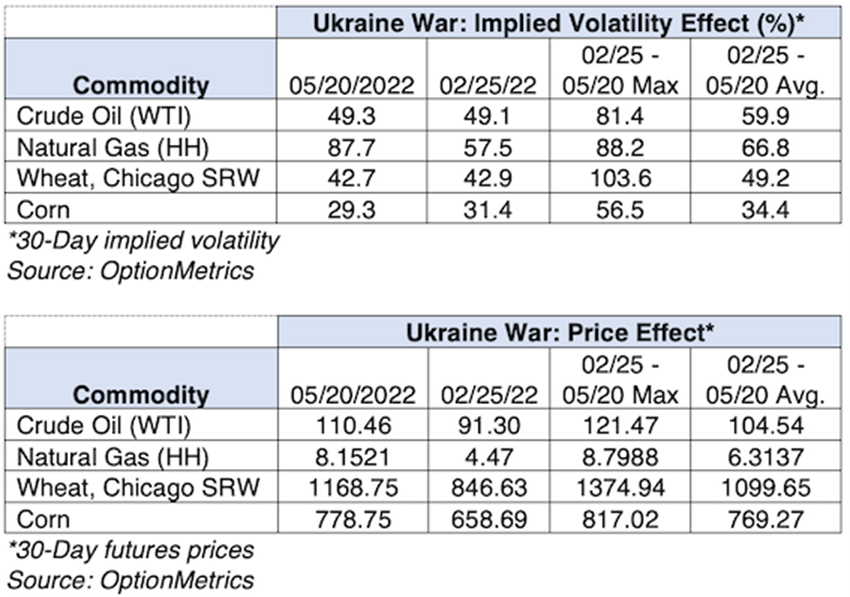

Then early in its development, it was apparent that “the consensus was wrong and the outcome unclear.” Needless to say, the war has gone on for a lot longer than anyone predicted (especially Russia), and the implied volatility of these four commodities has steadily decreased as the stalemate continues. In contrast, their prices remain stubbornly high and close to, or even higher than, when the war first began.

