The Crypto.com Miami Grand Prix. The 151st Kentucky Derby. A lot of racing went on this past weekend.

If your heart has been racing lately too, I’m not surprised! This has been one wild and wooly market to trade. But there MAY be some relief on the way.

Let’s start with what I wrote back on Feb. 3: That a Trump 2.0 regime was already leading to higher volatility – and that trend would likely continue. Boy did that turn out to be the understatement of the year!

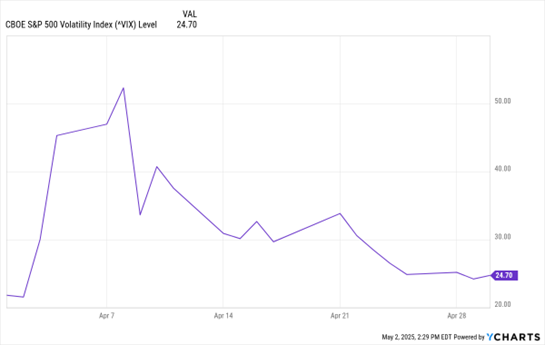

CBOE Volatility Index (VIX) in April

Data by YCharts

Check out the MoneyShow Chart of the Day. It shows the level of the VIX throughout April. You can see the index closed as high as 52.33 on Apr. 8. That came after it hit an intraday high of 60.13 a day earlier.

The AVERAGE VIX close for the month: Around 32.3. That’s almost DOUBLE the average of 16.76 I highlighted for January 2025 (which was up from 13.39 a year earlier).

Bottom line: Yes, it HAS been a more volatile market. Much more.

But we may be starting to calm down finally. And the major stock market averages MAY have put in longer-lasting lows, at least based on technical signals and historical pattern analysis. That means heart-racing season could be over – and you can get back to trading the long side more consistently.