What does inflation look like when analyzed through a technical lens? There is a clear relationship between the Producer Price Index (PPI) and Consumer Price Index (CPI). PPI generally leads CPI higher and lower, with peaks and troughs usually occurring within a few months of each other, observes Jeff Hirsch, editor-in-chief of The Stock Trader’s Almanac.

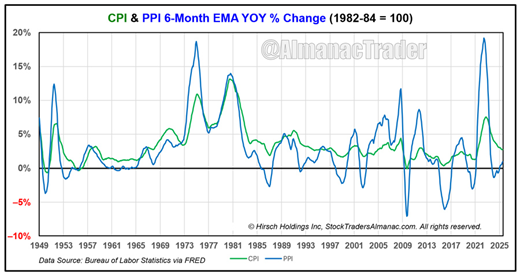

Below is a chart of the six-month exponential moving average (EMA) of the monthly year-over-year change in CPI and PPI. If this chart looks familiar, it is. We have been using it in our annual forecasts over the years.

(Editor’s Note: Jeff will speak at the 2025 MoneyShow/TradersEXPO Orlando, scheduled for Oct. 16-18, 2025. Click HERE to register.)

We choose a six-month EMA as it tends to work well at smoothing out monthly volatility in CPI and PPI while better capturing the underlying trend of each. The PPI used in this chart is not the same as the one making headlines last week. The PPI Final Demand index only goes back to November 2009. The PPI we plotted has data available back to 1917 – and it saw a similarly large monthly increase.

This relationship does persist back to 1917 as well, but we started in 1949 to create a reasonably sized chart with adequate resolution for the more-recent timeframe. Focusing on the last couple of years of data, PPI bottomed in February 2024 and has been trending higher, while CPI has continued its trend modestly lower. It seems reasonable that if PPI continues to climb, CPI will also do the same.

While investors are nearly certain the Federal Reserve will be cutting its key interest rate in September, perhaps the market is overly optimistic. After all, there will be another CPI (Sept. 11) and PPI (Sept. 10) release before the Fed’s next meeting, along with the August employment situation (Sept. 5) report.

Potentially of even greater importance will be PCE (personal income and outlays) on Aug. 29. If inflation fails to ease in any of these upcoming reports, the odds of a September cut are likely going to retreat.