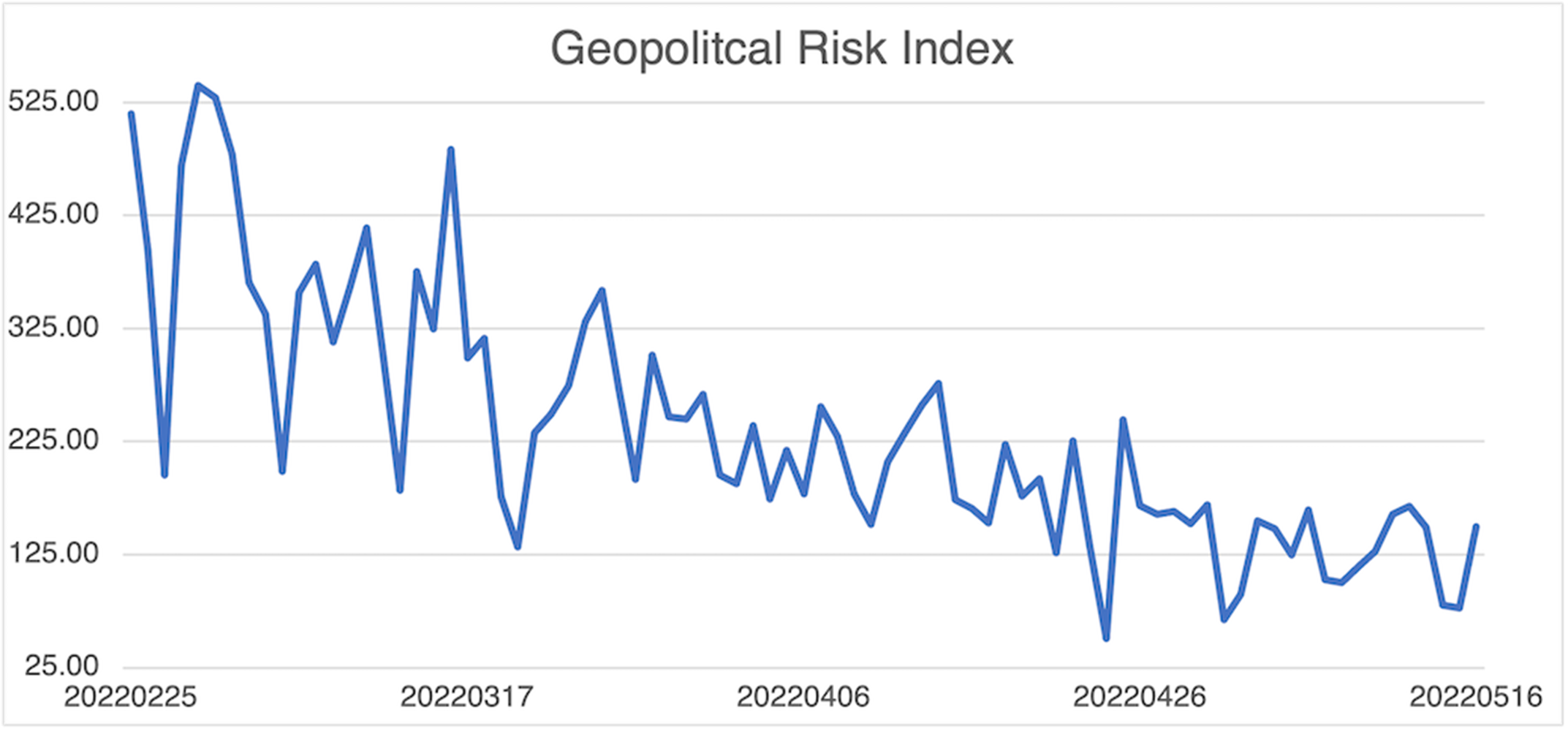

As anyone who follows the news can attest, the Ukrainian war has faded from the top headlines and has become relegated to “below the fold” news. This observation is supported by the GPR Index, a news-scraping metric that measures geopolitical risk based on its mention in ten domestic and international newspapers. As is evident below, the index spiked at the beginning of hostilities in late February but has been on a downward trend ever since then. It is currently on the low end at 149.8 (the index peaked at 1046 after 09/11; its average since 1985 is 100).

Source: matteoiacoviello.com

Apparently, no “new news” has been forthcoming, or the conflict no longer merits as much coverage as when it first burst onto the scene in late February. War anxiety has decreased, and this usually means a decrease in uncertainty and implied volatility. For the four commodities most affected by the war—crude oil, natural gas, wheat, and corn—this is mostly true, with natural gas being the notable exception. In contrast, however, prices for these four commodities have increased or stayed elevated over the period and have shown little tendency to decline.

