We’re in the waning days of the third quarter – and that means the year-end sprint is about the begin. So, which S&P 500 Index (^SPX) sectors are winning? Which are losing? And what does that say about the market's "character?"

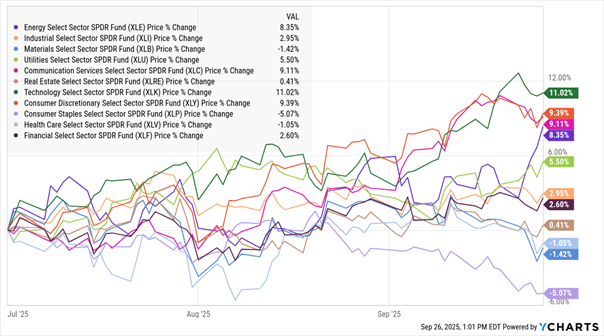

Take a look at the MoneyShow Chart of the Day. It shows the performance of the 11 S&P 500 sector SPDR funds from the start of the quarter through Friday.

Q3 Sector Report Card: Who’s Winning, Who’s Losing

Data by YCharts

You can see that all in all, it has been a pretty solid quarter. Only three of 11 sector ETFs – those targeting health care, materials, and consumer staples – are trading in the red in the waning days of Q3. Plus, the worst loss is just 5% for the Consumer Staples Select Sector SPDR Fund (XLP).

Of the winners, only one is up double-digits. It’s the Technology Select Sector SPDR Fund (XLK), with a gain of 11%. But three other sector ETFs are close – those that track energy, communications services, and consumer discretionary stocks. Meanwhile, the Real Estate Select Sector SPDR Fund (XLRE) is the best example of an “undecided” one, trading right around breakeven.

What message can we take away from this trading action? I’d characterize it as fairly bullish. Defensive groups like staples and healthcare are underperforming. Offensive groups like tech and discretionary are outperforming. Energy is also mounting a late-quarter rally – which could signal some relief for investors in that lagging corner of the commodities market.

Or in other words…It’s still a “Be Bold” market.