The outcome of the US midterm elections began to crystalize over the weekend with Democrats taking the Senate and Republicans possibly controlling the House, but counting is ongoing, writes Ian Murphy of MurphyTrading.com.

Stocks rallied on the prospect of a divided US government for the next two years which would scupper Democrat’s ambitions to increase taxes and regulations on listed firms.

The bullish mood in US equities drove the indicator used on the 52-Week Strategy back above zero where it finished out the week (magnified). For a valid re-entry on this strategy, we need another close above the line on Friday coupled with the price bar closing above the -1ATR line.

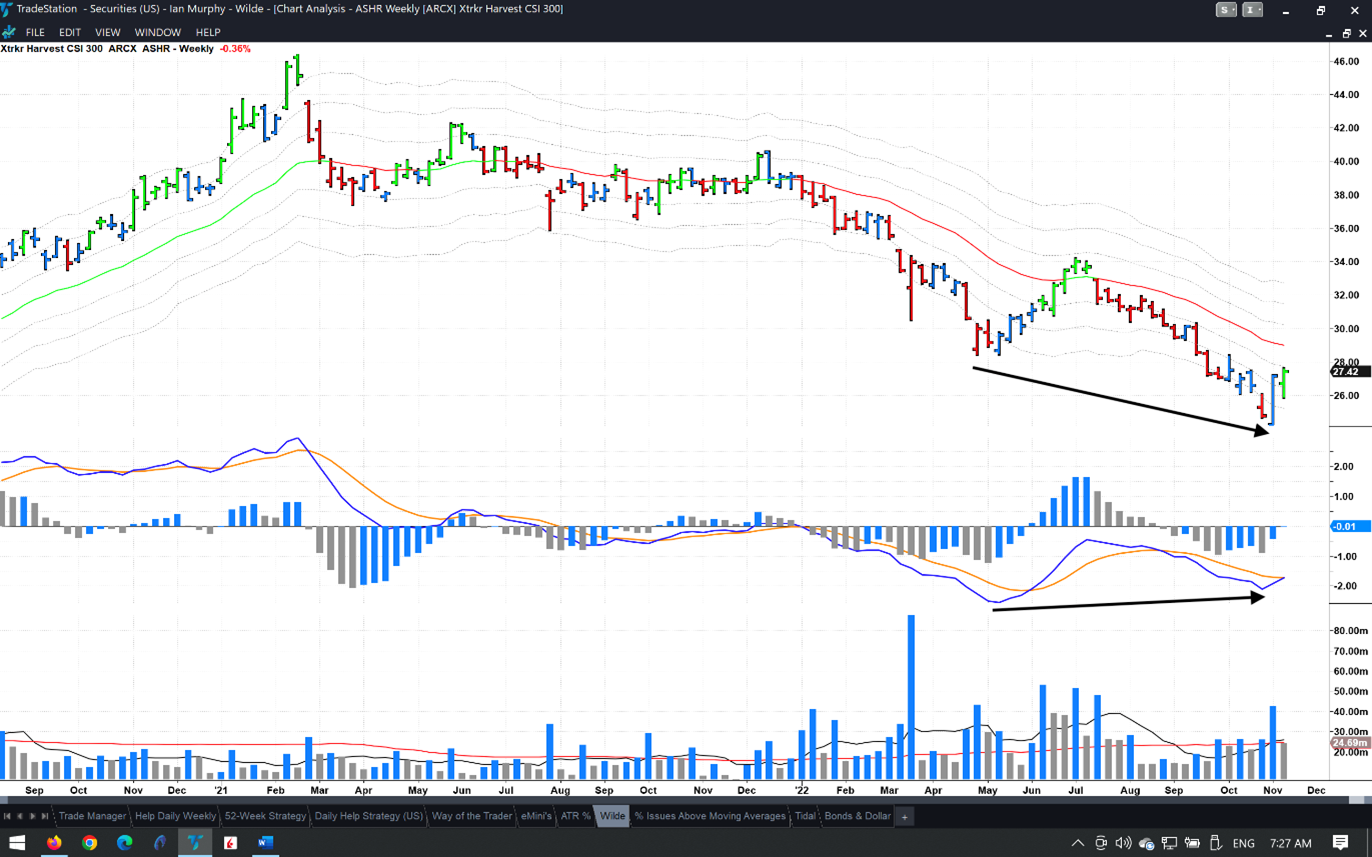

Over the weekend a query came in about entering a weekly trend following trade on the Chinese equity market considering the 16-point plan to support real estate just announced by the Chinese government. The Xtrackers Harvest CSI300 ETF (ASHR) is the largest US-listed ETF that tracks A-shares in mainland China. There is a bullish divergence of MACD-H, but I would like to see the price form a first higher low pattern above the -1ATR line.