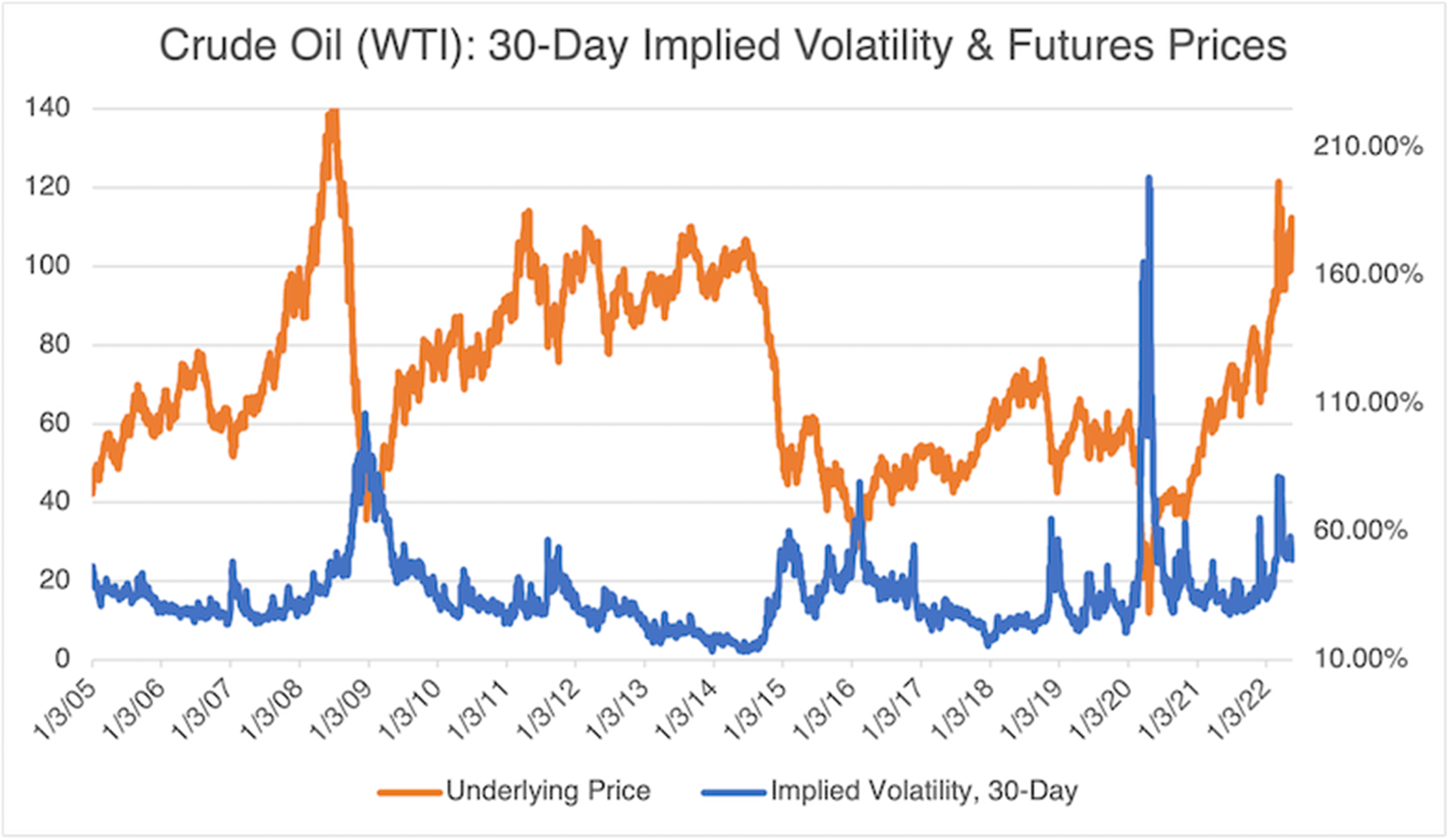

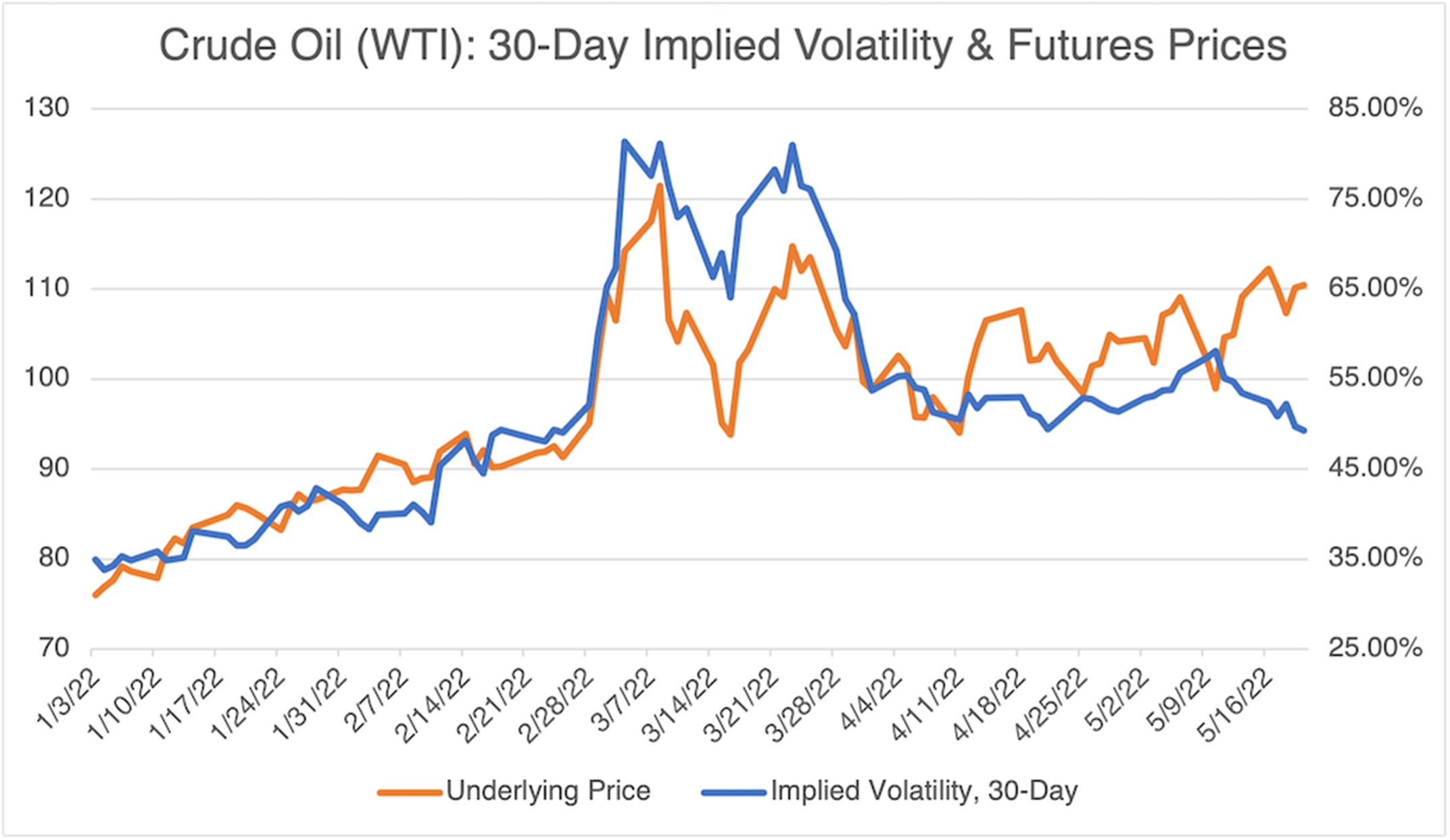

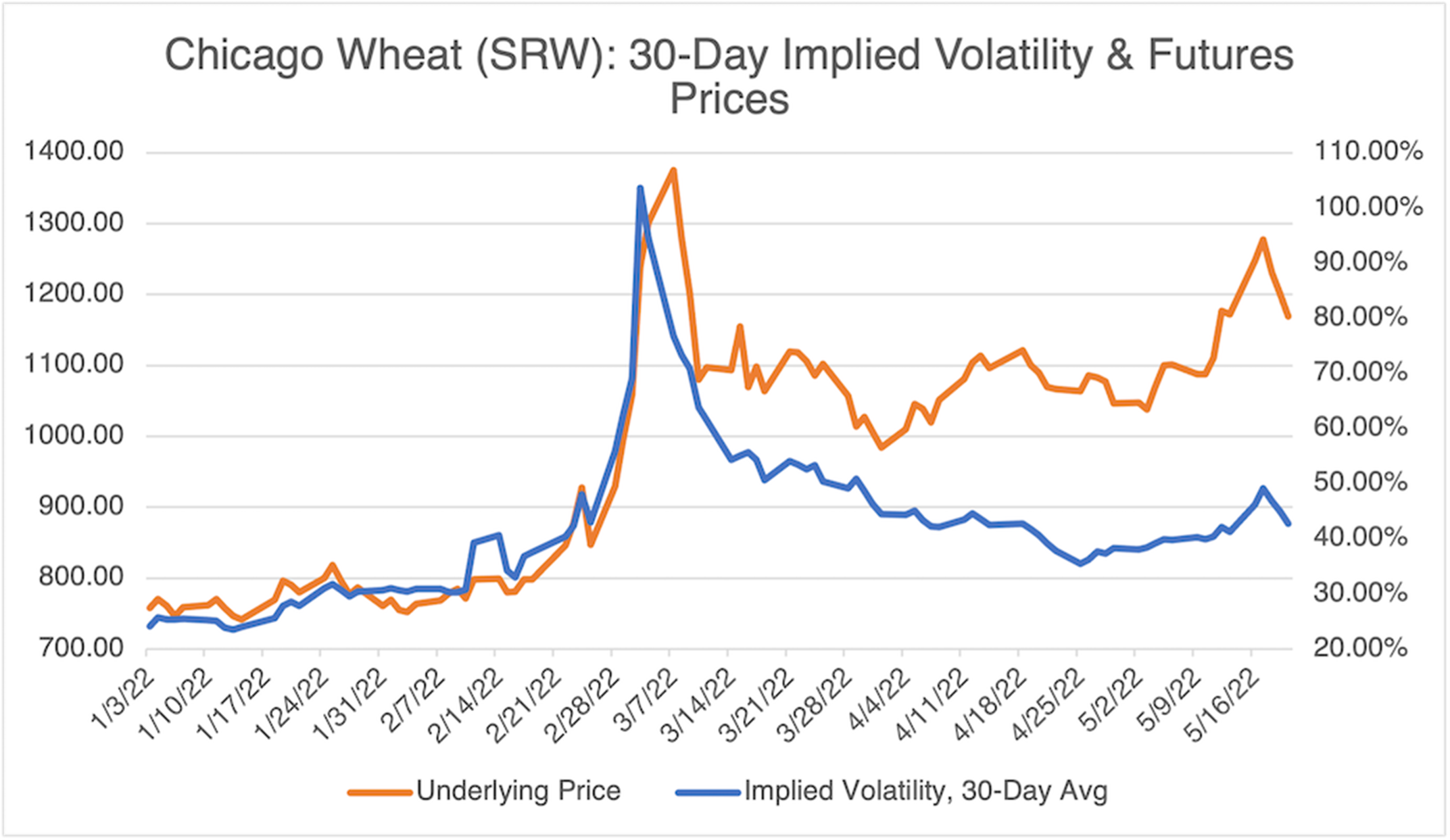

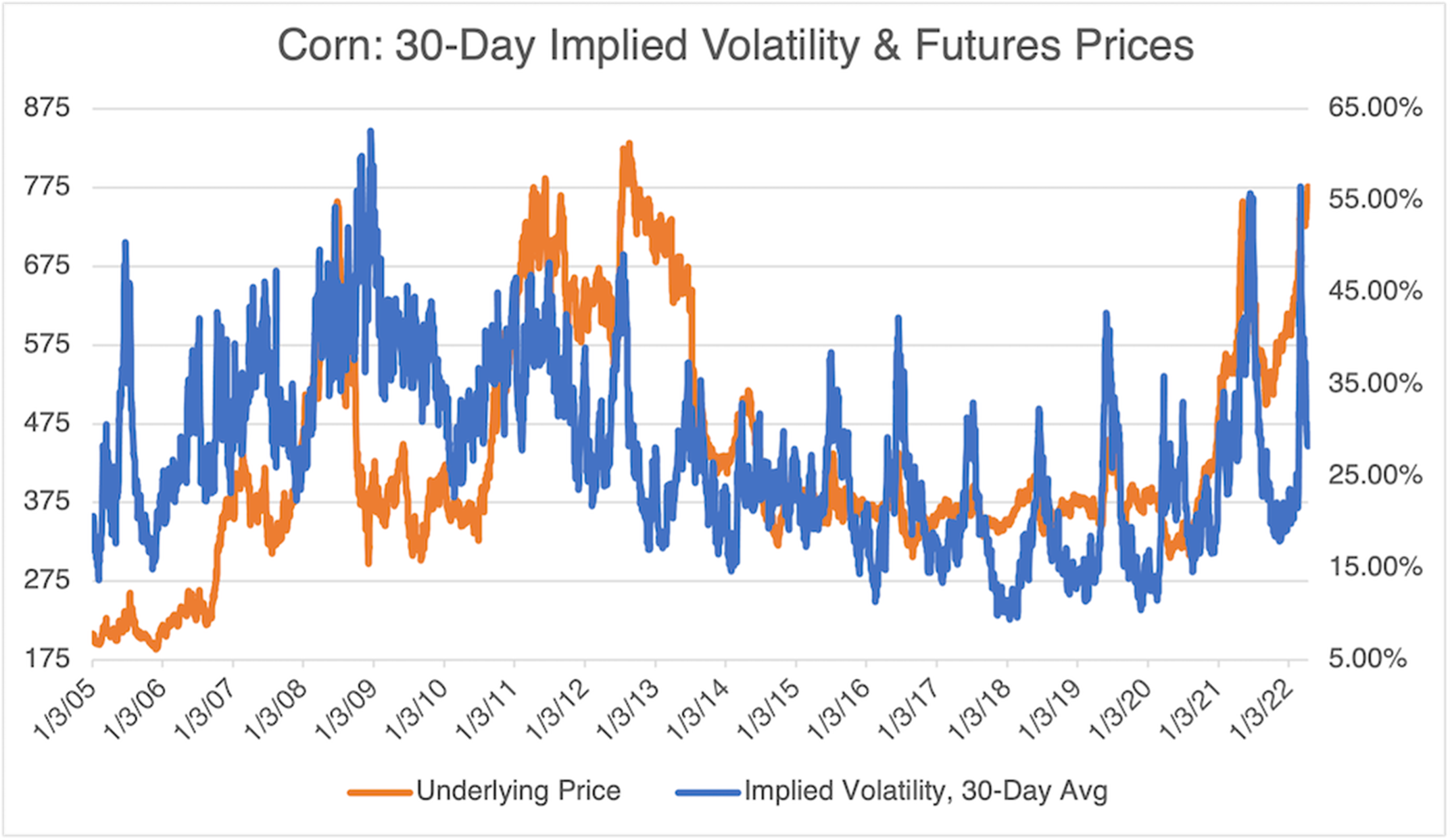

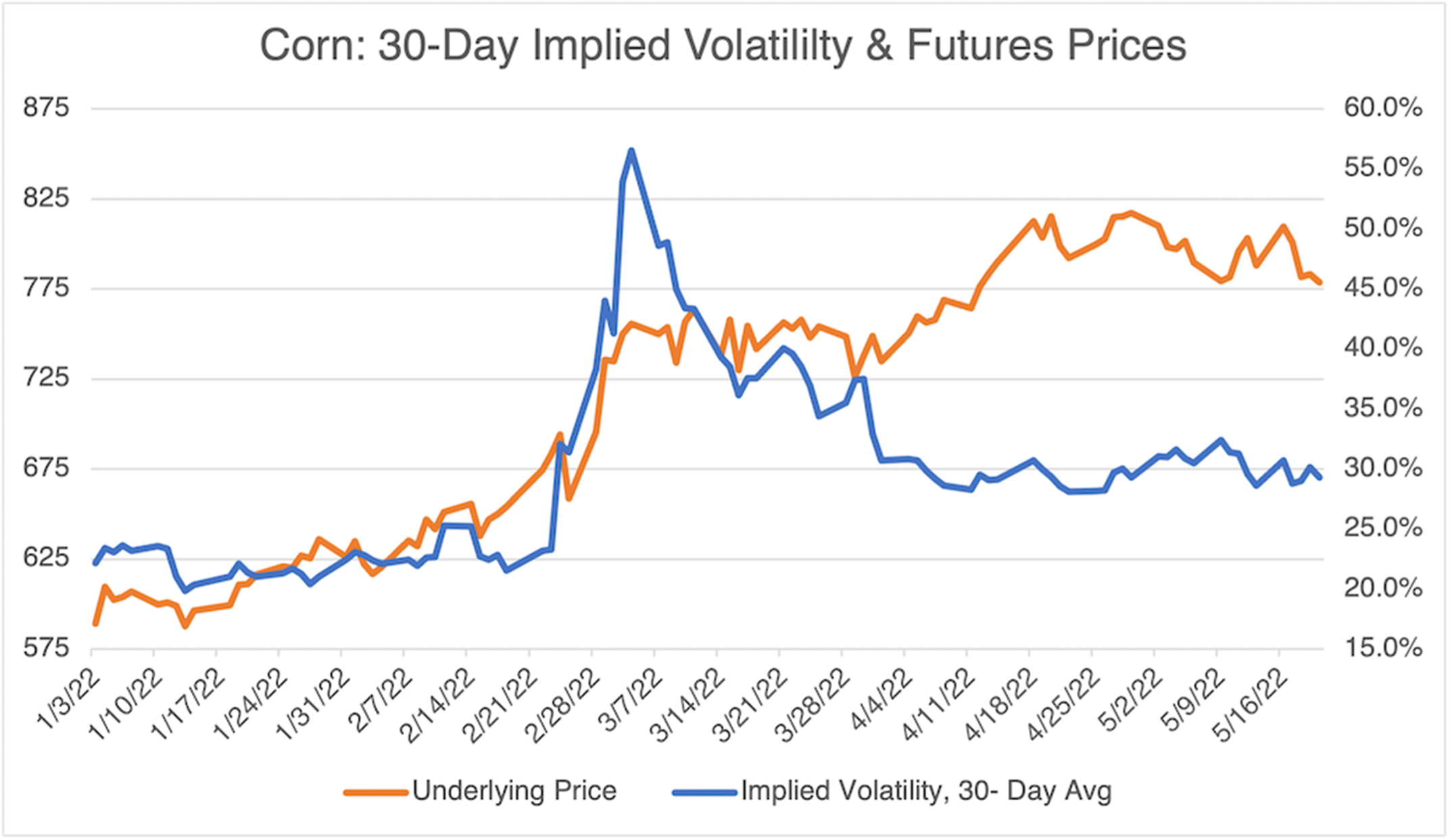

Consider the following charts:

Source: OptionMetrics

Source: OptionMetrics

Interestingly, crude oil implied volatility is usually inversely proportional to its underlying price and tends to increase the most to declining, not increasing prices; its reaction to increasing prices tends to be muted. In fact, its highest implied volatility of over 200% was achieved during the negative intraday price debacle of March 2020. The war initially produced the opposite result, with implied volatility almost doubling to over 80% soon after hostilities broke out as prices spiked to over $120. Currently, the long-term tendency is reasserting itself, with implied volatility decreasing back down to the unremarkable 45-50% level as prices remain stubbornly high and over $100.

