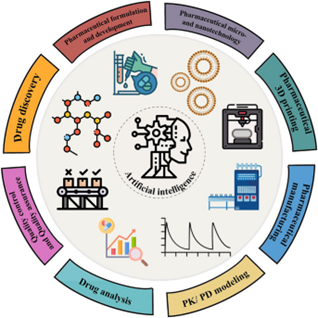

Artificial Intelligence (AI) is used in a variety of ways in the pharma industry. You can trade the trend by directly buying shares of pharma companies that have embraced AI…or by opting for shares of companies that power this trend from the tech side, notes Michael Proffe, founder and chief analyst at Proffe Invest.

To discover new drugs, huge data sets have to be analyzed. That works best with the help of AI algorithms that detect patterns and that can help link/match data. AI algorithms can, for example, sort sets of genomics data to search for genes that may play a role in the development of drugs. That helps find risk factors, as well as potential treatment approaches.

AI provides a better understanding of how drugs work, too. AI can predict what side effects drugs may cause, what dosing should look like for optimal outcomes, and so on. This helps reduce risks when drugs are tested in humans later on, shortening timelines and bringing down costs.

It can also reduce human workloads for documentation and other bureaucratic tasks. The pharma industry is heavily regulated. Patients want drugs that are both effective and safe. But this heavy regulation causes huge workloads that boost costs for pharma companies.

Finally, by analyzing large data sets, AI tools can help control the safety of drugs that are already in use. Adverse effects that have been reported can be analyzed for patterns, helping identifying potential problems.

If you want to trade pharma companies, stocks like Bristol-Myers Squibb Co. (BMY) or Pfizer Inc. (PFE) already use AI in drug discovery and other tasks. On the tech side, Nvidia Corp.’s (NVDA) high-end GPUs are used to train advanced AI algorithms. The company is a key player when it comes to advancing the pharma industry with AI tools.