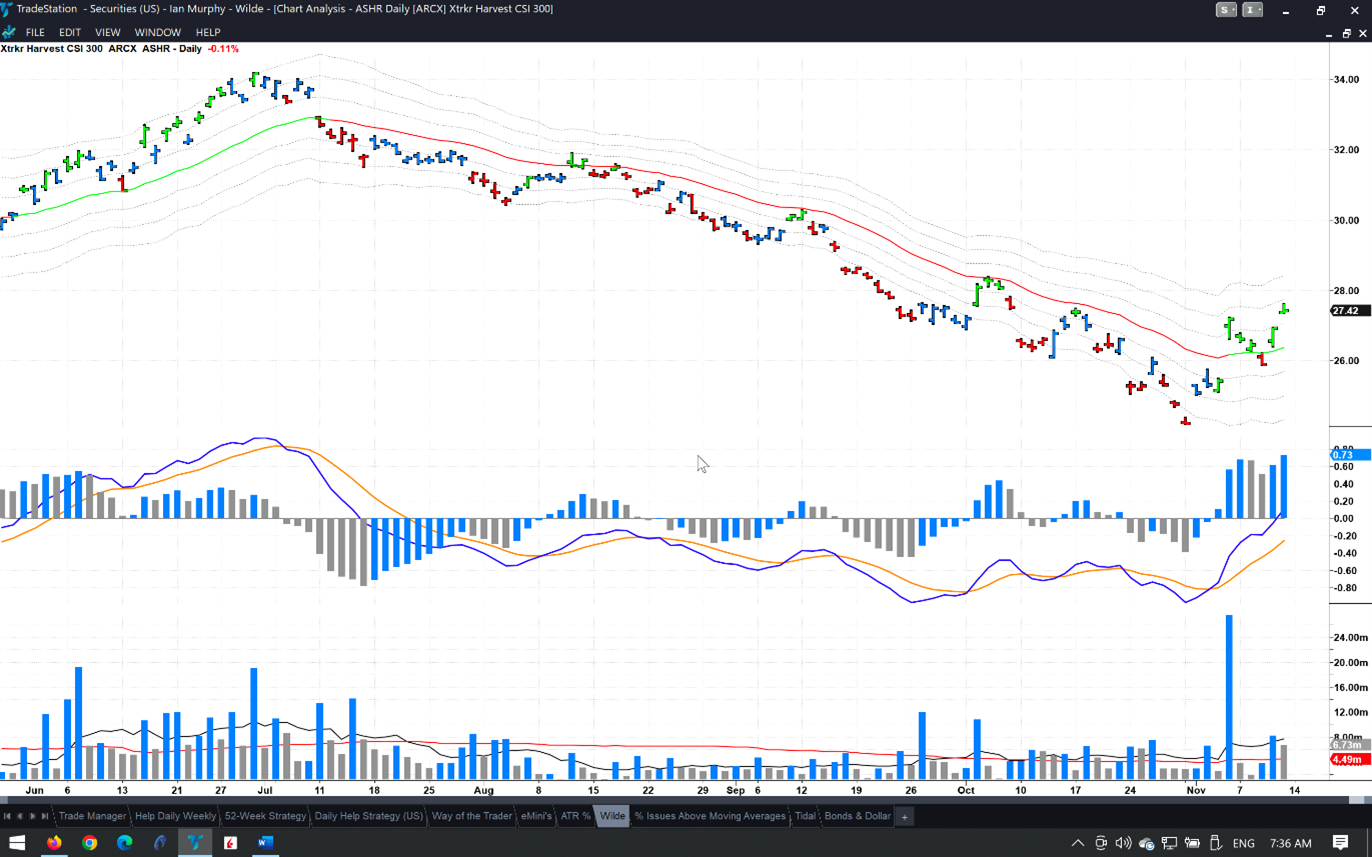

The usual caveat applies to US-listed ETFs which track overseas indices; the overnight action on the index instantly manifests in the opening price so large gaps are common as shown above on a daily chart. The best way to trade this is with a soft trailing stop on the -1ATR line on a weekly closing basis.

Learn more about Ian Murphy at MurphyTrading.com.