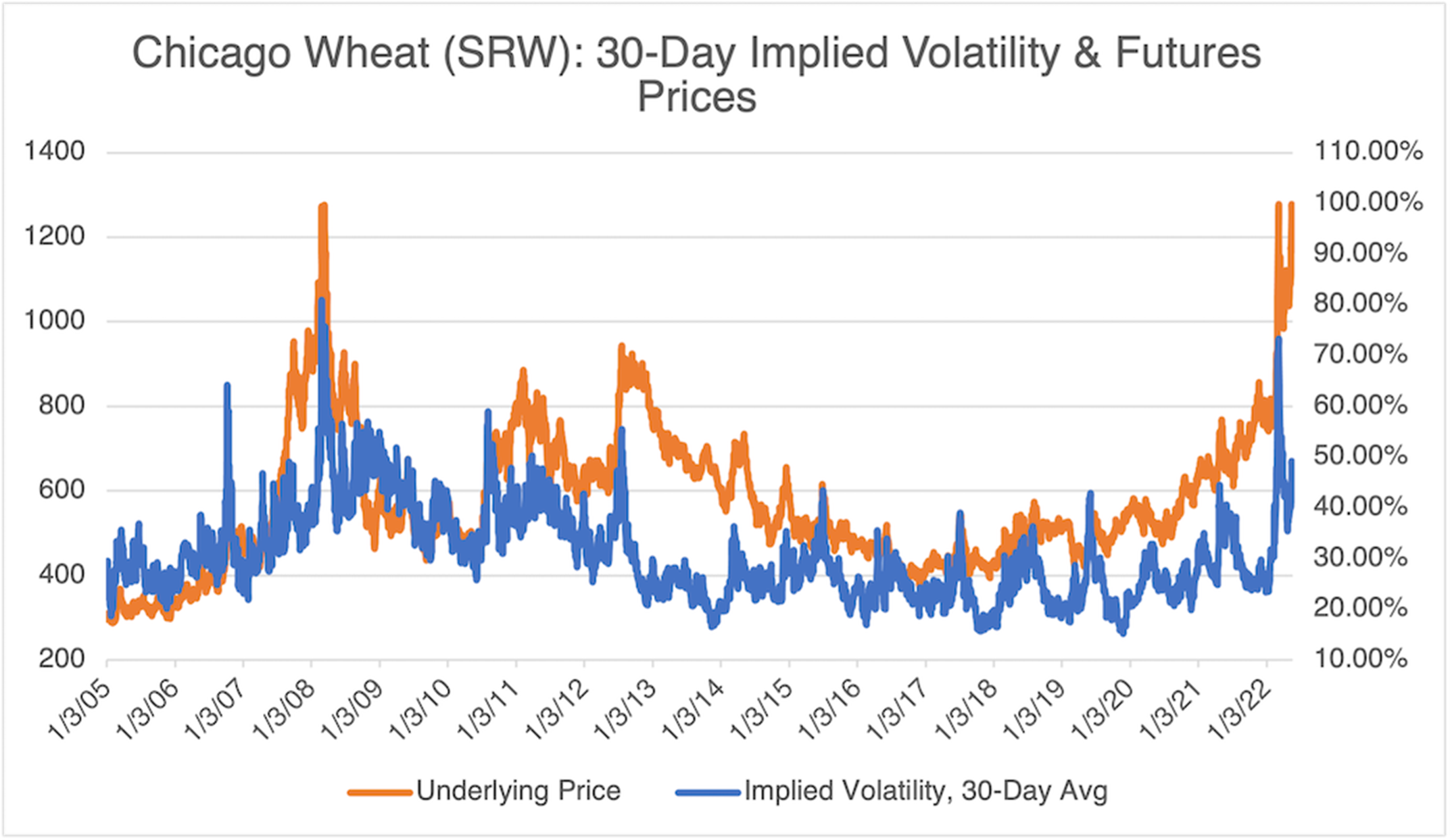

Unlike crude, implied volatility in both wheat and corn has been historically in lockstep with their underlying prices. As in crude, a divergence between their price level and implied volatility is growing, with elevated prices near or above pre-war levels but with implied volatility decreasing.

