When we sell cash-secured puts (CSPs), we are getting paid to undertake the contractual obligation to buy the holders' shares at a price that we (the sellers) determine, called the strike price, by a date that we determine, called the expiration date, states Alan Ellman of The Blue Collar Investor.

In the BCI methodology, we favor out-of-the-money (OTM) CSP strikes, which are lower than the current market value. Since we agree to buy the option buyers' shares and understand that exercise can occur at any time during the contract (although early exercise is rare), it makes sense to favor securities that we would otherwise not mind owning in our portfolios. This is why we do such meticulous due diligence when screening our stocks & ETFs.

Given this type of CSP trade structuring, there are two major favorable outcomes, with the understanding that there is an inherent risk in all trades that seek to generate more than risk-free returns.

What Are the Two Favorable Outcomes?

Let us set aside the critical skillset exit strategy intervention and focus on the two major potential outcomes.

Unexercised: If the price of the underlying security does not drop below the OTM put strike at expiration, the option will expire worthless, and we will have realized our initial time-value return. The cash previously utilized to secure that put is now freed up to secure another put in the next contract cycle.

Exercised: If the share price declines below the (once) OTM put strike, the share will be “put” to us on the Saturday after expiration Friday at a cost basis of (put strike—put premium). This represents a discount from the original price of the underlying, given the strike was OTM plus the put premium credit. Since this is a security we wouldn’t mind owning, aside from the options aspect, this represents another potentially favorable outcome.

Dividends: If there is an ex-dividend date during the contract cycle, we will add the dividend amount to the premium for final calculations

Real-Life Example with Toll Brothers, Inc. (TOL)

- 7/3/2023: Buy 100 x TOL at $79.07

- STO 1 x 8/4/2023 $77.00 OTM put at $1.40

- 7/6/2023: Capture $0.21 dividend (ex-dividend date)

- Option premium + dividend = $1.61

- Calculate unexercised & exercised results

Option-Chain for TOL On 7/3/2023

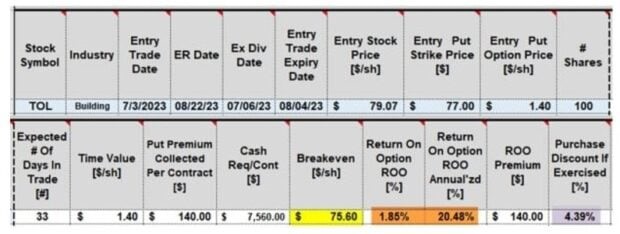

TOL Calculations Without Dividend: Two Favorable Outcomes

- Initial time-value 33-day return is 1.85%, 20.48% annualized (brown cells)

- The purchase discount price, if exercised is 4.39% (purple cell)

- Calculations accomplished using the BCI Trade Management Calculator

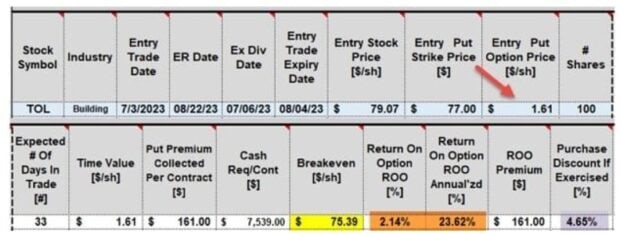

TOL Calculations with Dividend: Two Favorable Outcomes

- Initial time-value 33-day return is 2.14%, 23.82% annualized after adding the $0.21 dividend to the option premium (brown cells)

- The purchased discount price, if exercised is 4.65% (purple cell)

- Calculations accomplished using the BCI Trade Management Calculator

Discussion

When selling out-of-the-money cash-secured puts on securities we would otherwise want to own, there are 2 favorable outcomes. Either we purchase the shares at a discounted price (from the time of trade entry) or we get paid not to buy the shares. It is important to recognize the fact that the risk in the trade is the price of the underlying dropping below the breakeven price points (yellow cells) when we can start losing money. This is where our exit strategy arsenal must be activated.

Learn more about Alan Ellman on the Blue Collar Investor Website.