COMMODITIES, GLOBAL, MONEY MANAGEMENT, STOCKS, STRATEGIES

Adrian Day

Chairman and CEO,

Adrian Day Asset Management

- Recognized Authority in Global & Resource Investing

- Pioneer in Promoting Benefits of Global Investing

- Manages Accounts in Global & Resource Stocks

Follow

About Adrian

Adrian Day, a London School of Economics graduate, heads Adrian Day Asset Management, specializing in global diversification and resource equities. Mr. Day is the sub-adviser to the EuroPacific Gold Fund. His latest book is Investing in Resources: How to Profit from the Outsized Potential and Avoid the Risks.

Adrian's Articles

It has been a bumpy few months for Business Development Companies (BDCs), companies that lend money to small private businesses which are passed on to investors as high dividend yields. But I like one of the strongest, as well as one of the oldest and largest, Ares Capital Corp. (ARCC), says Adrian Day, editor of Global Analyst.

I am repeating my growth pick from last year, Lara Exploration (LRA.CA). The small exploration company focuses on Latin America and is advancing its main copper project, Planalto in northern Brazil, towards a sale, highlights Adrian Day, editor of Global Analyst.

Barrick Gold Corp. (GOLD) just agreed to sell its 50% stake in the Donlin project in Alaska for $1 billion. On the one hand, the project has not been advancing for years and is only 1% of Barrick’s NAV. But the project has large potential and today’s higher gold price justifies moving it forward, writes Adrian Day, editor of Global Analyst.

A change in the monetary system presages a commodity bull market. Not only gold, but commodities generally will likely respond positively to what’s underway, advises Adrian Day, editor of Global Analyst.

Adrian's Videos

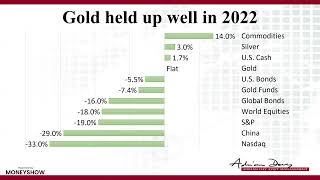

Gold stocks are now trading at close to the lowest valuations in 40 years. Despite the high price of bullion, gold stocks are trading at lower multiples with higher yields than the S&P.

In this presentation, Adrian Day looks at why gold dropped from its late April highs and looks at the fundamental factors that will see it end the year at new highs. How to invest: bullion or equities? Major miners or juniors?

In this presentation, Adrian Day will look at the factors that have made gold move historically and explain why everything is lining up for a great year (and more) for gold.

Adrian's Books

Adrian Day

Investing in Resources: How to Profit from the Outsized Potential and Avoid the Risks- Audiobook

Investing in Resources: How to Profit from the Outsized Potential and Avoid the Risks details how history and fortunes will be made in another extraordinarily rare investment opportunity that's happening right now.

Newsletter Contributions

Global Analyst

Adrian Day's Global Analyst, a premium advisory service distributed exclusively by e-mail.

Learn More