Source: OptionMetrics

Source: OptionMetrics

Source: OptionMetrics

Source: OptionMetrics

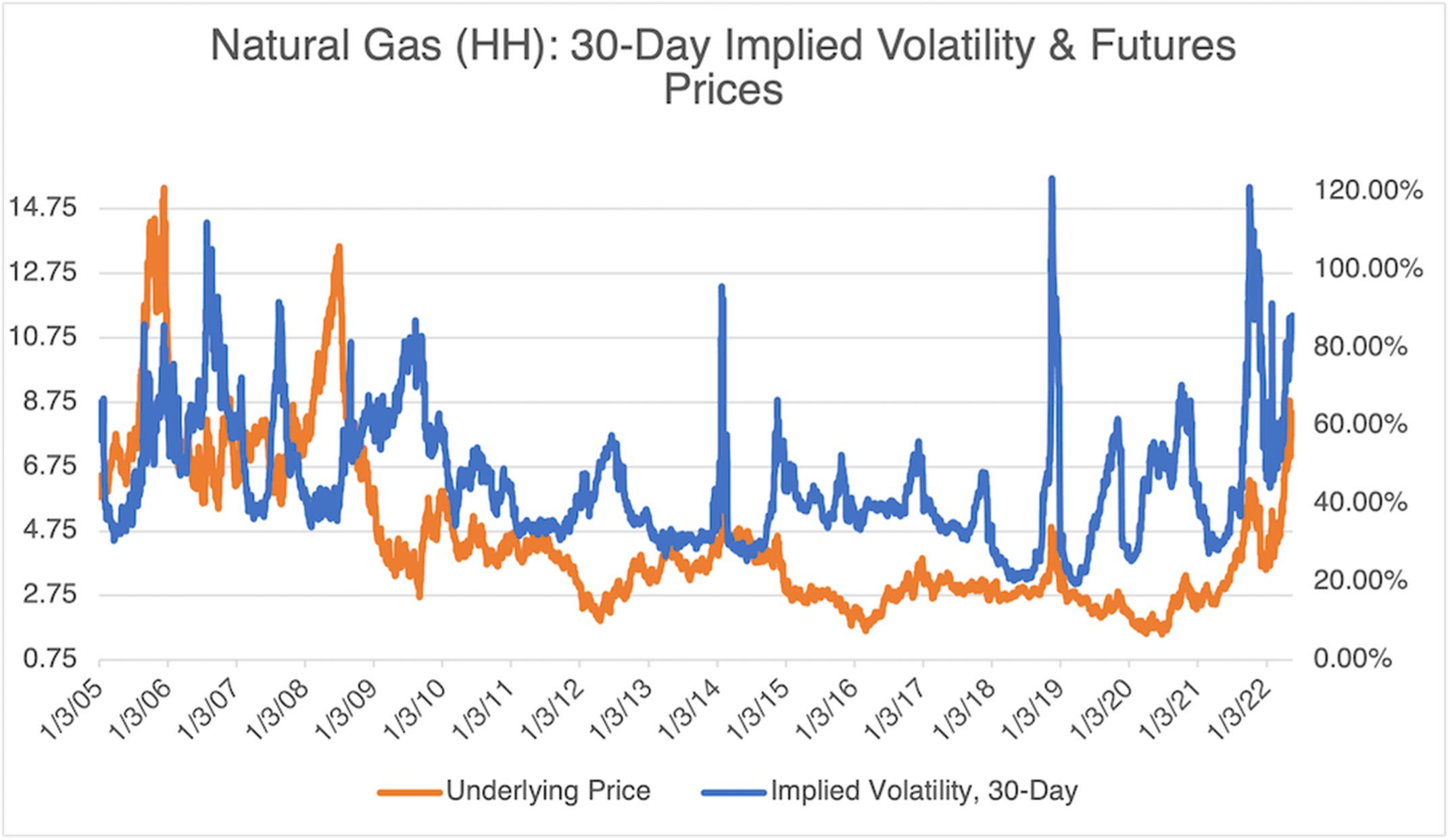

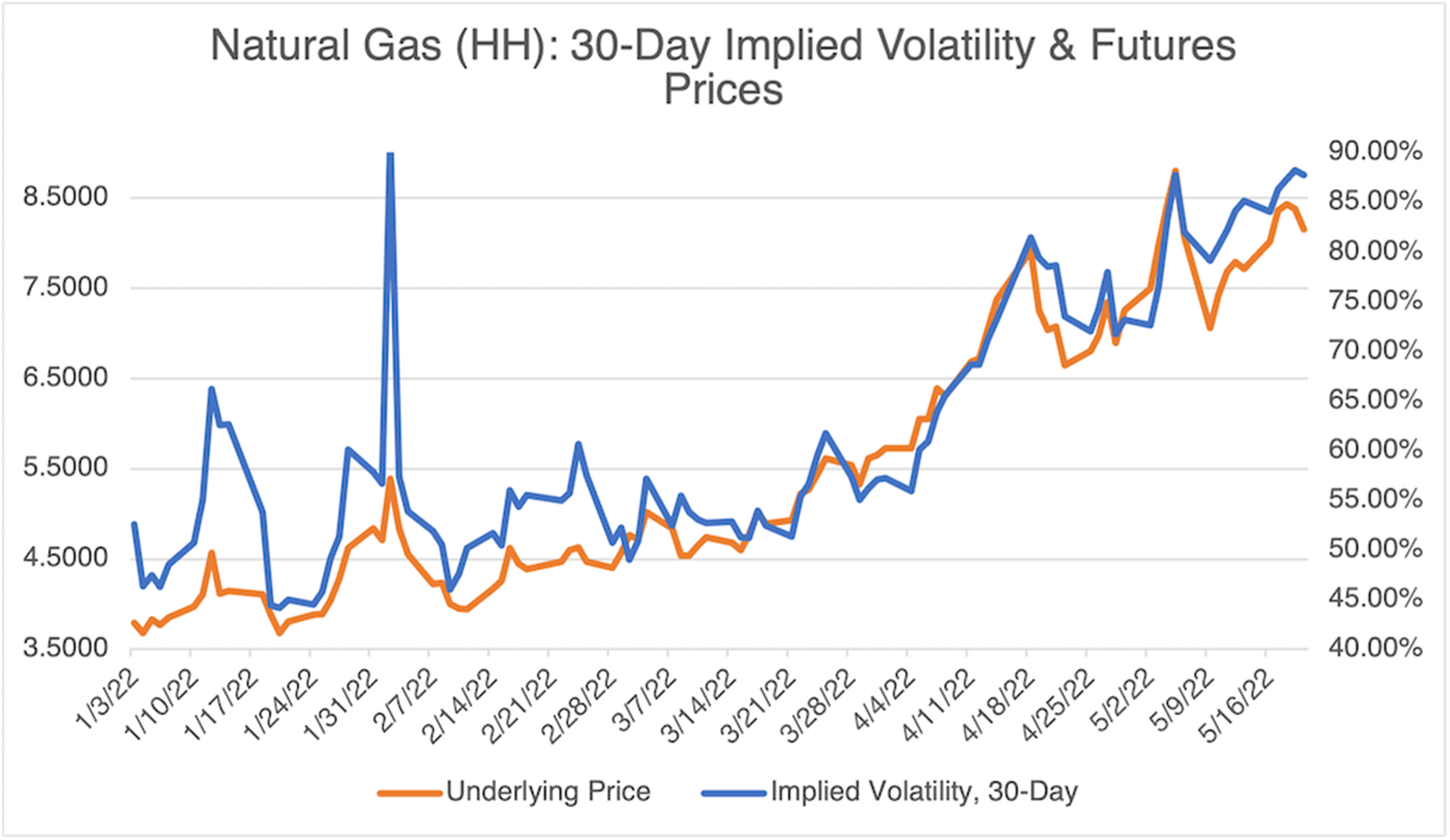

Natural gas presents a different picture, with sharply higher elevated implied volatility and price levels:

Source: OptionMetrics

Source: OptionMetrics

Summarizing the contrasting price and implied volatility effects, a clear divergence in their trends is evident since the war began:

Source: OptionMetrics

Implied volatility tends to require more extreme or different price action to increase. Without this, it tends to drift lower. In the case of crude, wheat, and corn, prices since the war have remained elevated but will require a steady stream of new highs for implied volatility to increase significantly. In contrast, natural gas has consistently made new highs since the beginning of 2022; hence, its implied volatility has not decreased. The war accentuated the price trend it was already in.

