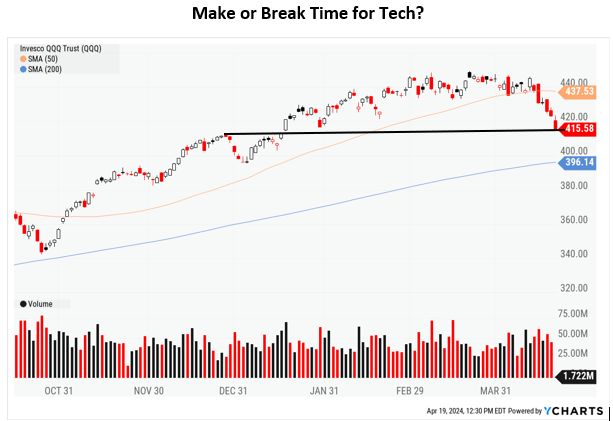

Is it “Make or Break” time for the technology sector? And the Invesco QQ Trust (QQQ)?

It sure looks like it after a lousy start to Q2. When poet T.S. Eliot wrote that “April is the cruelest month,” he wasn’t referring to tech stocks. But the QQQs are now down more than 6% month-to-date, with just over a week of trading left to go.

Data by YCharts

Not only that, but as you can see in the MoneyShow Chart of the Week, we’re rolling over on heavy volume. We took out the 50-day moving average several days ago. And we’re now testing the original upside breakout level from back in January.

If you’ve been following some of my commentary – and the guidance from several MoneyShow experts – this shouldn’t come as much of a surprise. I’ve been writing about the rotation theme and ways to profit from it since we rolled out the Chart of the Week feature earlier this year. David Keller, chief market strategist at StockCharts.com, and I talked about it on the MoneyShow MoneyMasters Podcast three weeks ago, too.

While we’ll probably see a bounce in the QQQs soon, the message from the charts is pretty clear. This isn’t the same market environment we had in 2023. So as traders, you need to focus on NEW leaders in this (still) NEW year.