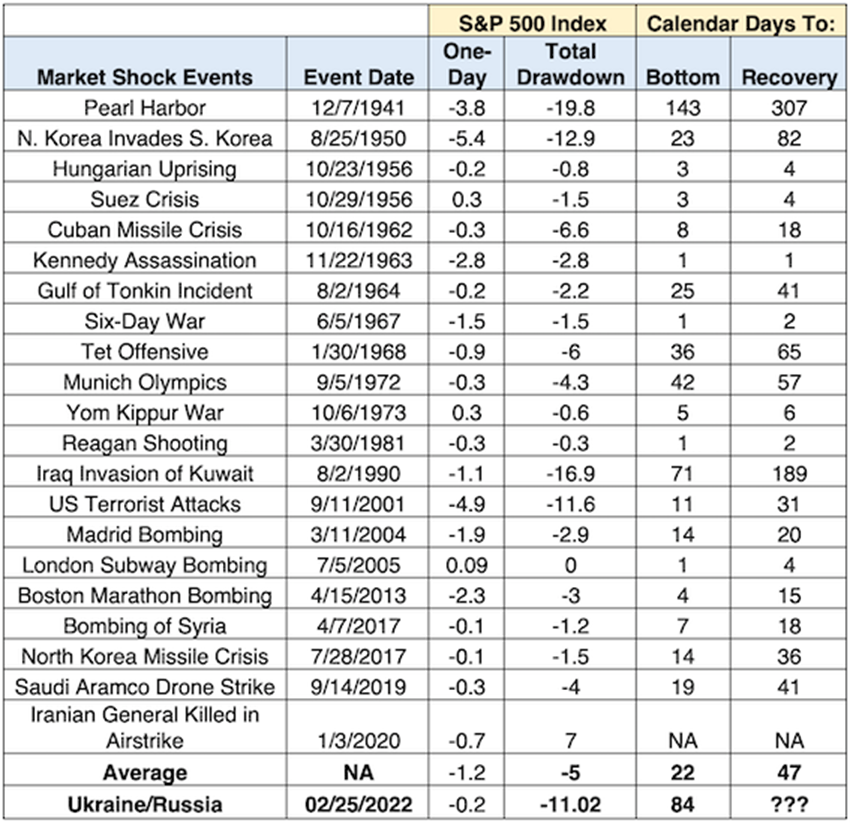

Effect on the S&P 500 Not Yet Settled

The effects of the war on the S&P 500 (SPX) have not faded. As displayed below, if you ignore the short-lived S&P rally in early March, then the current decline in terms of price is only matched by four out of 21 hostile events. In terms of duration, only Pearl Harbor has exceeded the current duration. As I wrote in March, “Geopolitical shocks require pre-existing economic conditions and must be truly global in nature to have a lasting effect. In other words, they don’t tend to change the underlying trend as much as act as a catalyst to the factors that have been weighing on the market previously.” In this case, the war might have triggered a deeper decline by focusing on and exacerbating pre-existing trends, such as inflation and the general decline in consumer confidence.

Source: LPL Research, S&P Dow Jones Indices, CFRA